Customisable Dashboards

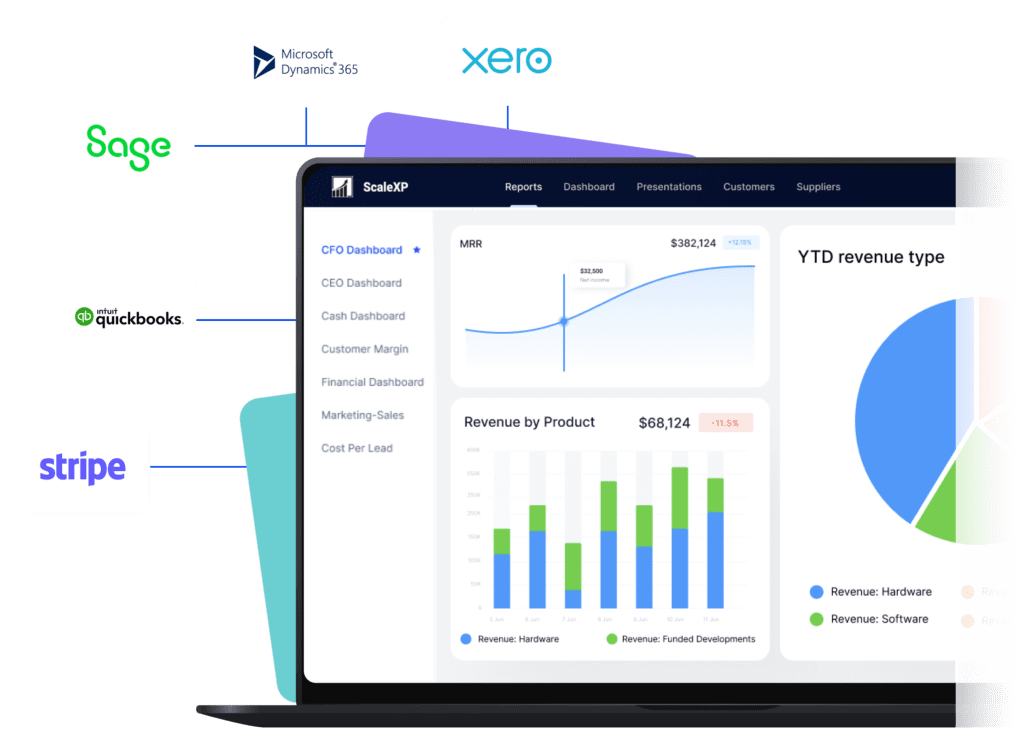

Gain a comprehensive and tailored view of your finance results and north star metrics with customisable dashboards.

- Track your performance across multiple dimensions using visually stunning charts and graphs.

- Effortlessly connect to your accounting or CRM system, transforming numbers into visual stories ready for sharing with your team.

- Create an unlimited number of dashboards that are updated in real-time for your organisation.

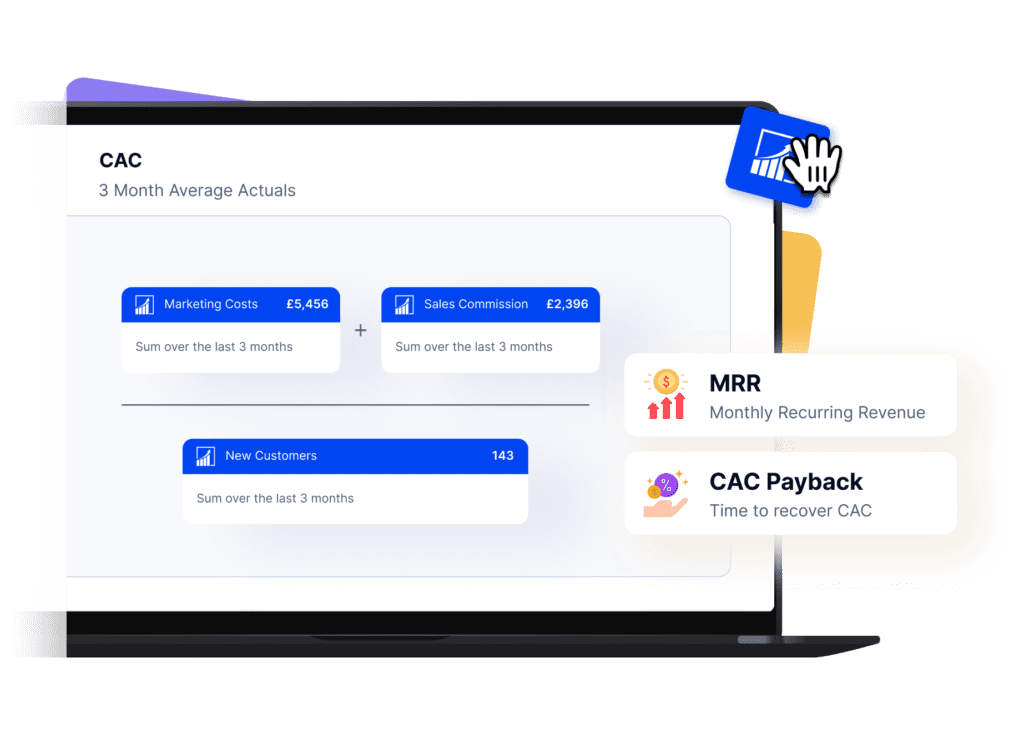

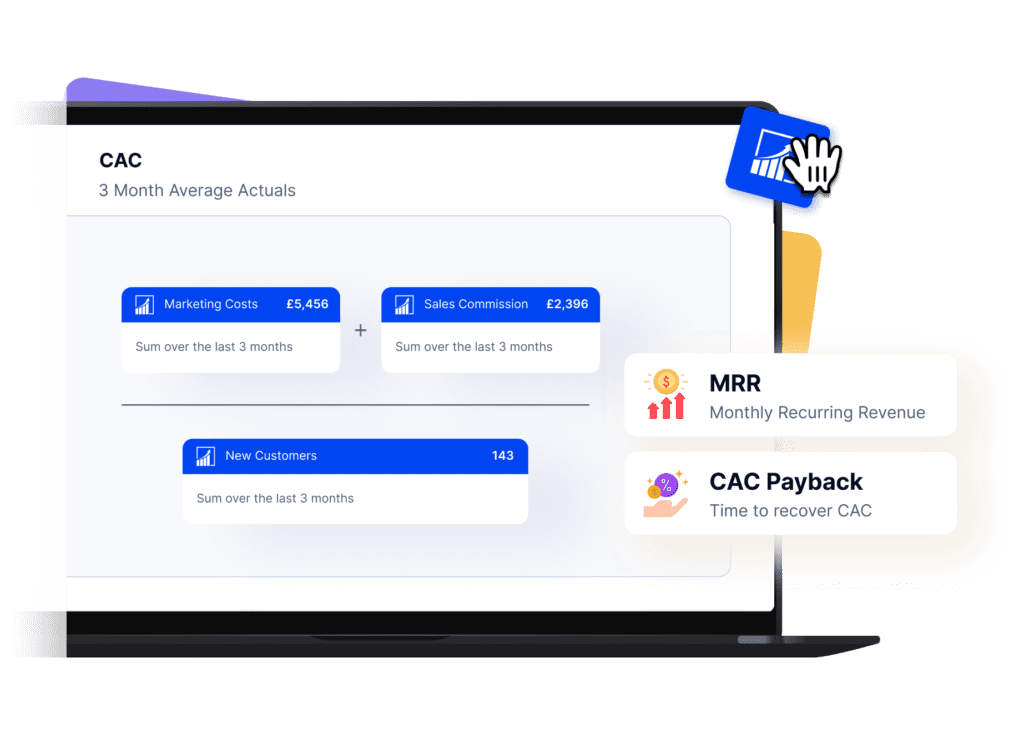

SaaS Metrics Automated

Choose and track from over 30 SaaS metrics, pre-defined or customised to your business in a few clicks.

- Track ARR/MRR and over 30 business-critical SaaS metrics in real-time for your organisation.

- Live dashboards enable you all to review your SaaS metrics for a single business unit or at a consolidated level.

- Customise pre-defined metrics to align with your own definitions.

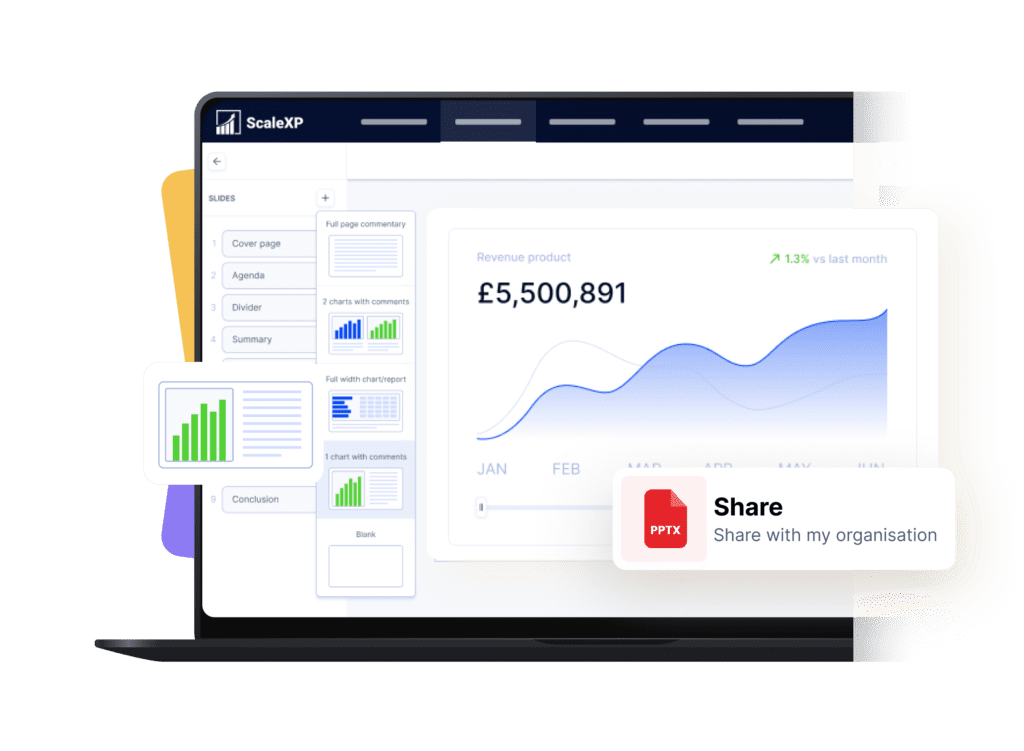

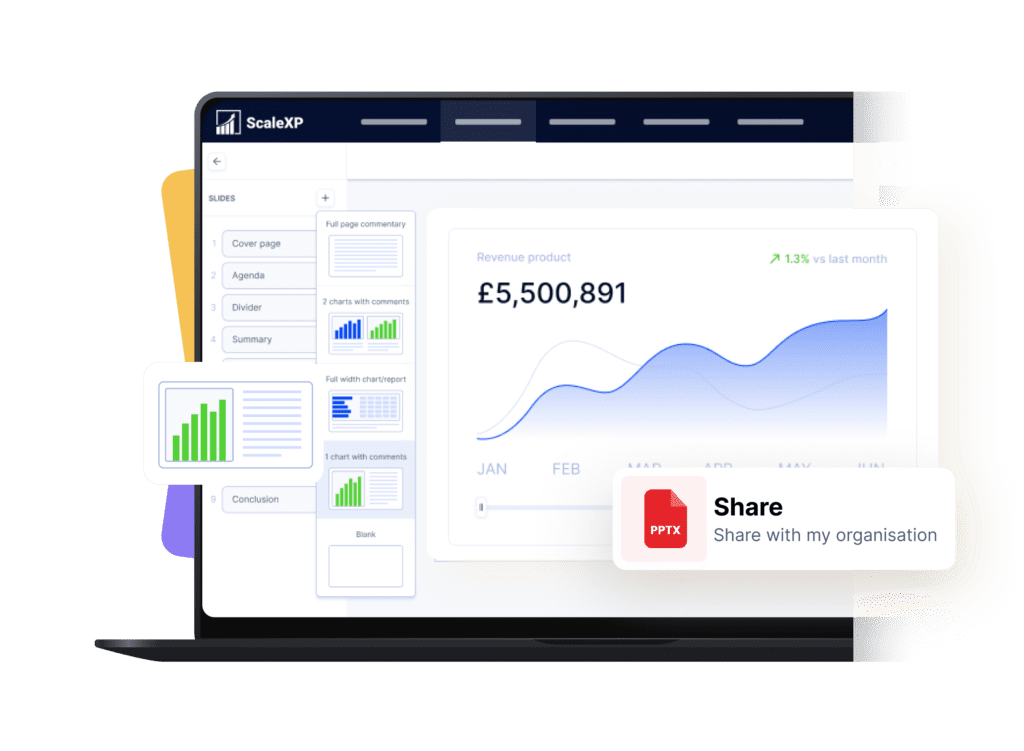

Report With Ease

ScaleXP smart reporting makes it easy to create a series of monthly management reports by team, by business unit or by department.

-

Report by board, country

or department. -

Track SaaS metrics against

budgets, forecasts or targets. -

Create and share reports with

your team in an instant.

With ScaleXP you can

A view for every team

ScaleXP is designed to create a single source of truth, grounded in financial data. The system suggests templates for key stakeholders: the CEO, investors, the marketing team, even customer success.

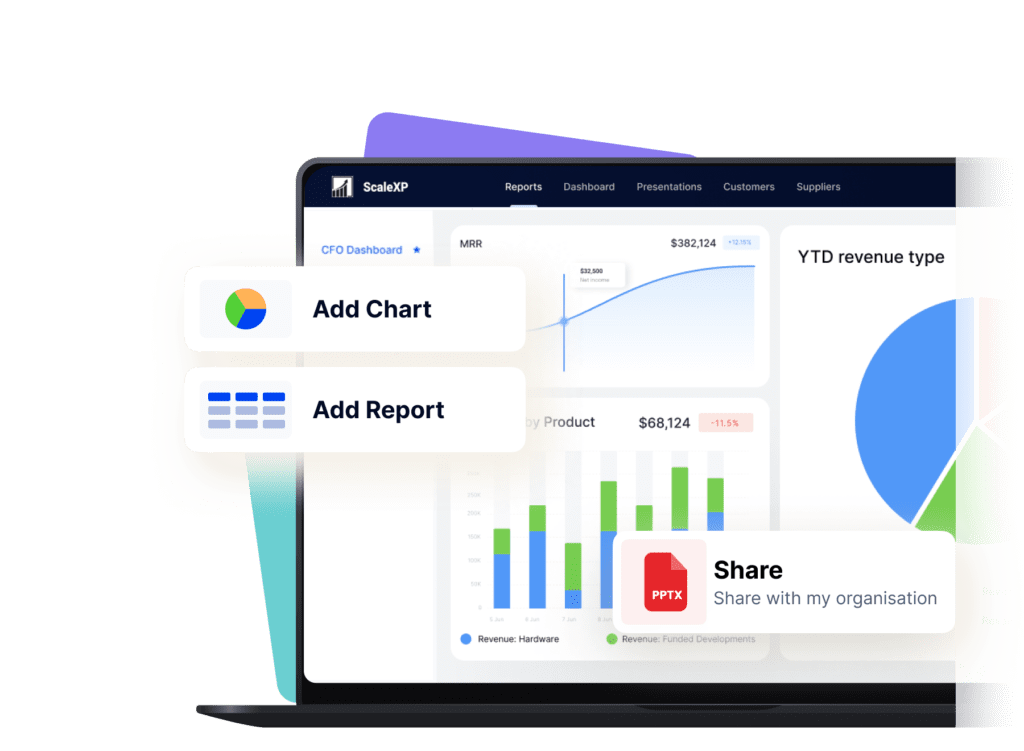

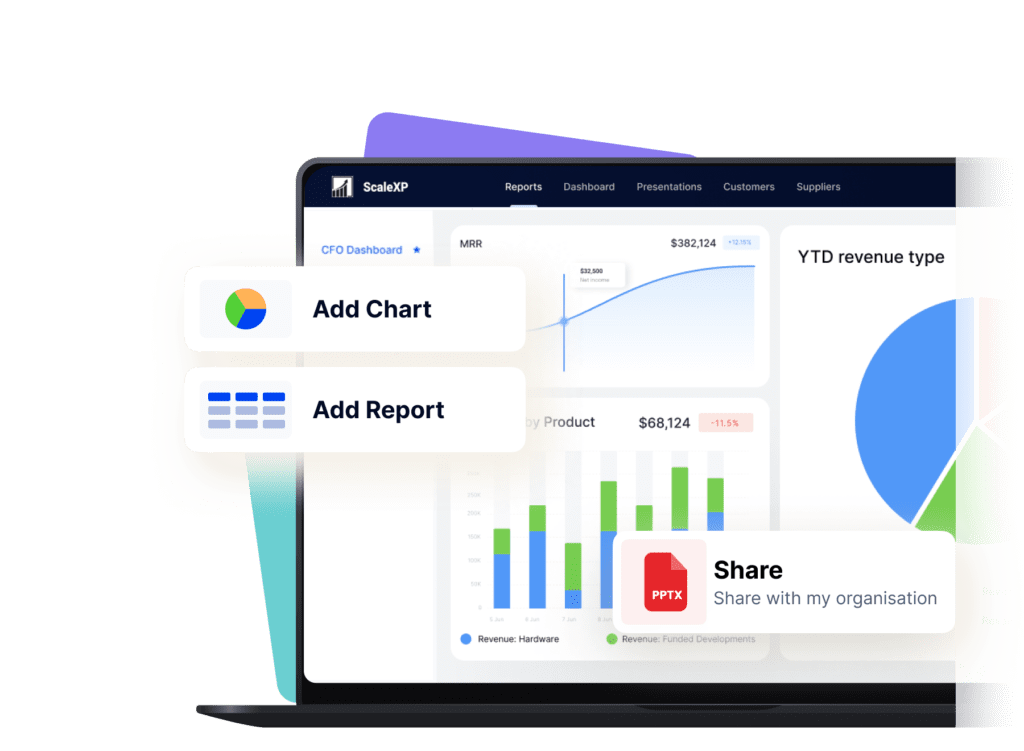

Branded, drag & drop dashboards

Updating dashboards and templates is as simple as drag and drop, making it easy for you to create stunning, insightful dashboards within minutes. Incorporate your brand colors to elevate your reports to a whole new level.

Consolidated data at

your fingertips

ScaleXP enables you to effortlessly view SaaS metrics across your organisation, from group level to specific units. Leveraging up-to-date accounting and CRM data, it ensures consistently accurate figures.

What our customers say

Lots of reports to automatically create metrics that we care about without having to dig through data. The customer support is also excellent.

Lots of reports to automatically create metrics that we care about without having to dig through data. The customer support is also excellent.

Xero App Store Review

Xero App Store Review  Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Xero App Store Review

Xero App Store Review  Tracking MRR by customer is easy: You see immediately how much there's new, expanded, downgraded or churned MRR, and from which individual customers that came from..

Tracking MRR by customer is easy: You see immediately how much there's new, expanded, downgraded or churned MRR, and from which individual customers that came from..

Xero App Store Review

Xero App Store Review  ScaleXP is great at calculating MRR by click of a button compared to

manual excel system which was very time consuming...

ScaleXP is great at calculating MRR by click of a button compared to

manual excel system which was very time consuming...

Xero App Store Review

Xero App Store Review  Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Xero App Store Review

Xero App Store Review  ScaleXP has given us hugely improved visibility on what is happening in the business

and saves hours every month on reporting.

ScaleXP has given us hugely improved visibility on what is happening in the business

and saves hours every month on reporting.

Xero App Store Review

Xero App Store Review Who uses ScaleXP?

Preparing for investment is daunting. ScaleXP ensures that your data is in line with industry best practice. If investors throw you a new definition, the system will calculate the metric for you, using your own data.

Preparing for investment is daunting. ScaleXP ensures that your data is in line with industry best practice and available at your fingertips. And if investors throw a few new definitions at you, the system will provide a full definition and calculate the metric for you, using your own data.

Ensure that you have full access to data and calculations from day 1. Update metrics in a few clicks, viewing historical and current performance. Build spreadsheets in ScaleXP, preloaded with both accounting and CRM data.

CFO Dashboards FAQs

Our dashboards are designed to provide a full business update in one or two screens – integrating financial, sales and marketing data. They are provided using cutting-edge technology to join data across systems, ensuring a full view of the business.

The dashboards provide actionable KPIs and comparisons to targets or budgets. Our objective is to make it easy to access the data so more time can be spent analysing it, rather than compiling.

Set up only takes one hour!

Each new customer is onboarded over Zoom, in a one-hour session. At the end of that hour, you will have a dashboard, with your data, the metrics that you want to track, and reports which allow you to dig deeper.

All data on the dashboard is ‘drag and drop’ and can be updated in less than a minute.

Yes, of course. Many of our customers created dashboards for their colleagues. You have full control over the dashboards you create and share, ensuring the business is focused on a single source of truth.

Yes, of course. ScaleXP includes a comprehensive set of SaaS KPIs: MRR, ARR, acquisition cost, lifetime value, net dollar retention, and much more.

For CFOs in SaaS (Software as a Service) companies, certain metrics are crucial for monitoring on a dashboard. These include:

- MRR (Monthly Recurring Revenue): Tracks the predictable revenue stream.

- ARR (Annual Recurring Revenue): Similar to MRR, but on an annual basis.

- CAC (Customer Acquisition Cost): The cost of acquiring a new customer.

- LTV (Lifetime Value): The total revenue expected from a customer over their lifetime.

- Churn Rate: The rate at which customers cancel their subscriptions.

- Gross Margin: Measures the efficiency of production and service delivery.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Indicates overall financial health.

- Burn Rate: The rate at which the company is spending its capital.

- CLV:CAC Ratio (Customer Lifetime Value to Customer Acquisition Cost): Assesses the value of a customer relative to the cost of acquiring them.

- Cash Flow: Understanding the inflows and outflows of cash.