This is the third in our series of articles on the latest SaaS Benchmarks, providing a global view of benchmarking data. This article focuses on cash burn, which is particularly relevant in these times of high inflation and investor conservatism.

Key take-aways from 2023: the importance of cash burn

A few points as to why cash burn is so important to investors in 2024.

Cautious market valuations: Having declined substantially in 2022 following all-time highs in 2021, 2023 reflected a return to more conservative valuations for tech stocks in which profit and cash flow once again increased in importance. Whereas in 2021 tech companies could expect high valuations based on sales growth alone, this is no longer the case.

Increased focus on cash and operational efficiency: Investors and founders are now placing more emphasis on current and projected cash flows, not just revenue growth. Companies that demonstrate prudent financial management, coupled with an ability to scale operations efficiently, are more likely to attract and retain investor interest. In OpenView’s 2023 SaaS Benchmarks report, 32% of founders were worried about burning too much cash; this compares to just 13% in 2021.

Responsible growth and scaling: Facing inflationary pressures and eoncomic uncertainty, investors are looking for growth aligned with financial health and stability. SaaS companies are encouraged to pursue growth trajectories that are sustainable, with a clear path to profitability.

Optimism about opportunities in 2024. Private sellers were reluctant to exit in 2023, seeing reduced public market valuations and increased scrutiny of their profits. At the same time, the amount of money available to invest remained high, particularly relative to the volume of opportunities in 2023. Going into 2024, this suggests there will be a high level of investor interest in companies with the right profile. A recent SEG survey of SaaS buyers and investors showed that 46% placed profitability and positive cash flow in their top qualities of attractive assets, behind only strong retention and solid product/market fit.

If you are looking for more information on other SaaS benchmarks, just click here to see all the benchmarks.

What is cash burn?

Cash burn, often referred to as “burn rate,” measures the amount of cash a company uses in order to operate its business. Cash burn is a gauge of the company’s financial health and an indicator of how long the company can continue operating with its current financial reserves before needing additional funding or income.

Cash burn is a crucial metric for Software as a Service (SaaS) companies, particularly in the early stages of development or during periods of rapid expansion.

How is cash burn calculated?

Cash burn is calculated by taking the difference between the cash balance at the beginning and the end of a period (usually monthly or quarterly), adjusted to take out the impact of any external equity investment or loan.

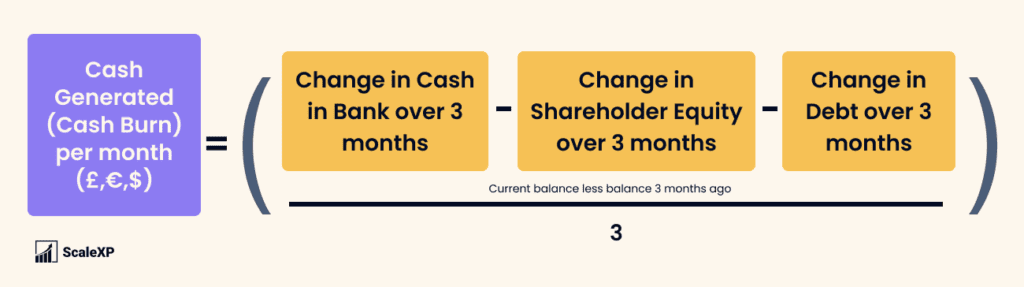

Here is the formula for calculating cash burn for a quarter:

What is cash runway?

Cash runway is the amount of time a company has before it runs out of money. In other words, it’s a measure of how long the company can keep operating at its current burn rate without having to secure additional funding or income.

This metric is particularly crucial for SaaS companies, which often have significant upfront costs and may take time to become profitable.

How is cash runway calculated?

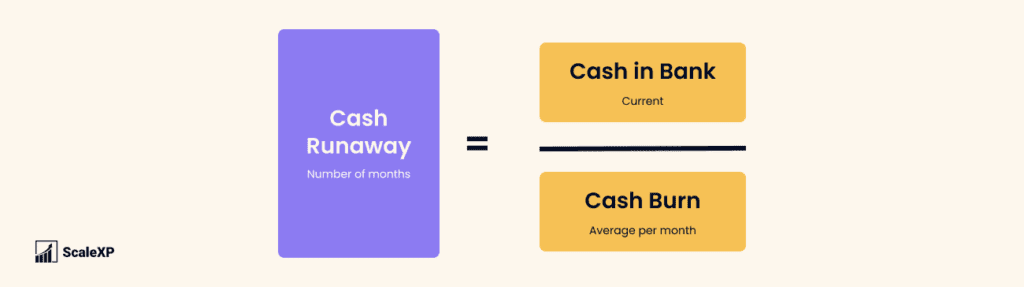

For companies who are using more cash than they are generating, the amount lost per month is cash burn. Cash reserves divided by cash burn per month indicates the number of months of cash reserves remaining.

Cash runway formula by ScaleXP – https://scalexp.com

As illustrated above, to calculate cash runway in number of months, simply divide current cash in the bank by the average cash used per month, or monthly burn rate. This will give you the number of months of cash remaining. The average cash used per month is net of cash received, that is, the total amount used after accounting for cash receipts.

Why is cash and cash burn so relevant to SaaS companies?

One of the idiosyncrasies of SaaS companies is that, especially in early stages, the faster they grow, the more cash they burn. It sounds crazy, but it is an inherent truth of the SaaS model.

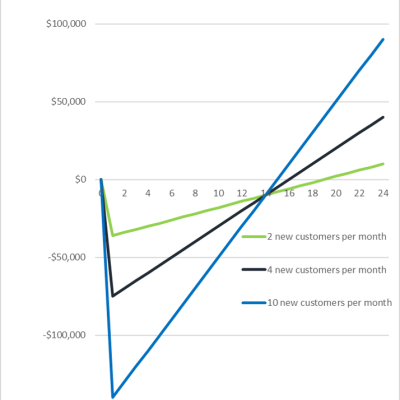

Have a look at the graph below. The blue line – which is based on acquiring the highest number of customers – shows the largest cash losses through Month 13.

The only difference between the three scenarios is the number of new customers. All other costs are fixed (salaries, office, etc), and each customer pays the same subscription fee. Acquisition cost is the same for all customers. These assumptions are simplistic but highlight the truth that faster growth leads to larger cash losses.

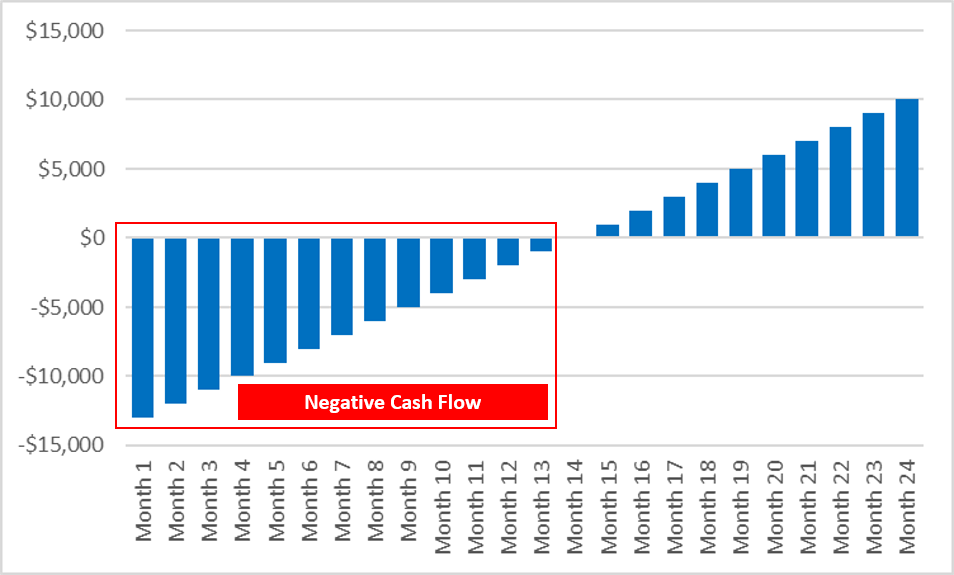

This is because SaaS companies spend more money acquiring a customer than they earn in the first month or even the first several months. In fact, global benchmarks show that an average SaaS company (with $5 to $20 million of revenue) requires 14 months to recoup acquisition costs (source: OpenView 2023 SaaS Benchmarks Report), resulting in a short term cash dip, as shown below.

The time to recoup the cost of acquiring a new customer is called CAC Payback, and we have written several interesting articles on this topic. Click here to read more.

What are the latest SaaS cash burn benchmarks?

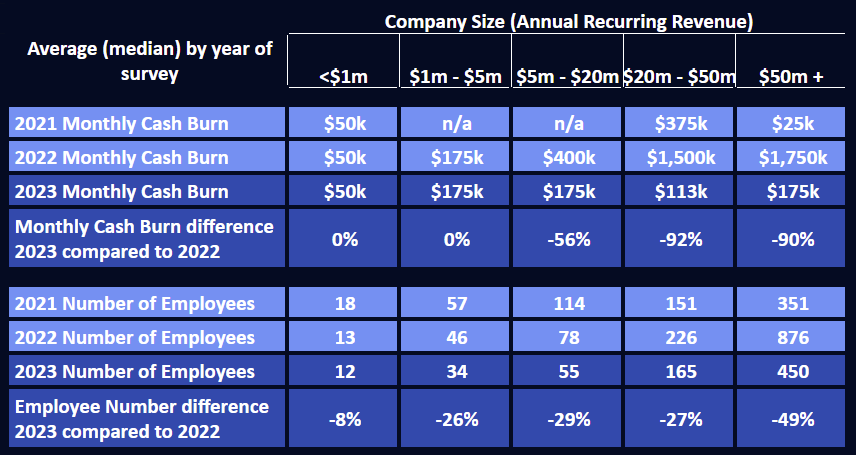

The table below shows the average cash burn rate and headcount for SaaS companies by size in 2023 and prior years. This reflects a survey of over 3,500 SaaS companies across the globe by OpenView Partners.

In 2023, we see that the burn rate for SaaS companies is, on average, $175k or less for all sizes of SaaS company. This marks a significant reduction from the year prior.

A year earlier, in 2022, the average burn rate for companies over $20m was well over $1m/month, some 10x the cash burn in 2023 (or, in other words, a reduction of over 90%). Mid size companies ($5-20 million in annual revenue) also reduced their cash burn to less than half prior amounts, on average.

Equally notable is the consistent compression in employee numbers over the past few years, particularly for the smallest companies. Companies in all categories had, on average, substantially fewer employees working to generate the same amount of revenue. For larger companies, this reversed a growth trend many had experienced in 2022. For smaller companies, this reflected a continuing trend of finding new ways to do more with less.

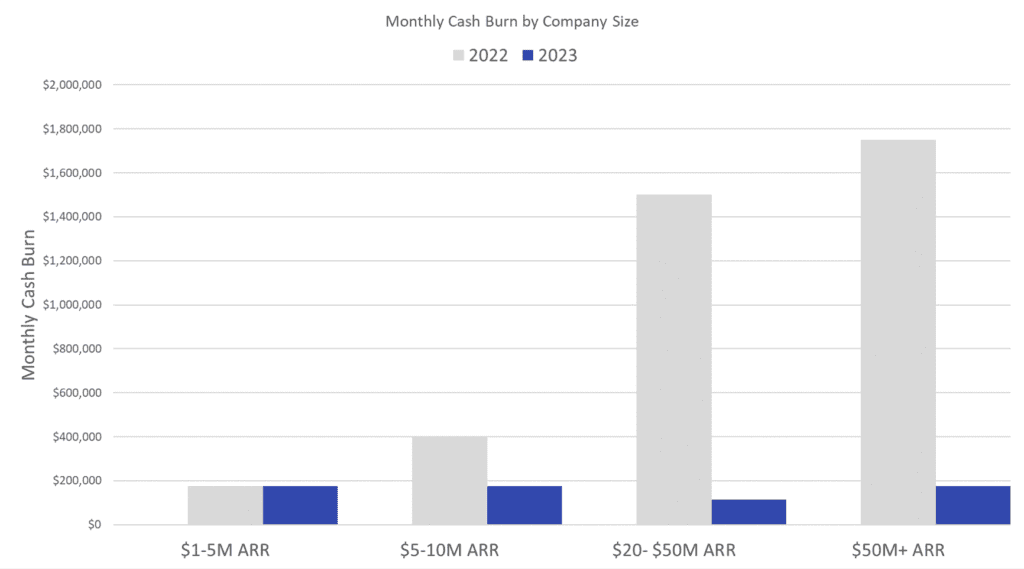

Below you can see the dramatic reduction in cash burn in 2023 versus 2022.

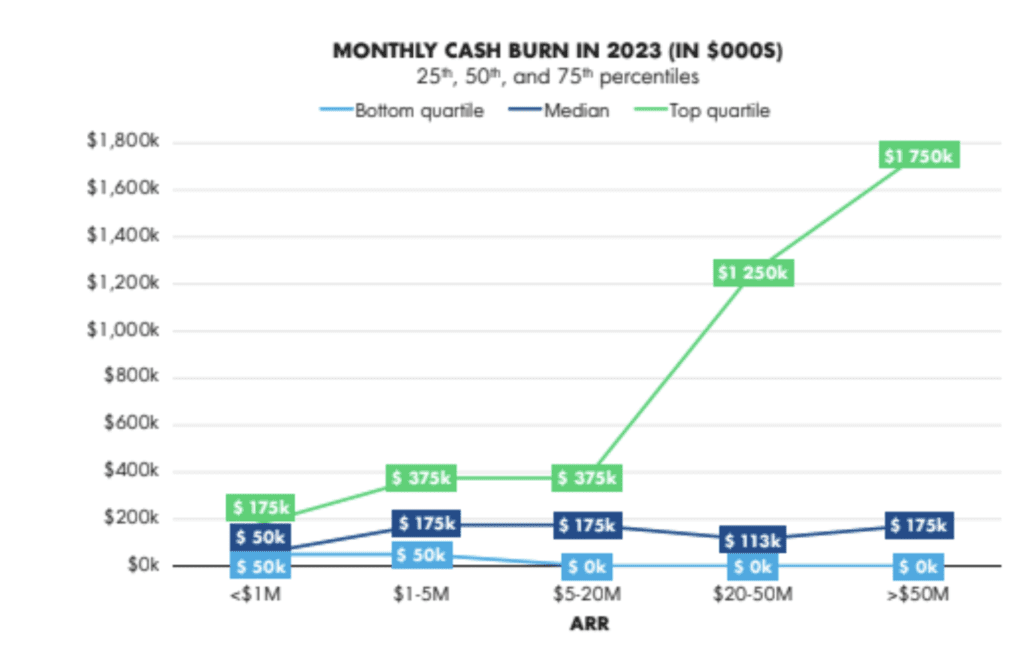

The chart below illustrates in another way the drive towards cash neutrality for SaaS companies in 2023, with the top quartile of OpenView survey respondents reaching cash neutrality for all but the smallest (under $5m annual recurring revenue) size of company. Moreover, even the worst (“top” in the below) quartile were at levels of cash burn at or below the median cash burn one year earlier.

How can you improve your cash burn and cash runway?

Here are some key ways to have a material impact on your cash burn:

- Budget and forecast effectively. SaaS companies need to plan their expenses judiciously, ensuring that investments in growth are balanced with the need to extend the company’s runway.

- Grow revenue. Implementing strategies to increase revenue, such as upselling, cross-selling, or improving sales processes, can significantly reduce cash burn and increase your cash runway.

- Operate efficiently. Streamlining operations and optimizing resource allocation can reduce unnecessary expenses, thereby lowering the burn rate.

- Fundraise smartly. If additional funding is required, companies should plan and initiate fundraising activities well before the cash runway ends. Having a clear understanding of the cash runway provides valuable leverage in investment negotiations.

What can we expect in 2024?

In 2024, facing continued economic and political uncertainty, investors are increasingly prioritising SaaS companies with low cash burn rates, signifying a strategic shift towards sustainable growth and financial discipline. Investors are looking for SaaS enterprises that not only demonstrate innovative solutions and market potential but also exhibit a conscientious approach to spending, ensuring a longer runway and higher resilience against market volatilities.

Conclusion

At ScaleXP, we are passionate about using data to understand and improve performance. We have fully automated all SaaS metrics, from Cash Burn and Cash Runway to CAC Payback, ARR, and Rule of 40. By connecting with, and importing data from, both your accounting and sales or CRM systems, the ScaleXP platform creates a single source of truth for your SaaS data. To check if we integrate with your systems, just click here.

To read more about how we can automate your SaaS metrics, click here.