What is Customer Lifetime Value?

Customer Lifetime Value is a prediction of the total value that a customer will bring to a business over the course of their relationship with the company. Customer Lifetime Value is frequently abbreviated CLTV or LTV.

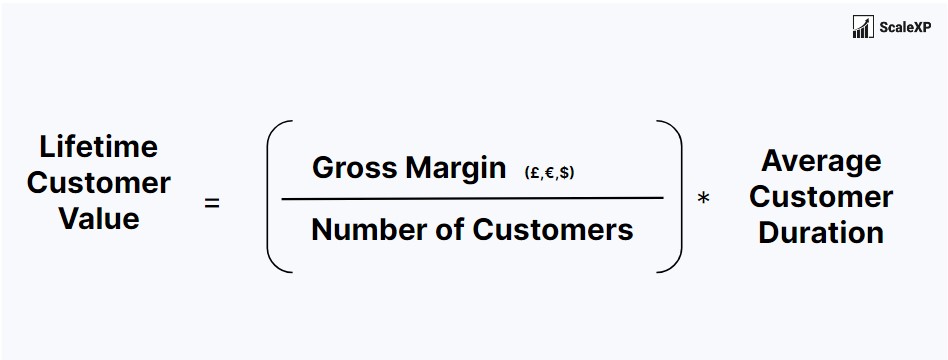

To calculate Customer Lifetime Value, you need to know:

- Expected duration of the customer’s subscription (in months or years)

- Average revenue that the customer is expected to generate per month or year

- Profitability or margin of the customer

The formula for Lifetime Value is:

If you don’t have a known value for Average Customer Duration, you can estimate it using this formula: 1 divided by Customer Churn % per month equals customer duration in months.

How is Customer Lifetime Value is used by SaaS companies?

Lifetime Value is an important metric because it helps businesses understand the value of their customers and make informed decisions about how much they can afford to spend to acquire new ones. By comparing lifetime value to acquisition (CAC), businesses can determine the return on investment of their customer acquisition efforts and make informed decisions about how to allocate their resources.

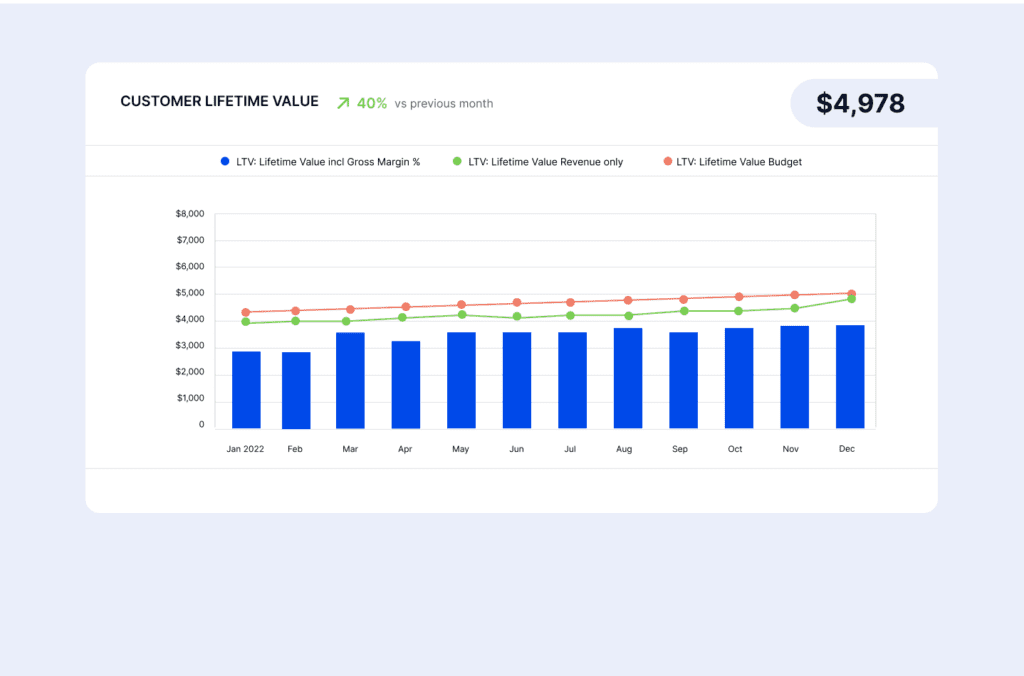

LTV Visualisation Example

This chart is an example of customer lifetime value, with month on month and budget comparisons, making it much easier to understand trends, improvements, even seasonality.

You may also be interested in

ScaleXP fully automates Lifetime Customer Value with easy customisation of definitions as well as instant links to your finance systems, allowing instant visualisation of all your data and KPIs as well as automated revenue recognition and analysis. To learn more, click here.

LTV : CAC

Lifetime value divided by acquisition costs, indicating the margin delivered by each new customer.

CAC Payback Period

Measures how long it takes for a company to recoup the costs of acquiring a new customer.