ARR stands for Annual Recurring Revenue. It is used to understand the annualised revenue for a company, particularly for businesses with a subscription or SaaS model.

ARR is easy to calculate. It is just monthly recurring revenue multiplied by 12. Yes, it’s that simple!

Monthly Recurring Revenue (MRR) can be slightly more complex as it requires:

- Identifying revenue that is truly recurring

- Allocating annual or quarterly to each relevant month

Why are ARR and MRR important for investors?

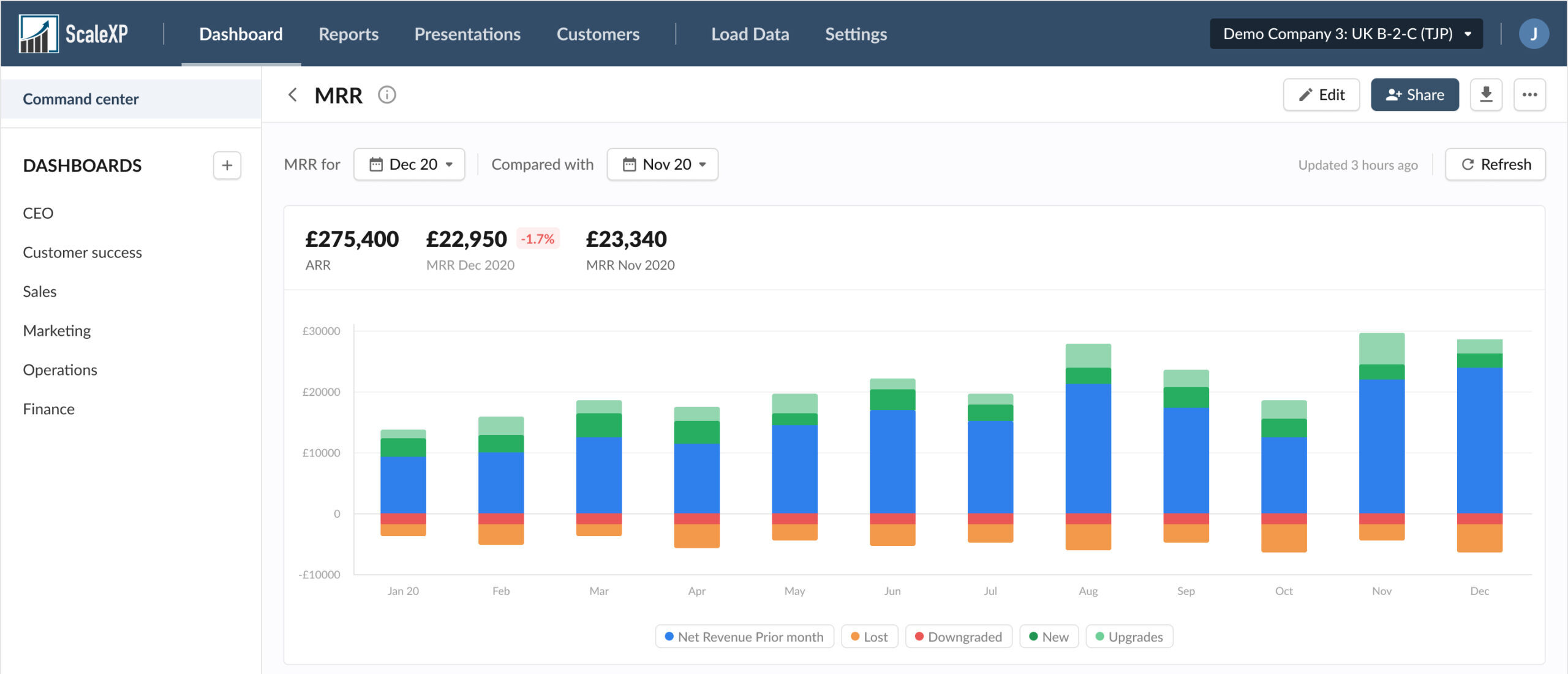

ScaleXP provides a full auditable view of MRR and ARR, down to each invoice (and each line within an invoice). This was a complex piece of automation, so why did we take the time?

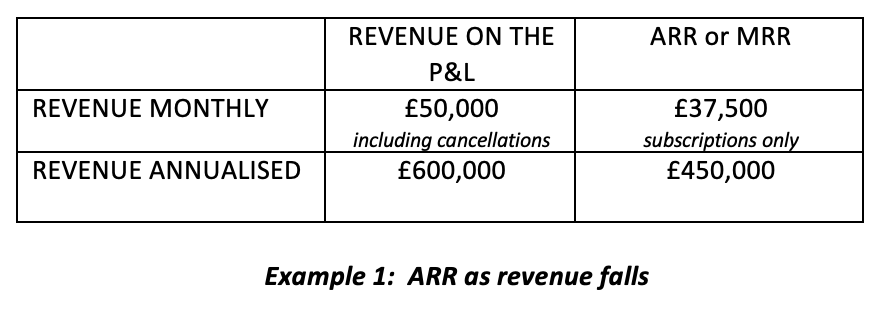

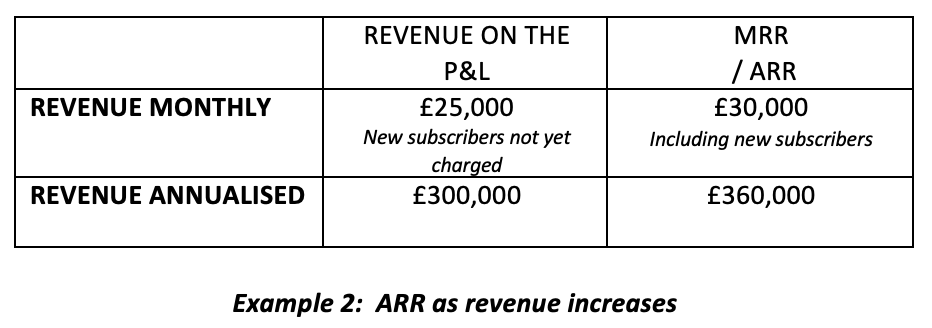

ARR is a good measure of future revenue, far better than revenue on the P&L, as it provides a far superior better indication of growth. This is particularly true when revenue is changing quickly, either increasing or decreasing.

To illustrate this point, we will look at the example of your local gym – which generates sales by selling memberships – during COVID-19.

Example 1: Prior to the pandemic, the gym was busy with 1000 subscribers. Some pay quarterly; most pay monthly. The average fee is £50 per month, making MRR £50,000, and ARR is £600,000. Revenue on the P&L is the same.

Example 2: COVID-19 hits, and 25% of members cancel their membership in a single month. The cancellation period is two months, so there is no immediate impact to reported revenue, as everyone is still being charged during the cancellation period. MRR, however, has now fallen to £37,500 (calculated as 750 members at £50 per month). ARR is now £450,000.

The distinction between these numbers highlights the power of ARR. Investors prefer to assess ARR, rather than reported revenue.

Example 3: COVID-19 finally ends (thankfully!). The gym, unfortunately, has just 50% of its original customers. It launches a marketing campaign, offering two months free on an annual contract. They get 100 subscribers.

Once again, ARR and MRR provide a superior view of the business.

Key Takeaways

ARR (Annual Recurring Revenue):

- A metric for annualized revenue, especially relevant for subscription or SaaS models.

- Calculated simply by multiplying Monthly Recurring Revenue (MRR) by 12.

MRR (Monthly Recurring Revenue):

- Involves identifying genuinely recurring revenue.

- Requires allocating annual or quarterly revenue to each relevant month.

Importance for Investors:

- ARR provides a clearer picture of future revenue and growth trends.

- More accurate than standard P&L revenue, especially during rapid revenue changes.

Using ScaleXP to automate ARR and MRR

Most businesses are far more complex than this simple example of our local gym. In almost all cases, there will be some combination of quarterly and annual invoices mixed with monthly ones. To add to the complexity, some types of revenue are recurring while others are not, and these are frequently hard to separate.

As a result, calculating MRR and ARR can take time. Too often, accounting revenue must be exported to a spreadsheet and recalculated, taking hours each month and risking errors.

This is the main reason ScaleXP has fully automated these calculations. The system recognises quarterly, and annual invoices based on the invoice description. Each type of revenue can be tagged as recurring or not. The output is a full auditable view of MRR and ARR, down to each invoice (and even each line within an invoice).

Being able to reliably and instantly extract reliable recurring revenue data has a positive knock-on effect. The next level of analysis is to identify high growth customers by examining lifetime value and cohort analysis. This is now infinitely faster and easier.

ScaleXP is continuously pushing the boundaries of business data analysis through time saving automation and visualisation. Our single-minded mission is to help companies grow faster. Read more about benchmarking funding stages here.