AUTOMATE Revenue Recognition

Best in class revenue recognition software

Streamline and automate revenue recognition, using only the data in your current accounting system.

- Shorten the month-end close, saving 3+ days each month.

- Reduce errors with transparent schedules.

- Be GAAP and IFRS audit ready.

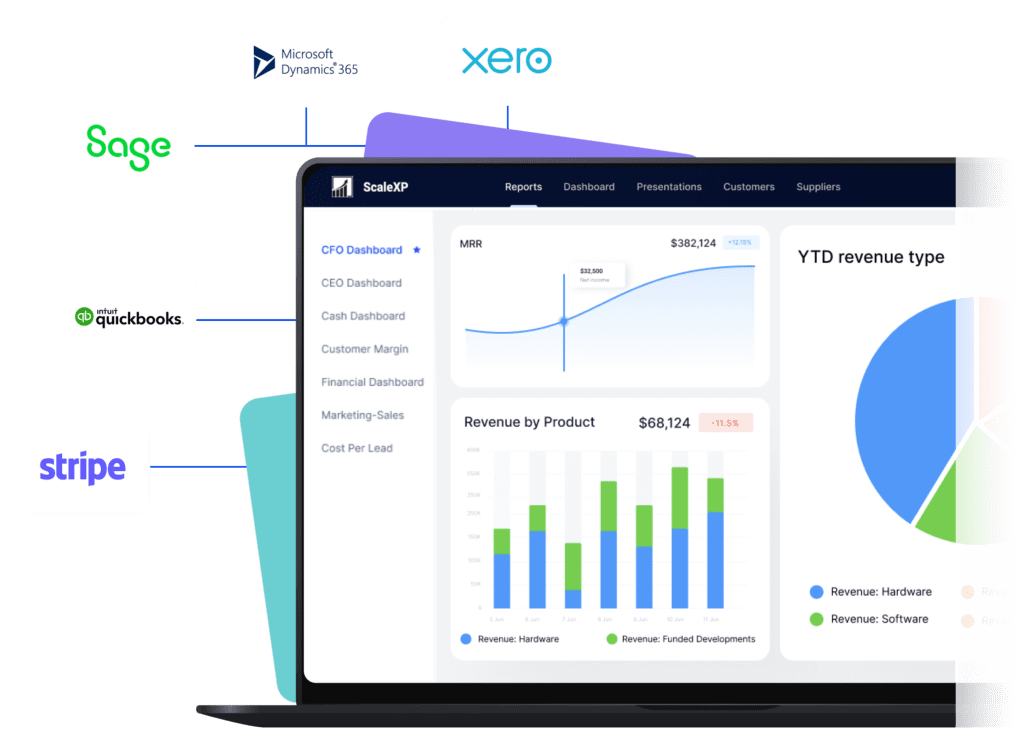

ScaleXP integrates with all leading accounting & CRM platforms:

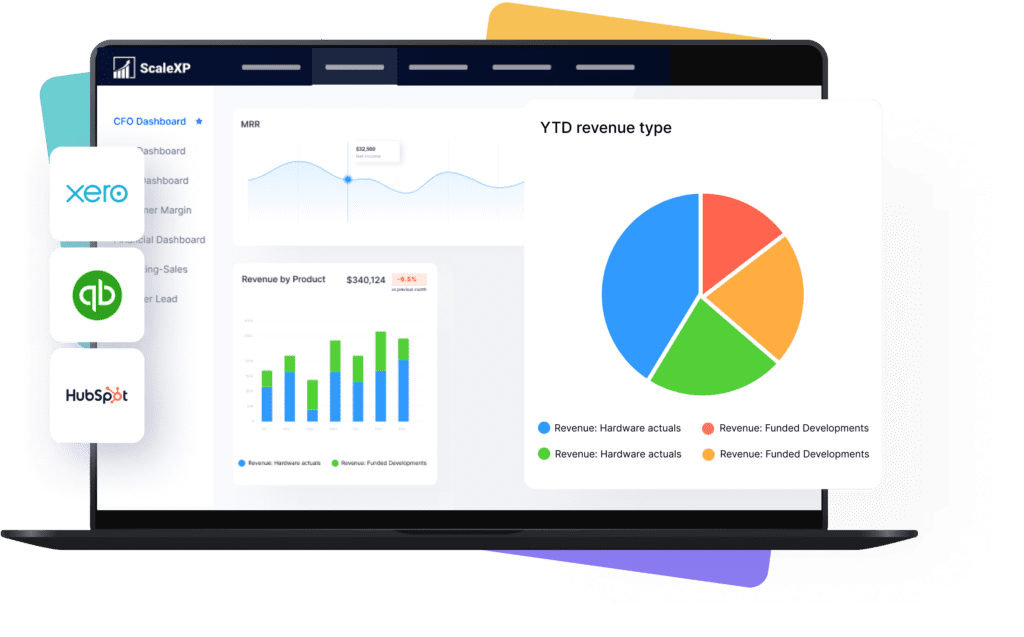

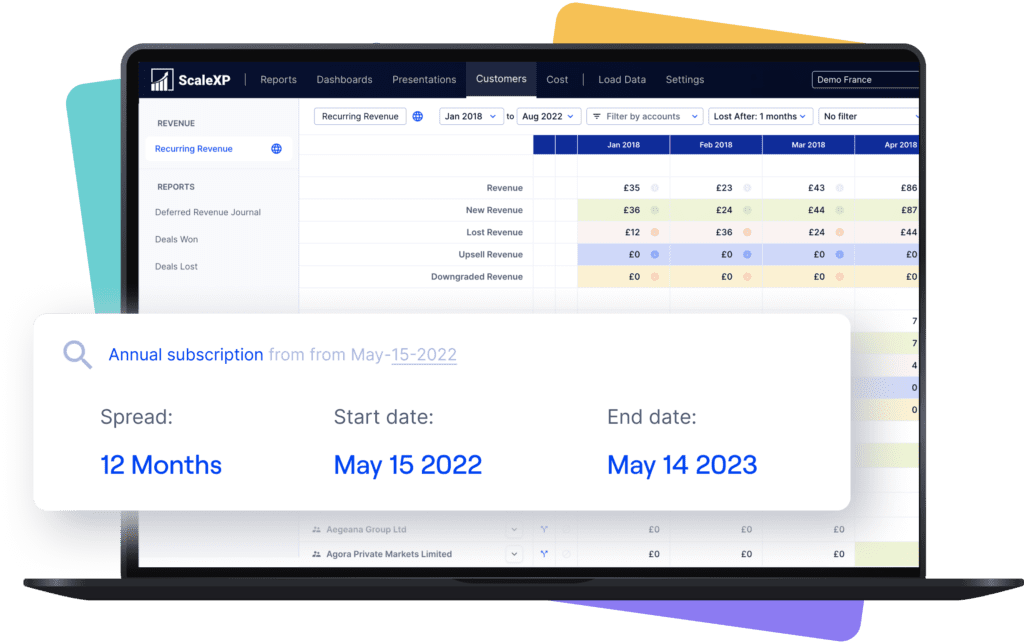

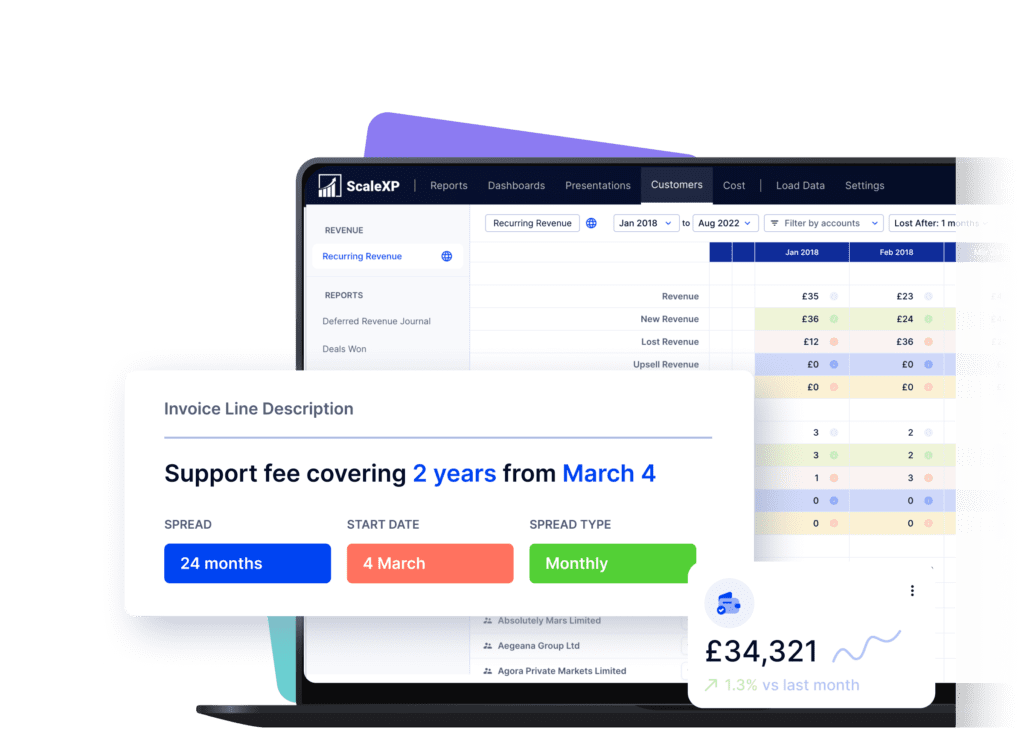

Automate deferred revenue recognition

ScaleXP eliminates the need for manual spreadsheets to track deferred revenue calculations with deferred revenue automation.

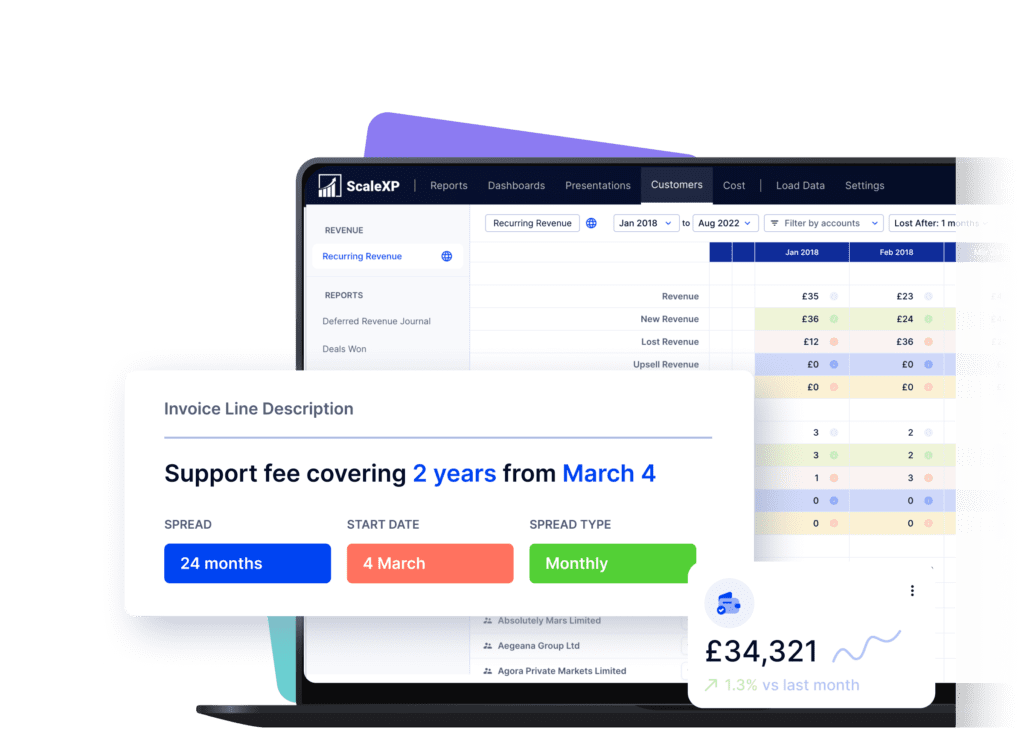

- A sophisticated series of natural language algorithms read and process all data and text on your invoices.

- Fully integrates to your accounting system, preparing real time revenue recognition schedules and providing journals for your review and approval.

- Schedules are fully GAAP and IFRS compliant and audit ready.

Streamline accrued income recognition

-

ScaleXP software suggests accruals based on synced contract and invoice information - Flags when related invoices are issued enabling quick and accurate reversals of related accruals.

- Sophisticated solution enables you to easily resolve accrued revenue when invoices are issued, reducing revenue recognition errors.

Automate invoicing from Hubspot

- Easily create invoices, without leaving HubSpot, including the relevant fields from your deals.

- Import contacts, tax rates, account codes, product data from Xero or QuickBooks.

- Sync invoices to QuickBooks or Xero as draft or final, providing finance review when required.

- Ensure your sales team is always up-to-date, with a two-way sync between systems.

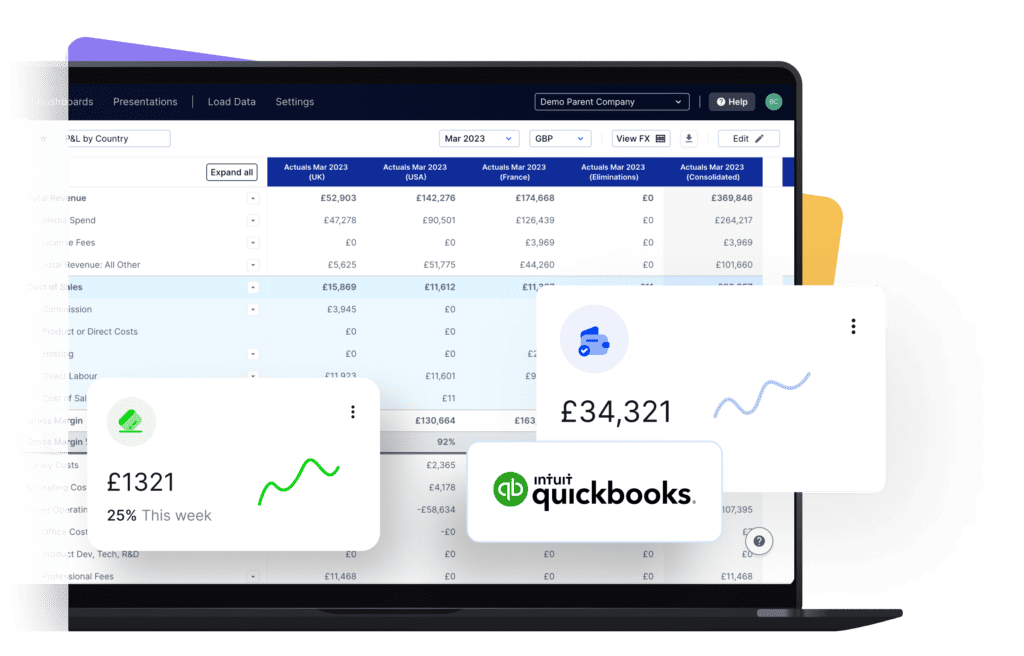

With the ScaleXP platform you can:

Close the month 3 days faster

Automate deferred revenue, accruals, and prepaid expenses. Link directly to journals and management accounting packs.

Reduce errors

Eliminate spreadsheet and billing errors. Prevent revenue leakage and ensure all of your data is audit ready with automated revenue recognition schedules.

Be IFRS & GAAP compliant

Transparent tracking of deferred revenue, accruals and prepaid expenses. Clear auditable schedules. Automated checks.

What our customers say

ScaleXP is a "Xero Staff Pick"

In July 2023, ScaleXP was selected by Xero as one of the top apps. This decision is based on the quality of our integration as well as our straight 5 star review in the Xero app store.

Revenue Recognition FAQs

Revenue recognition can be fully automated from Stripe, Xero, QuickBooks, Sage Business Cloud, most versions of Sage 50, Microsoft Dynamics 365, Exact and other platforms. For the full list of our accounting integrations, just click here ->

A CRM connection is not essential. Revenue recognition can be fully automated using all of the data and text on your invoices. The only requirement is for the system to see your invoices.

ScaleXP is built on a series of sophisticated natural language processing algorithms, which read and understand the text, just as a person would. Any date format can be used. You can even mix and match American date format (mm-dd-yy) and British date format (dd-mm-yy).

The system also understands words which convey time such as annual, quarterly, 6 months, 2 weeks, 6 days, just about anything you can think of. If a person can read and understand the revenue recognition period on your invoices, the ScaleXP algorithms will also understand.

Xero and QuickBooks can be automatically updated with draft revenue recognition journals. You simply review and click to approve. Journals can not be automatically passed to Sage or Dynamics, but ScaleXP provides the full journal and a comprehensive CSV download.

Yes, of course. ScaleXP provides a full breakdown of both Revenue (on the P&L) and Deferred Income (on the Balance Sheet). It will work across all of your accounts, as many as you have.

Schedules can be viewed by customer, by invoice, and by general ledger code. An audit trail of all journals passed to the accounting system. And, in case that’s not enough, all schedules can be downloaded to an Excel file.