What is CAC Payback Period?

The Customer Acquisition Cost (CAC) Payback Period measures how long it takes for a company to recoup the costs of acquiring a new customer. It is calculated by dividing the total cost of acquiring a customer (CAC) by the gross profit margin generated by that customer over a specific period of time.

The CAC Payback Period is typically expressed in months, and a shorter payback period is generally considered better, as it means that the company is able to recover the costs of acquiring a customer more quickly. A longer payback period may indicate that the company is spending too much on customer acquisition relative to the revenue it is generating from those customers.

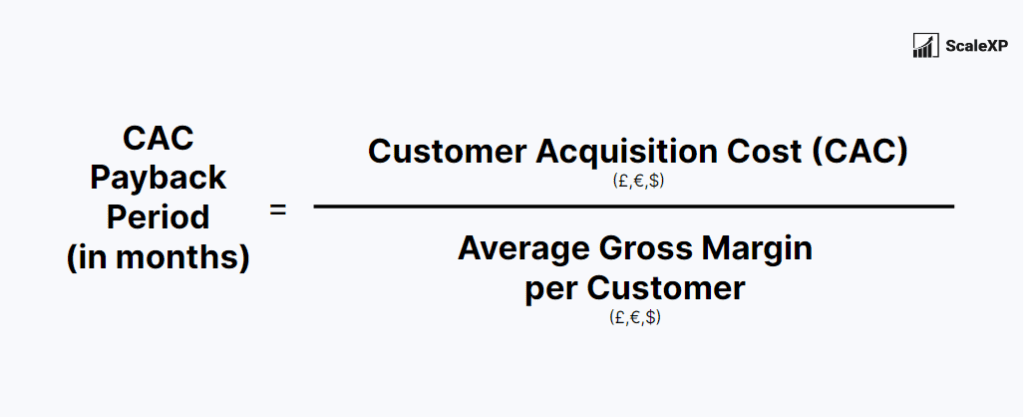

How is CAC Payback Period calculated?

To calculate the CAC Payback Period, a company needs to have a clear understanding of its CAC and the gross margin generated by its customers. CAC can include a variety of expenses, such as marketing and advertising costs, sales commissions, and employee salaries. Gross margin, sometimes called gross profit or net revenue, is the revenue generated by a customer after deducting any directly associated costs, such as the cost of goods sold.

The formula is:

For example, if it costs a company $500 to acquire a customer that earns it $100 per month: CAC Payback Period = CAC / (Gross margin per customer per month) = $500 / $100 = 5 months. In this example, it would take the company 5 months to recoup the cost of acquiring a new customer.

How is CAC Payback used by SaaS companies?

- Setting financial goals: SaaS companies can use the CAC Payback Period to set financial goals and track progress towards those goals. For example, a company might aim to reduce its CAC Payback Period over time by increasing the gross profit generated by its customers or reducing its CAC.

- Evaluating marketing and sales strategies: The CAC Payback Period can be used to evaluate the effectiveness of different marketing and sales strategies. For example, a company might compare the CAC Payback Period of customers acquired through different channels (e.g., online ads, direct mail, referral programs) to see which strategies are the most cost-effective.

- Determining pricing: SaaS companies can use the CAC Payback Period to inform their pricing decisions. For example, a company might adjust its pricing to increase the revenue generated by its customers, which can help to shorten the CAC Payback Period.

- Assessing the sustainability of the business model: The CAC Payback Period can be a useful indicator of the sustainability of a SaaS company’s business model. If the payback period is very long, it may be a sign that the company is spending too much on customer acquisition relative to the revenue it is generating from those customers.

What is a good result?

- Industry benchmarks: It can be helpful to compare the CAC Payback Period of your company to industry benchmarks to see how it compares to similar businesses.

- Long-term value of customers: While a shorter payback period may be desirable, it is important to also consider the long-term value of customers. A customer who generates a lower gross profit in the short term may still be valuable if they are likely to make repeat purchases or refer other customers in the future.

- Cost of customer acquisition: It is important to ensure that the cost of acquiring a customer is not too high relative to the revenue that the customer generates. If the CAC Payback Period is very long, it may be a sign that the company is spending too much on customer acquisition relative to the revenue it is generating from those customers.

- Investment in customer acquisition: The CAC Payback Period should be considered in the context of the overall investment that a company is making in customer acquisition. If a company is making a large upfront investment in customer acquisition, it may be acceptable to have a longer payback period as long as the investment is expected to pay off in the long run.

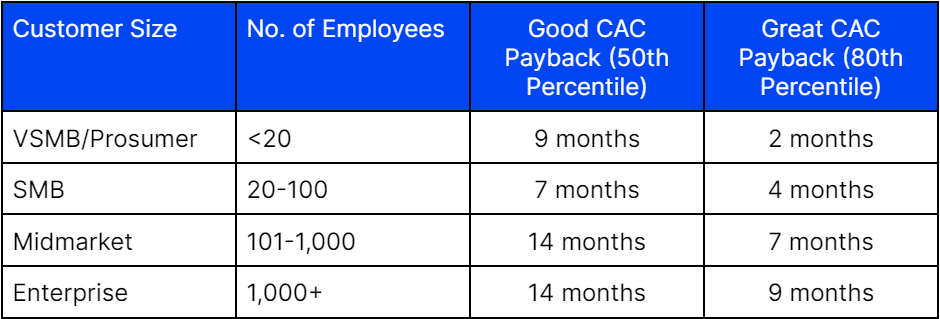

What are the CAC Payback Period benchmarks?

CAC Payback Period varies widely by the size of your customers and target market, with shorter payback periods associated with smaller customers. Based on 2022 benchmarks, here is a reasonable range:

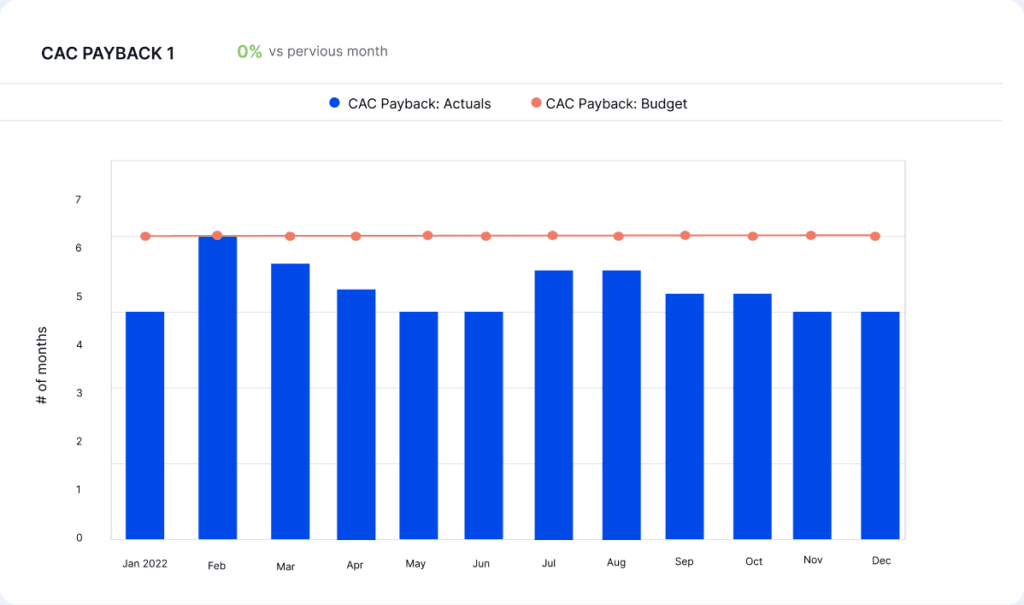

CAC Payback Period Visualization Example

ScaleXP makes it easy to track CAC Payback Period. Data is compiled automatically from your accounting or financial system, including Xero, QuickBooks and other systems. Budgets and Benchmark comparisons can be added in a click, allowing you to quickly share insights across the business.

You may also be interested in

Lifetime Value to CAC Ratio (LTV: CAC)

Lifetime value divided by acquisition costs, indicating the margin delivered by each new customer.

SaaS MAGIC NUMBER

A measure of growth or sales efficiency. Calculated as Revenue Growth divided by Customer Acquisition Costs.