For the latest SaaS Benchmarks click here.

This is the third article in our 6-part series covering SAAS benchmarks.

This article focuses on funding by growth stage, so we think you’ll find it particularly interesting.

We include data from the USA, Europe, UK, as well as the impact of covid.

Keep reading for all the juicy details and in case you want to find our other benchmarks you can just click here.

What are those funding stages?

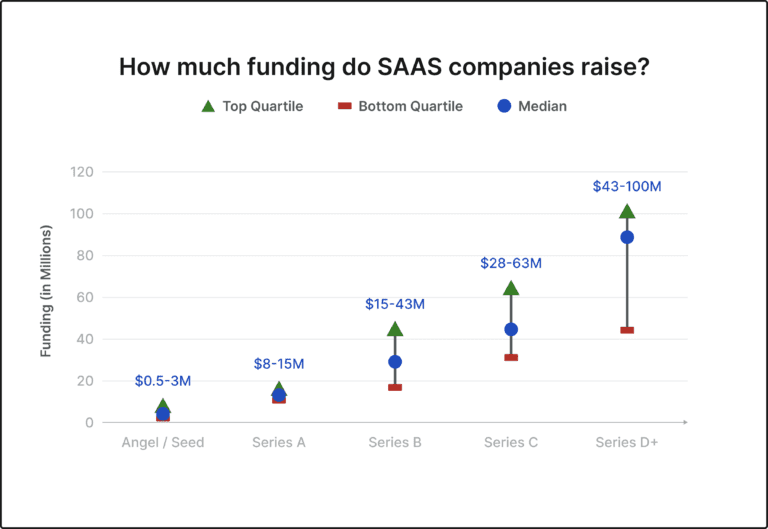

Have you ever noticed that people refer to ‘pre-seed’, ‘seed’, or ‘Series A’ rounds as if there is a global definition? While this does simplify discussions, it can mask huge variances. Here is a graphical view of the ranges of money raised by stage:

This data is sourced from Open View’s global 2020 SAAS benchmarking study, based on input from more than 1200 companies.

While helpful, this also highlights some holes in the data. (A quick glance at the numbers suggests that there just aren’t many companies. What happened to companies that raise $5M?)

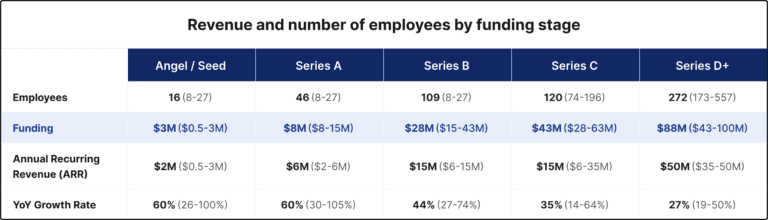

To provide a broader picture of each round, here are details on the number of employees by funding size as well as the ARR (or annual recurring revenue).

This should help clarify where your business is on the table.

The Open View data set, while global, does disproportionally focus on the USA.

Leading us to question….

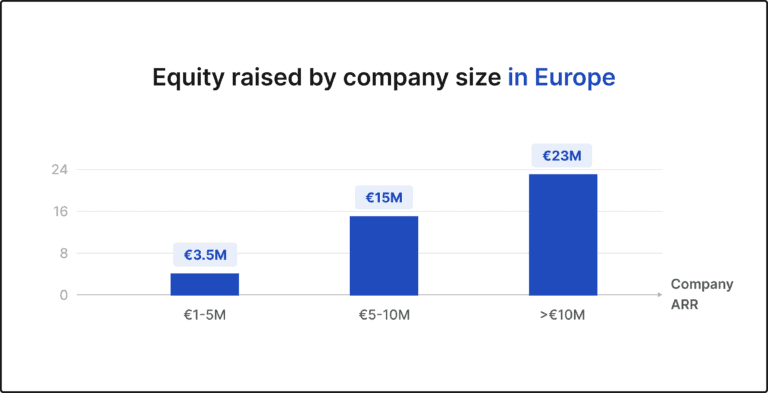

How much money is raised in Europe?

Sadly European specific benchmarks are harder to find. This study, by Serena Capital, is based on a much smaller sample, just 100 companies from across Europe.

It may ask large regional differences. Additionally, data from Series B onwards is difficult to deduce.

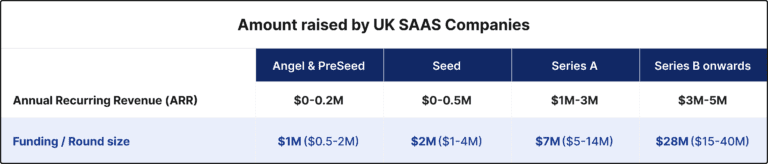

And how much is raised by UK SAAS companies?

Try as we might, we simply can not find substantial benchmarking studies for UK SAAS businesses. To provide a qualitative assessment of the data, we asked our friends at Founders Factory, who have invested in over 200 companies and have ongoing relationships with so many VCs, to provide a qualitative view of the market.

Input was provided by Darren Mulvihill, who is in the epicentre of fundraising.

The key takeaways are:

- For companies raising a Series B or later, funding markets are global, with little distinction between the UK and international data

- The Angel, Pre-Seed, Seed and even Series A rounds tend to be more local, with funding rounds as shown here:

What has been the impact of covid on SAAS companies?

And so...

Subscribe to our newsletter

If you found this article or any other article on our website helpful, you can join our monthly newsletter where we will be sharing all of our new reports exclusively with you.