Case study: Revenue Recognition

Save 15 hours each month by streamlining revenue recognition.

Navarro Properties

Navarro Properties is a family owned commercial property management company.

The company owns more than 16 million square feet of commercial space at 29 different locations.

Invoice modifications issues

Prior to using ScaleXP, revenue recognition was a complex and time-consuming process, taking at least 2 days per month. Each invoice included multiple lines with different terms, from a few weeks to 3 years. Shorter invoices could cross a month end, say for a 3-week period from 15 January to 10 February. Approximately 15% of the invoices covered a year or longer. The scenarios were endless.

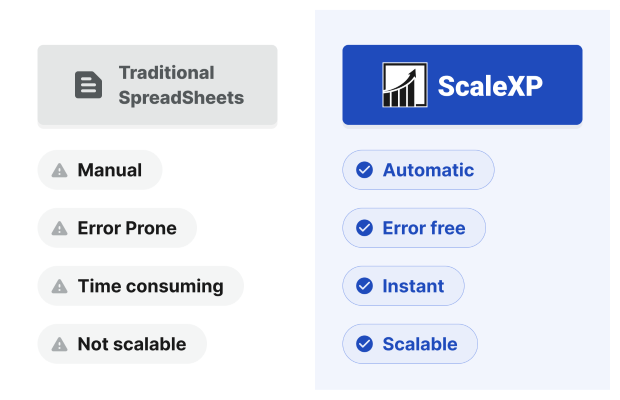

To calculate revenue recognition, every line on every invoice needed to be exported to a spreadsheet, with the term manually calculated and allocated by month.

Invoice modifications and credit notes were particularly painful, as tracking invoices which had been modified was not a simple task.

The main goal of moving to ScaleXP was to improve efficiency and free up accountants to focus on analysis and reporting.

“We wanted a system that would allocate revenue by day, with full traceability. We needed all invoice modifications and credit notes to be detected automatically. We also wanted to enable auditors to log in on their own to confirm the allocation.”

Why ScaleXP is the best solution

By using ScaleXP, Navarro Properties has saved two days each month. Time has shifted from updating tedious spreadsheets to focusing on business priorities.

“Our revenue reporting is so much easier and more accurate now. We are so pleased with the software and how it has simplified our month end process. We literally save 2 days per month during month end, which allows us to provide information faster and more dynamically.” – Chelsea Duncan, Financial Controller

Save 15 hours each month by streamlining your revenue recognition.

ScaleXP automatically imports data from Xero, Quickbook and Sage. Revenue is allocated daily, ensuring continuous accuracy. The system can fully automate both deferred and accrued revenue, using just the text in the invoice line description. It recognises all date formats as well as invoice terms, automatically, by using sophisticated natural language processing algorithms.

ScaleXP correctly recognises revenue within QuickBooks, Xero, Sage 50, Sage 200, Sage Cloud, Netsuite and other systems.

To explore other benefits of ScaleXP, including how the system can automatically calculate business KPIs, click here ->