What is IFRS 15?

The IASB introduced IFRS 15, a global accounting standard that explains how to recognise revenue from customer contracts.

Guess what? If you’re preparing financial statements using IFRS, you’ve got to follow IFRS 15. And it doesn’t matter if you’re a public or private company, a not-for-profit organisation, or even a government entity.

So, why is IFRS 15 so important? Well, it ensures consistency and transparency in financial reporting across different industries and regions. By following IFRS 15, businesses can provide a clear and accurate picture of their revenue streams. This helps investors, stakeholders, and regulators make informed decisions based on comparable financial information. In short, IFRS 15 plays a crucial role in building trust and confidence in the global financial market.

At ScaleXP our platform is built to automate tasks such as revenue recognition, whilst being compliant to both IFRS 15 and ASC606 saving businesses both time and hassle when calculating their finances. You can see for yourself with a 7-day free trial.

What does IFRS 15 say about revenue recognition?

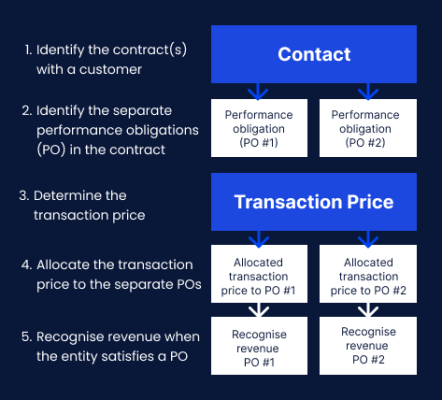

IFRS 15 has this five-step model for revenue recognition, and here’s what entities need to do:

- Spot the contract with the customer.

- Figure out the performance obligations in the contract.

- Work out the transaction price.

- Share the transaction price among the performance obligations.

- Record revenue when or as they fulfil a performance obligation.

The IFRS chose this model because it provides a clear and consistent framework for revenue recognition across various industries and transactions. This approach ensures that financial statements reflect the true economic substance of business activities.

How does IFRS apply to software or SaaS companies?

Software subscriptions

Under IFRS 15, when software is a distinct performance obligation, you should recognise revenue over the subscription period.

If a subscription includes other goods or services, like maintenance and support, evaluate whether they are distinct performance obligations. If they are, allocate the transaction price among them based on their relative standalone selling prices, and recognise revenue for each distinct obligation throughout the subscription period.

Annual software licences

When a subscription is a single performance obligation with a period of one year or less, recognise revenue evenly over the subscription period or use another method that better reflects the transfer of goods or services to the customer.

Multi-year software licences

For subscription periods longer than one year, assess if significant financing components, such as the time value of money, are present in the transaction price. If you identify such components, adjust revenue accordingly.

Variable discounts

If a subscription has variable consideration, like discounts or rebates, estimate the variable consideration and recognise revenue based on the most likely amount to be received. Update revenue for any changes in estimated variable consideration in the period of change.

Upgrades and enhancements

Under IFRS 15, you should recognise revenue for software upgrades when the customer takes control, typically when the licence period begins or activates.

Professional services

To recognise revenue for professional services or setup fees, determine if they are distinct performance obligations. If they are, recognise revenue when providing the service or setup fee to the customer. Recognise the allocated transaction price as revenue when transferring control of the service or setup fee to the customer.

If professional services or setup fees include variable consideration, such as discounts or rebates, estimate the variable consideration and recognise revenue based on the most likely amount to be received.

What are the criteria to comply with IFRS 15?

IFRS 15 requires recognising revenue over the contract period, not upfront at the time of sale. To follow IFRS, software companies must maintain accurate and complete customer contract information, including contract terms and service pricing details. Contracts can be written, oral, or implied by actions.

What are the major differences between ASC606 and IFRS 15?

ASC 606 and IFRS 15 aim to ensure accurate revenue recording and recognition, providing clear, detailed guidance. Despite similarities, differences exist. For instance, IFRS 15 requires including variable consideration in the transaction price when it’s highly probable significant revenue reversal won’t occur. Meanwhile, ASC 606 requires including variable consideration as long as a significant revenue reversal is improbable.

Companies operating in multiple jurisdictions or considering global IPOs may need to comply with both standards, staying aware of their differences.

How can software make compliance easier?

SME accounting systems like Xero and QuickBooks lack ASC 606 compliance functionality. Add-on software, such as ScaleXP, can help by importing invoices from the accounting system, and automating revenue recognition with advanced text recognition algorithms. Setup is easy, usually providing a full revenue recognition schedule within an hour.

Click here to see if ScaleXP integrates with your accounting platform. Or set up a free trial account today.

For companies operating in the USA, click here to read our article on ASC 606 revenue recognition.