Customer Acquisition Cost (CAC) payback tells you how long it takes to earn back the money you spent to get a new customer. Ideally, you want this payback period to be as short as possible. Why? Because a faster payback means you’ll start making a profit from that customer sooner, which fuels your company’s growth.

This article will answer these questions:

- What is Customer Acquisition Cost, and what is CAC Payback?

- How are Customer Acquisition Costs and CAC Payback calculated?

- Why is CAC Payback important?

- What are the latest benchmarks?

What is Customer Acquisition Cost (CAC) & what is CAC Payback?

Customer Acquisition Cost, abbreviated CAC or CCA (for Cost of Customer Acquisition), is the amount spent to acquire a new customer. CAC Payback is the length of time it takes for the company to recoup the acquisition cost.

CAC and CAC Payback Period are two critical and complementary metrics for growth companies as they speak to the pace at which a company can grow and the cash that it will require to meet its growth targets

How are Customer Acquisition Costs and CAC Payback calculated?

Acquisition cost is the average cost to acquire one new customer and usually includes the following costs:

Marketing and advertising

Business development

Salaries for the sales and marketing teams

Sales commission and sales incentive schemes

Any other costs incurred specifically to acquire new customers

These costs are divided by the number of new customers, resulting in the average cost to acquire a single new customer.

CAC Formula by ScaleXP – https://scalexp.com

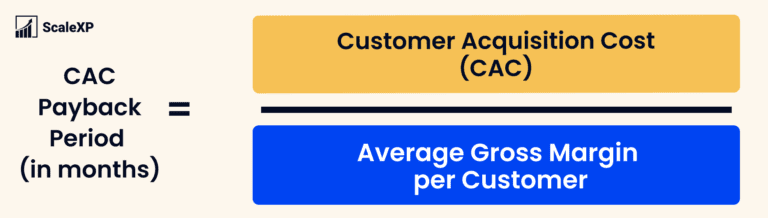

To calculate CAC Payback, simply divide CAC per month by the average Gross Margin per customer per month, as shown below. The result will be the number of months required to recoup acquisition costs.

CAC Payback Formula by ScaleXP – https://scalexp.com

Why is CAC Payback important?

CAC Payback is a key value driver for SaaS investors and business leaders. OpenView Advisors, for example, a lists it amongst the top three drivers of value for SaaS companies, alongside Gross Dollar Retention and Net Dollar Retention.

What are the latest CAC and CAC Payback benchmarks?

As CAC in absolute value terms varies widely for different business models (being generally higher, for example, for large ticket enterprise sales than for businesses targeting higher volumes of lower value sales), CAC Payback is the critical metric for benchmarking.

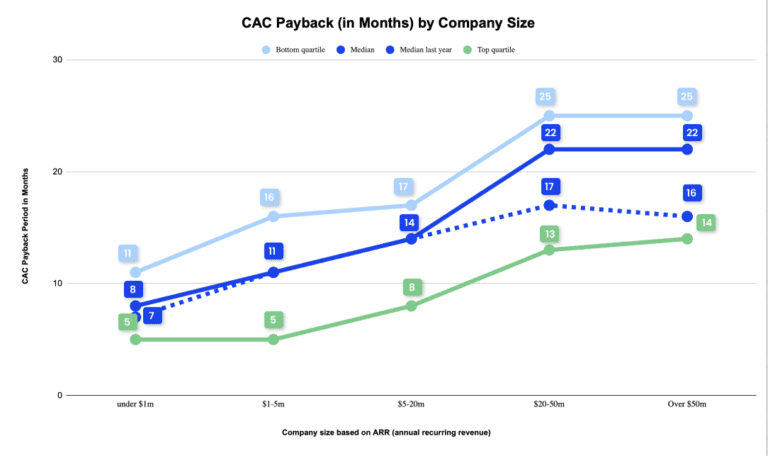

The below shows CAC Payback Period in months for a sample of SaaS companies in 2023. You can see that the payback periods are shortest for the smallest companies in the sample and that the top quartile of SaaS businesses of all sizes have payback periods averaging less than 14 months with the better performing small companies all paying back in well under one year.

How can you improve your CAC Payback?

Here are some key ways to have a material impact on your CAC Payback:

Monitor it well. Don’t just rely on simple comparisons using cash revenue. Look at gross margin and earned revenue.

Reduce your churn. OpenView’s number one recommendation for CAC Payback is to improve your retention rates and McKinsey & Company found that SaaS companies with a lower ratio of CAC to Customer Lifetime Value (LTV) tend to have higher valuations. Top-quartile SaaS companies have an LTV to CAC ratio of more than 5x, while bottom-quartile companies have a ratio below 3x.

Improve your Gross Margin. Companies with the best CAC Payback period have higher Gross Margins. Review your Cost of Sales or Direct Costs to determine if you can trim costs. Hosting costs, which is typically the largest component of Cost of Sales, can be drive lower by looking for start-up or scaleup offers. AWS has generous incentives for start-ups and Google has launched some offers as well

Hone your marketing spend. Focus on efficient growth, rather than growth at any costs. Tie sales incentives to results and negotiate agreements with marketing agencies. 2023 is the year of efficient growth, so you will be in good company.

What can we expect in 2024?

Looking at efficiency in acquiring companies is increasingly important to investors. While they are seeing SaaS companies becoming leaner in many areas, they are not necessarily seeing improvements in efficiency in acquiring customers, as shown in the above chart. CAC payback periods have actually gotten longer in 2023 versus 2022, especially for larger companies.

Conclusion

At ScaleXP, we are passionate about using data to understand and improve performance. We have fully automated all SaaS metrics, from CAC Payback to ARR to Rule of 40. By connecting with, and importing data from both your accounting and sales or CRM systems, the ScaleXP platform creates a single source of truth for your SaaS data. To check if we integrate with your systems, just click here.

To read more about how we can automate your SaaS metrics, click here.