Ready to transform data to insight?

Getting started with ScaleXP is easy! Try it for yourself free for 7 days. Or, if you have specific questions, just use the button to the right to schedule a quick meeting.

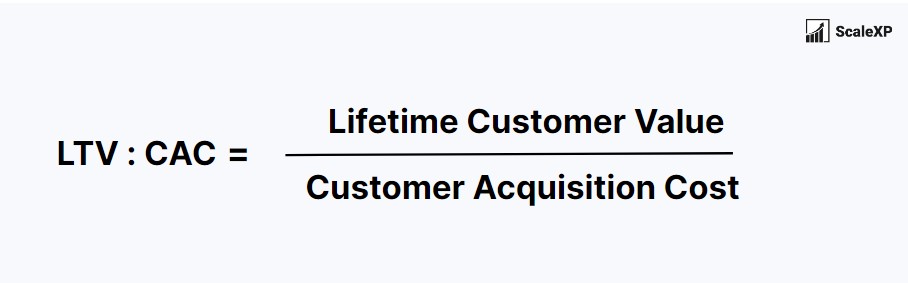

LTV to CAC is a ratio that compares the lifetime value of a customer to the cost of acquiring that customer. It is a key SaaS metric as it highlights growth efficiency.

By tracking the LTV to CAC ratio, businesses can identify trends and make adjustments to their customer acquisition strategies to improve their profitability and maximise the value of their customer base.

The formula for LTV : CAC is Lifetime Customer Value, divided by Customer Acquisition Cost, as shown below.

There are a few different ways that SaaS companies can use LTV:CAC to inform their business strategies:

By understanding the LTV/CAC ratio, SaaS companies can make informed decisions about how much to allocate towards sales and marketing efforts. A high LTV/CAC ratio indicates that the business is able to acquire customers at a low cost and that those customers are valuable and likely to generate a lot of revenue over the course of their relationship with the company.

By analysing the LTV/CAC ratio for different channels or campaigns, SaaS companies can identify which channels are most effective at driving customer acquisition and allocate more resources towards those channels.

By comparing the LTV/CAC ratio to the cost of customer acquisition (CAC), SaaS companies can determine the return on investment of their customer acquisition efforts and make informed decisions about how to price their products and services.

By understanding the LTV/CAC ratio and the lifetime value (LTV) of their customers, SaaS companies can make more accurate revenue projections and plan for the future growth of the business.

Overall, tracking LTV:CAC is an important part of managing a SaaS business and can help companies make informed decisions about how to allocate their resources and drive long-term growth.

There is no single “good” LTV:CAC result that applies to all businesses. The appropriate LTV:CAC ratio will depend on a variety of factors, including the specific industry, the target market, and the cost of goods and services.

In general, however, a high LTV:CAC ratio is generally considered to be a good sign. A high ratio indicates that the business is able to acquire customers at a low cost and that those customers are valuable and likely to generate a lot of revenue over the course of their relationship with the company. A ratio of 3:1 or higher is often considered to be strong, although it’s important to keep in mind that the appropriate ratio will vary depending on the specifics of the business.

On the other hand, a low LTV:CAC ratio may indicate that the business is spending too much to acquire customers or that the customers it is acquiring are not as valuable as they could be. In this case, the business may need to reassess its sales and marketing strategies to improve the efficiency and effectiveness of its customer acquisition efforts.

Ultimately, the goal of any business should be to maximise the LTV:CAC ratio by acquiring valuable customers at the lowest possible cost. By tracking and analysing this ratio, businesses can make informed decisions about how to allocate their resources and drive long-term growth.

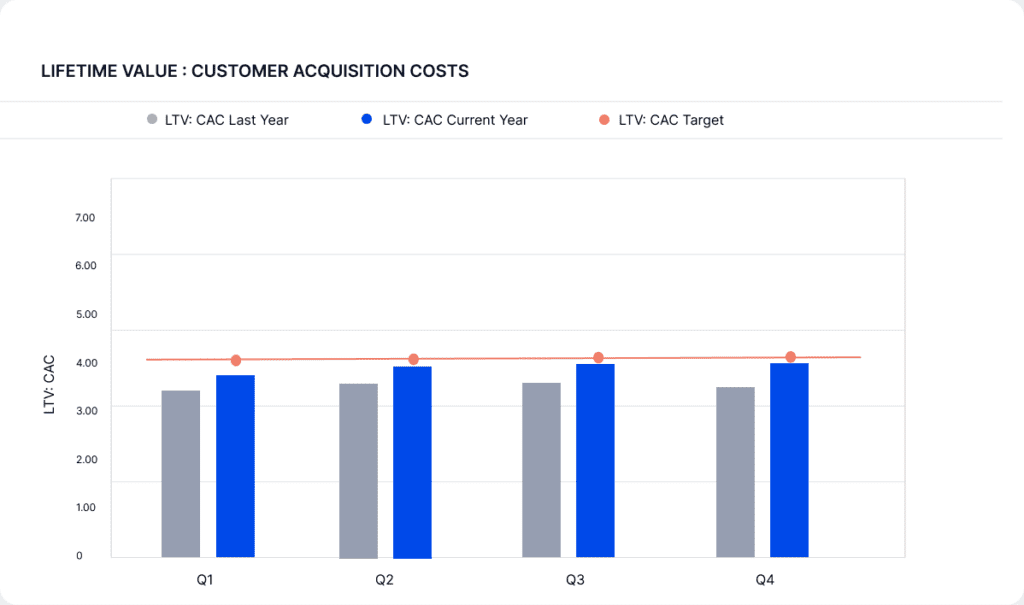

This chart is an example of the monthly LTV:CAC ratio over time compared to budget, making it much easier to understand trends, improvements, even seasonality.

ScaleXP fully automates LTV / CAC ratios with easy customisation of definitions as well as instant links to your finance systems, allowing instant visualisation of all your data and KPIs as well as automated revenue recognition and analysis. Click here to learn more.

Annual value of all recurring revenue. Typically calculated as MRR * 12.

Measures how long it takes for a company to recoup the costs of acquiring a new customer.

Connect and combine data from a wide range of accounting & sales CRM systems. Use integrated data to create a comprehensive, fully automated suite of SaaS metrics.

Click below to understand if ScaleXP connects to your systems.

Getting started with ScaleXP is easy! Try it for yourself free for 7 days. Or, if you have specific questions, just use the button to the right to schedule a quick meeting.