For the latest SaaS Benchmarks click here.

This is the third of six articles on the latest SaaS Benchmarks, providing a global view of benchmarking data with insights from the USA and Europe. This article focuses on cash burn, which is particularly relevant as there have been significant shifts in the market in late 2022 and early 2023.

The article will answer these questions:

- What is cash burn?

- How is cash burn calculated?

- Why is cash and cash burn so relevant to SaaS companies?

- How much do SaaS companies burn, by company size?

- Are there any differences between the USA and Europe?

- What are recent trends, and what can we expect in 2023?

Before we start...

Now, before we dive into the detail, here are a few reasons why this data is relevant to all investor-funded SaaS companies:

- In 2022, there was a seismic shift in the valuation of tech companies, both publicly and privately.

- Amazon stock, for example, fell a whopping 51%, marking the biggest decline since 2000. Meta (Facebook’s parent company) fell 66% and Tesla was down 68%.

- 2022 was a brutal year for mega-tech companies, and this has reverberated throughout the market.

- 2023 is looking no better. As of March 2023, Amazon stock has yet to recover even 10% of its value.

- And then there is the collapse of Silicon Valley Bank and ongoing economic uncertainty around interest rates. Flat valuations are the new metric of top-performing companies.

- Cash burn is the most important metric to gauge how long your company can survive until the next funding round or determine if you can build profitability. In fact, we actually accumulated a list of our top 10 KPIs & metrics here.

What is cash burn and how is it calculated?

Cash burn is the average monthly spend. It is calculated as all money coming into the company in a month, less all money paid out by the company.

There are two ways to measure cash flow:

- Revenue or sales less all costs. This is straightforward and provides a good starting point for companies which use accrual accounting. The downside is that it does not consider timing differences: Do customers pay on time? Are you incurring any costs but postponing payments? These can be material, particularly for software companies with annual or quarterly contracts.

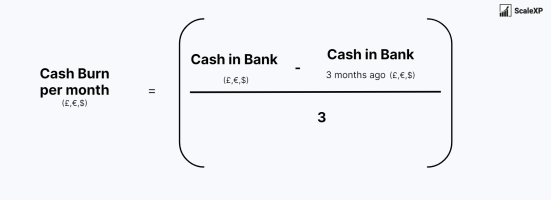

- Change in cash in bank over several months, as shown below. This is very easy to calculate but can mask material differences, particularly if the companies receive a portion of revenue through multi-month invoices.

Why is cash and cash burn so relevant to SaaS companies?

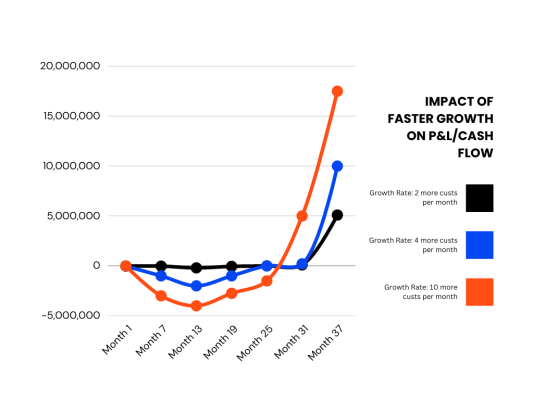

One of the idiosyncrasies of SaaS companies is that the faster they grow, the more cash they burn. It sounds crazy, but it is an inherent truth of the SaaS model.

Have a look at the graph below. The orange line – which is based on acquiring the highest number of customers – shows the largest cash losses through Month 28.

The only difference between the three scenarios is the number of new customers. All costs are fixed (salaries, office, etc), and each customer pays the same subscription fee. Acquisition is the same for all customers. These assumptions are simplistic but highlight the truth that faster growth leads to larger cash losses.

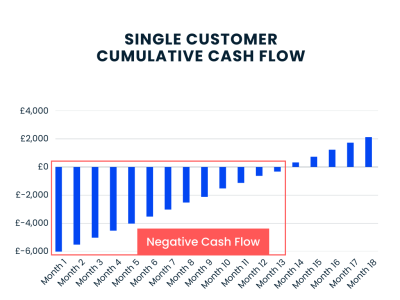

This is because SaaS companies spend more money acquiring a customer than they earn in the first month or even the first several months. In fact, global benchmarks show that an average SaaS company (with $10M of revenue) requires 12 months to recoup acquisition costs, resulting in a short term cash dip, as shown in image 2.

The time to recoup the cost of acquiring a new customer is called CAC Payback, and we have written several interesting articles on this topic. Click here to read more.

What are the benchmarks and how much cash do SaaS companies burn?

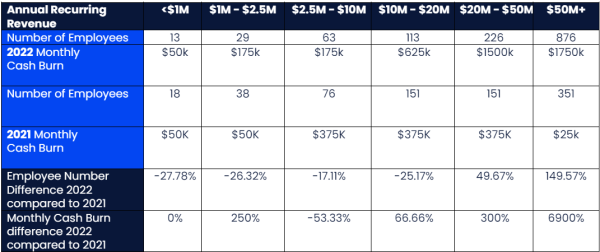

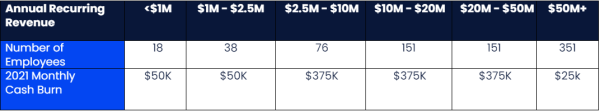

The tables below show the average cash burn rate and headcount for SaaS companies by size in 2021 and 2022. Find the column which represents your revenue. The number in the middle represents the average, while the numbers in brackets show the lowest quartile and the highest quartile. As an example, an average company generating $15M in ARR, would burn $375k per month in 2021. By 2022, this will have increased to $625k.

In 2022, we see a significant increase in the burn rate for larger SaaS companies. Smaller companies are burning at the same rate (those with $<1M) or less (those with $2-10M).

The time to recoup the cost of acquiring a new customer is called CAC Payback, and we have written several interesting articles on this topic. Click here to read more.

2022 cash burn rate by company size

This data is from the largest global benchmarking study, based on input from over 3000 companies and provided by OpenView VC in the USA.

Is cash burn different in the USA and Europe?

Are there any UK specific cash burn benchmarks?

UK SaaS benchmarks are virtually non-existent; something we intend to change over time. If you have any interest in UK specific benchmarks, just drop us a note here: admin@scalexp.com. In the meantime, you can read more about other key metrics in times of uncertainty in this earlier blog.

So what does this mean for you? What can you expect in 2023?

SaaS benchmarks are prevalent in the USA but, sadly, less so in the UK and Europe. The best data that we can find suggests that European SaaS companies generate similar losses in the early stages of growth but generate smaller losses as they grow.

In the second half of 2022, tech companies were hit by significant decreases in their valuation, driven by the huge declines in big tech (Amazon, Tesla, Meta), higher inflation, increases in interest rates.

Focus has shifted from “growth at any cost” to reducing burn and even lay-offs. Surveys of USA-based venture capital funded companies in Q1 2022 showed that the majority (56%) planned to increase headcount by 40%. Six months later, in Q3 2022, only 18% planned to continue hiring at this pace.

Our expectation is that the average monthly burn rate for most SaaS companies will fall below the levels of 2021, perhaps by as much as 35%. If you have just completed a funding round, drop a comment below to share your experiences. How did you find the market? Any advice for others? How have valuations changed in the last few months.

ScaleXP provides SaaS companies with a market-leading, fully automated view of all their key metrics, including those most vital to investors in 2023. By connecting with both your accounting data and your CRM platform, our solution empowers you to track benchmarks and measure performance with unparalleled ease.

If you’re ready to take your metrics tracking and benchmarking to new heights, click here to get started with ScaleXP. Enhance your company’s data-driven decision-making and stay at the forefront of the curve with ScaleXP.

Check out more from ScaleXP

How to automate prepaid expenses

Automating prepaid expenses, the costs a business pays upfront for future goods or services, not only saves time but also

How to automate Hubspot invoicing in QuickBooks

Easily invoice Hubspot deals in QuickBooks using ScaleXP Looking to streamline your invoicing process between HubSpot and QuickBooks? If your

Revenue recognition automation

Revenue recognition: a guide Revenue recognition is a crucial aspect of financial reporting, ensuring that companies accurately reflect their earned