What is the meaning of Annual Recurring Revenue (ARR)?

ARR stands for Annual Recurring Revenue. It is a financial metric that represents the expected annual revenue that a company will generate from its recurring (i.e. ongoing or subscription-based) revenue streams. It is a useful metric for businesses that have a subscription-based model, as it provides a prediction of future revenue based on the current level of recurring revenue.

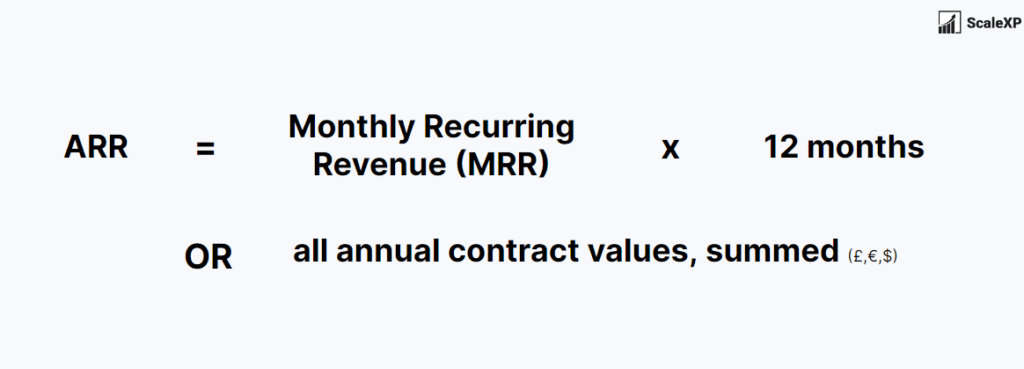

How is ARR Calculated?

The formula for ARR is shown below:

ARR is calculated by taking the total recurring revenue that a company expects to receive in a given month (Monthly Recurring Revenue or MRR) and multiplying it by 12, the number of months in that year. For example, if a company expects to receive $12,000 in recurring revenue per month, its ARR would be $12,000 per month x 12 months = $144,000.

How is ARR used by SaaS companies?

ARR is a critical metric to track the performance of SaaS companies because it can be used to plan for future growth and investment. It can also be useful for investors and analysts to evaluate the stability and growth potential of a company.

ARR is a particularly important metric for Software as a Service (SaaS) companies, as it provides a way to measure the expected revenue from ongoing subscriptions. SaaS companies typically generate revenue by selling subscriptions to their software products, which are delivered over the internet on a recurring basis.

There are several ways that SaaS companies can use ARR to inform their business decisions:

- Planning for future growth: By tracking ARR over time, SaaS companies can get a sense of the expected growth of their recurring revenue streams and use that information to plan for future expansion and investment.

- Setting financial goals: ARR can be used to set financial goals for the company and track progress towards those goals. For example, a company might aim to increase its ARR by a certain percentage each year.

- Evaluating performance: ARR can be used to compare the performance of different products or customer segments within the company. For example, a company might compare the ARR of its different software products to see which ones are generating the most recurring revenue.

- Determining pricing: SaaS companies can use ARR to inform their pricing decisions. For example, a company might adjust its pricing to increase its ARR or to move towards a higher-priced subscription model.

What is the difference between recurring and non recurring revenue?

Recurring revenue is revenue that is expected to be generated on a regular, ongoing basis. This can include subscription-based revenue, such as monthly or annual fees for a service, or revenue from contracts that are renewed on a regular basis. Non-recurring revenue, on the other hand, is revenue that is not expected to be generated on an ongoing basis. It is typically one-time in nature and may include revenue from the sale of a product or the completion of a project.

What is a good result?

A high ARR and a steadily increasing ARR are positive indicators of business performance. The most common ARR benchmark is ARR Growth Rate, or the annual increase in ARR. It is certainly one of the top 15 SaaS metrics.

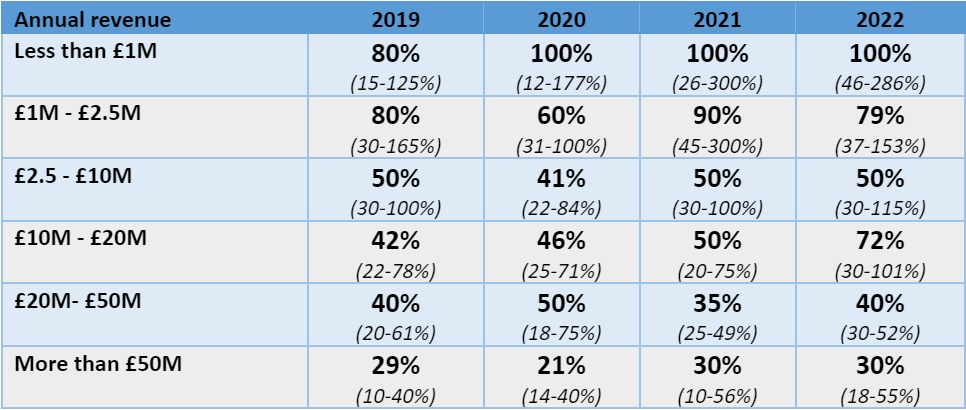

What are the ARR benchmarks for SaaS companies?

The below ARR benchmarks reflect a global SaaS benchmarking study by Openview VC which includes 600 VC-funded companies across all regions of the world. In the table, the left column is the annual revenue for the business. The bold number in the table is the average growth rate for companies of that size for that year, while the numbers in brackets show the average growth rates for the slowest 25% (first number) and fastest 25% (last number) of companies in that range that year.

The data above shows that the average growth rate for SAAS companies has generally increased over the last three years for companies of all sizes, except those generating £20-£50M revenue where growth rates have fallen.

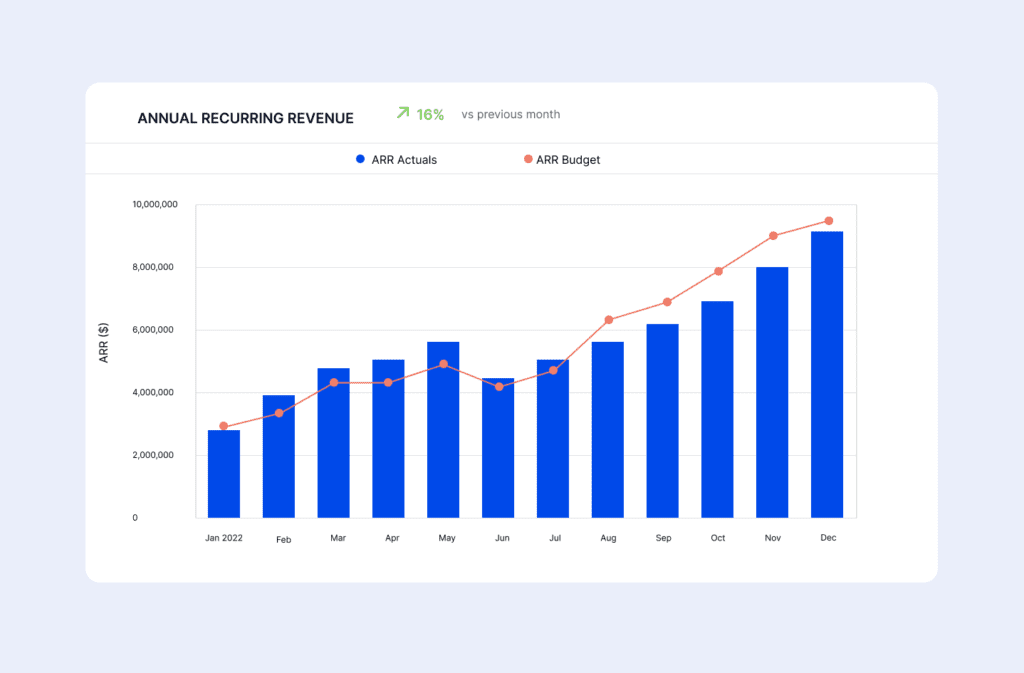

ARR Visualisation Example

ScaleXP is the leading SaaS finance tool, able to provide a full suite of SaaS metrics, automatically calculated each month. The system connects to and imports data from both your accounting (Xero or Netsuite) and CRM (HubSpot or Salesforce) systems. As data is imported, a series of smart algorithms prepare a revenue recognition schedule and from this, graphs such as these which show both ARR and a budget or latest forecast.

You may also be interested in

MRR

Predictable revenue that a company can expect to receive on a monthly basis from its subscription-based products or services.

MRR Growth Rate

Percentage increase in MRR over a certain period of time, most typically a quarter or a year.