Revenue Recognition

Your revenue recognition fully automated

Streamline and automate revenue recognition, using only the data in your current accounting system.

- Shorten the month-end close, saving 3+ days each month.

- Build confidence in data with transparent schedules.

- Get real-time visibility of current and future secured revenue.

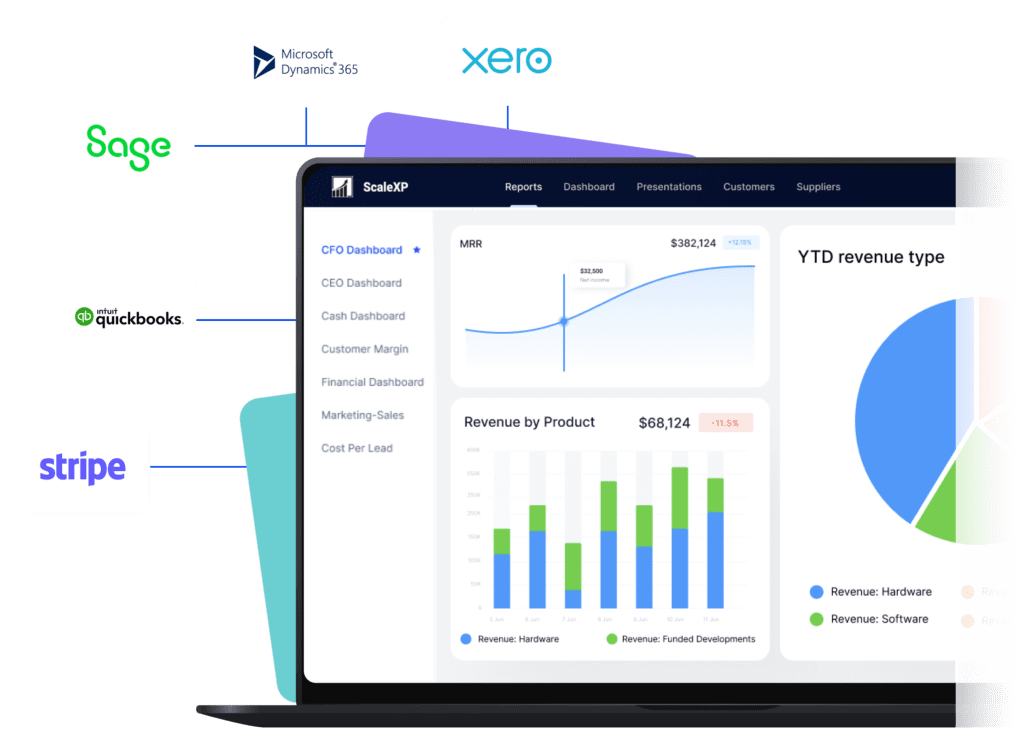

Automate revenue recognition from all leading accounting systems & more. See all accounting integrations.

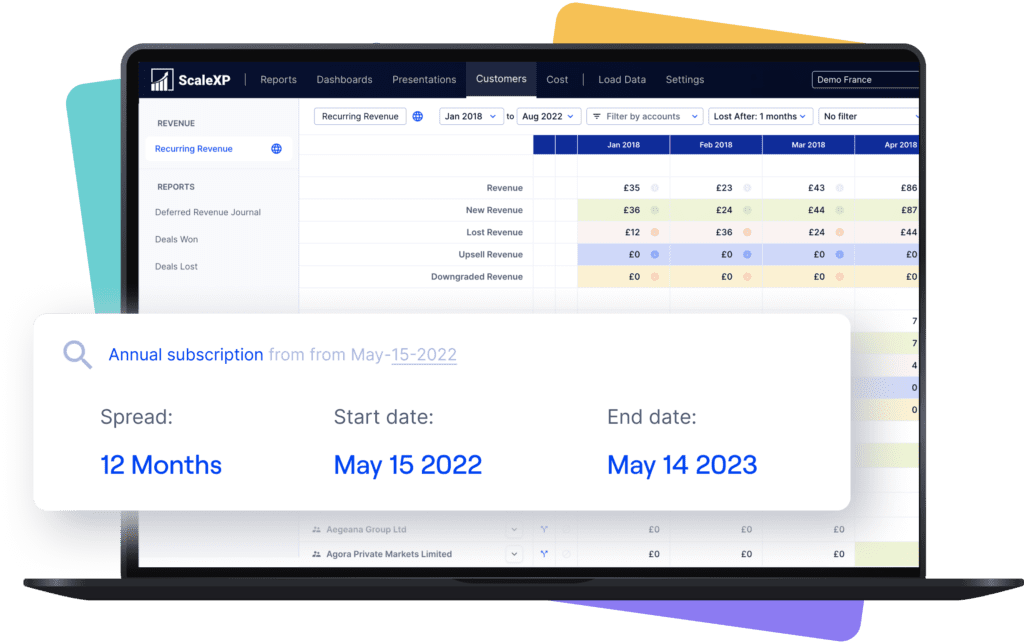

Automate deferred income recognition

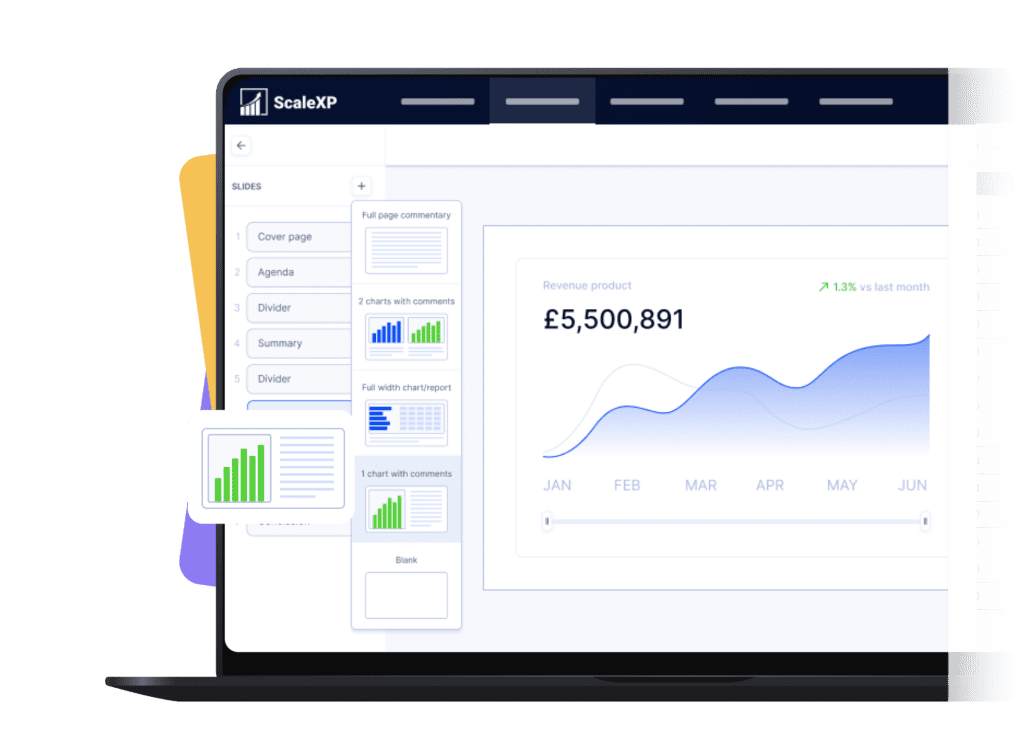

ScaleXP is a tool for smart finance automation, which uses technology to fully automate revenue recognition. Sophisticated natural language algorithms read and process all data and text on your invoices, preparing revenue recognition schedules.

Auditable schedules provide revenue recognition by month, by customer, by invoice, and by general ledger code. Detail is aggregated in schedules which are transparent and easy to share.

Streamline accrued income recognition

Revolutionise your accrued revenue recognition with ScaleXP. Our platform integrates seamlessly with your accounting system, offering flexible options for entering future-dated invoices.

Smart enough to detect changes in contractual periods and adaptable across countries and currencies, ScaleXP takes the hassle out of revenue management. Our customers save hours, even days, using ScaleXP revenue recognition technology.

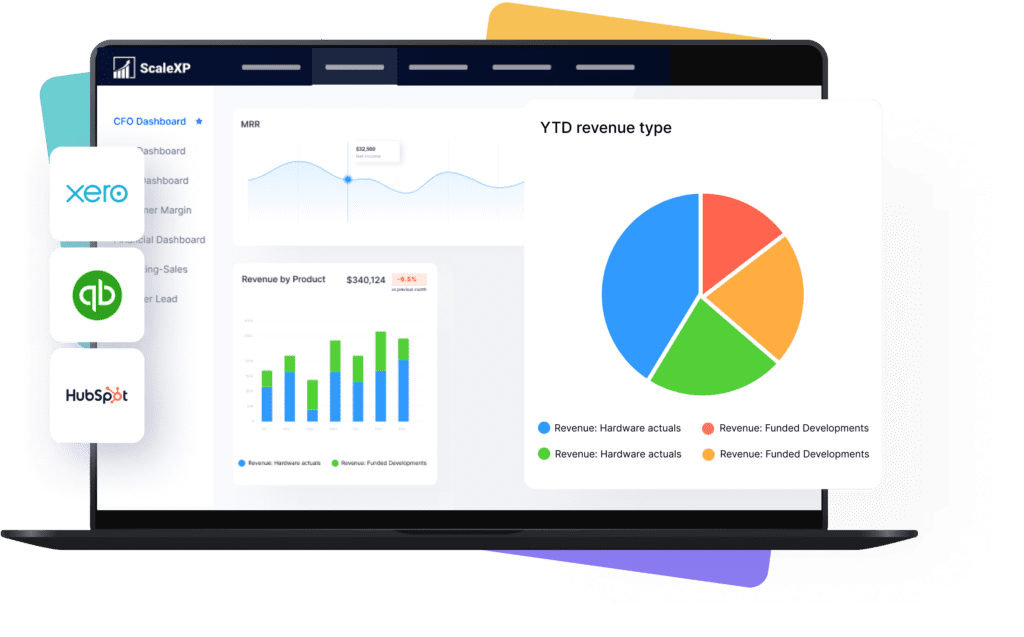

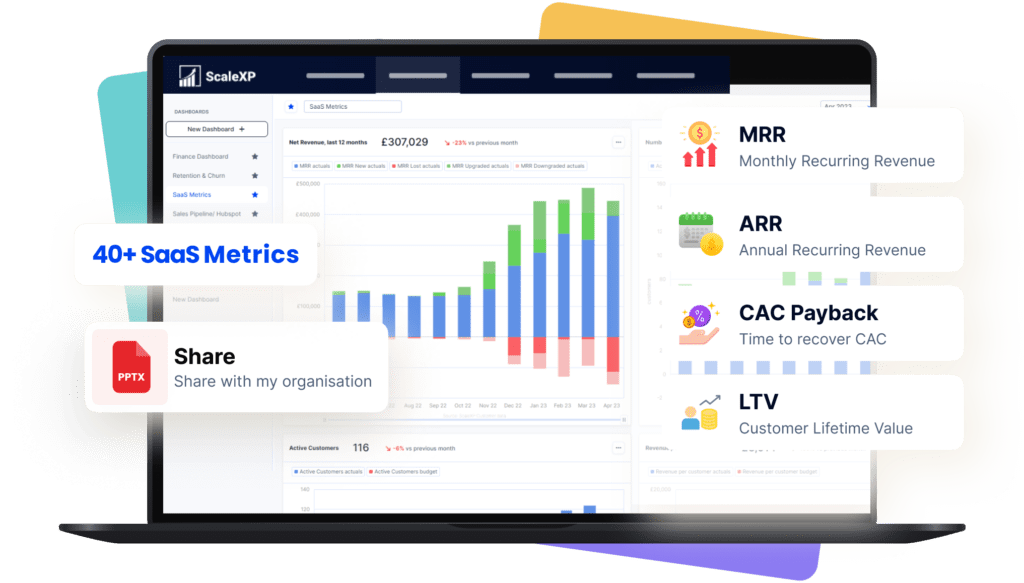

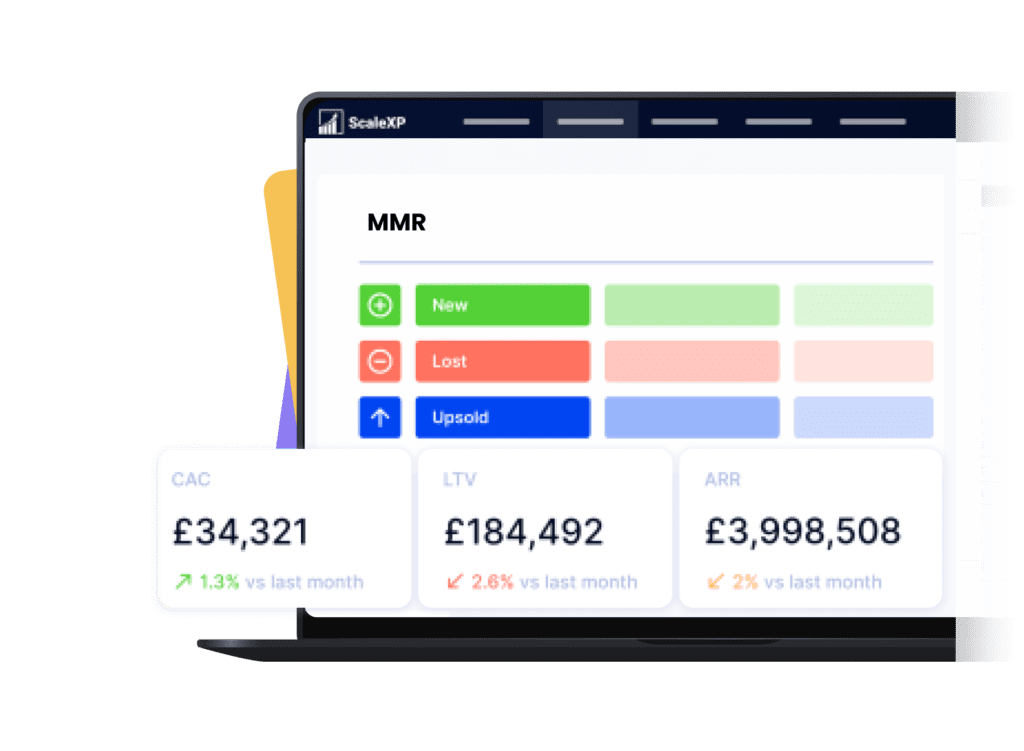

Automate all your

SaaS metrics

ScaleXP puts B2B SaaS metrics at your fingertips in transparent schedules which are easy to share.

Business-critical metrics including Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Customer Acquisition Cost (CAC), Customer Lifetime Value (LTV), even Net Dollar Retention are fully automated through sophisticated tagging.

With ScaleXP you can

Xero Revenue Recognition

ScaleXP is a certified Xero partner. The system automatically imports and processes new invoices and invoice modifications, ensuring 100% accuracy between the systems.

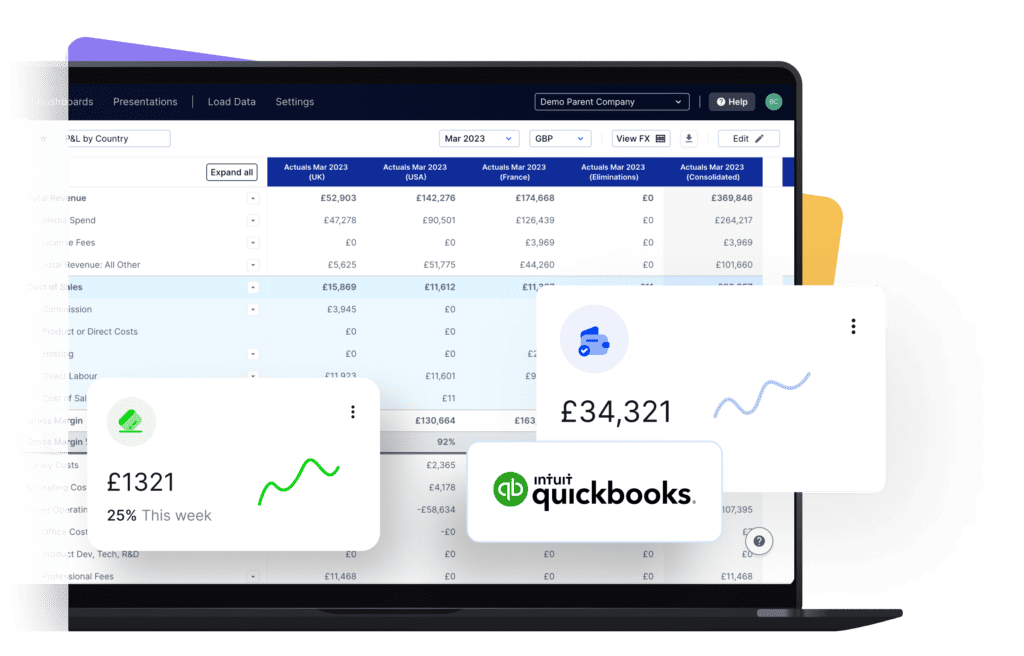

QuickBooks Revenue Recognition

ScaleXP is a certified QuickBooks partner. The system imports all invoices and is even clever enough to detect when an invoice has been modified, ensuring the systems are always aligned.

Sage Revenue Recognition

ScaleXP is a certified Sage partner. The system fully integrates with Sage Cloud and Sage 50, making revenue recognition in Sage a breeze!

What our customers say

Discover how we helped SquaredUp produce SaaS insights faster and with greater accuracy with revenue recognition

Revenue Recognition FAQs

Revenue recognition can be fully automated from Stripe, Xero, QuickBooks, Sage Business Cloud, most versions of Sage 50, Microsoft Dynamics 365, Exact and other platforms. For the full list of our accounting integrations, just click here ->

A CRM connection is not essential. Revenue recognition can be fully automated using all of the data and text on your invoices. The only requirement is for the system to see your invoices.

ScaleXP is built on a series of sophisticated natural language processing algorithms, which read and understand the text, just as a person would. Any date format can be used. You can even mix and match American date format (mm-dd-yy) and British date format (dd-mm-yy).

The system also understands words which convey time such as annual, quarterly, 6 months, 2 weeks, 6 days, just about anything you can think of. If a person can read and understand the revenue recognition period on your invoices, the ScaleXP algorithms will also understand.

Xero and QuickBooks can be automatically updated with draft revenue recognition journals. You simply review and click to approve. Journals can not be automatically passed to Sage or Dynamics, but ScaleXP provides the full journal and a comprehensive CSV download.

Yes, of course. ScaleXP provides a full breakdown of both Revenue (on the P&L) and Deferred Income (on the Balance Sheet). It will work across all of your accounts, as many as you have.

Schedules can be viewed by customer, by invoice, and by general ledger code. An audit trail of all journals passed to the accounting system. And, in case that’s not enough, all schedules can be downloaded to an Excel file.