This is the fourth in our series of articles on the latest SaaS benchmarks, focusing on revenue retention. In an environment of rising costs and pressure on profits, understanding and optimising revenue retention is more important than ever for SaaS companies.

Key take-aways from 2023: the importance of revenue retention

Here are a few reasons why, heading into 2024, revenue retention rates are more critical than ever:

Focus has shifted from growth to execution: Unlike recent years where growth at any cost was the mantra, 2023 has seen a shift to investor focus on sustainable growth, with a significant emphasis on revenue retention as a measure of business health and long-term viability. In OpenView’s 2023 SaaS Benchmarks report, 73% of founders were worried about go-to-market execution; this compares to just 59% who were worried about execution in 2021.

Investors rank strong retention first in their ranking of attractiveness in the SaaS industry: The 2023 SEG survey of 135 top SaaS buyers and investors, taken in August 2023 found that 71% ranked “strong retention / mission critical” as a top quality of an attractive SaaS company in the current market, well above any other survey response.

Cost effective growth: In an environment increasingly focused on efficiency and profitability retaining exisiting customers is a key component of demonstrable efficient growth. Companies which excel in customer retention can grow steadily and predictably without the constant need for high customer acquisiton spending.

If you are looking for more information on other SaaS benchmarks, just click here to see all the benchmarks.

Understanding revenue retention in SaaS

Revenue retention, at its core, measures the ability of a company to retain its customers and revenue over time. It is a critical indicator of customer satisfaction, product value, and overall company health.

Revenue retention is measured through metrics such as net revenue retention, also known as net dollar retention (NDR), gross revenue retention, and churn rate.

What is gross revenue retention?

Gross Revenue Retention refers to the percentage of revenue retained from existing customers within a specific timeframe, typically a year. It’s a vital indicator of customer loyalty and product value, as it reflects the company’s ability to maintain its revenue base in the face of customer churn and downgrades.

Key points about gross revenue retention:

Measures churn impact: Gross revenue retention looks at the amount of revenue retained from a prior period after taking into account revenue lost due to customers cancelling (churn) or downgrading their services.

Excludes upsell revenue: Gross revenue retention focuses solely on the retained revenue from existing customers, not accounting for any additional revenue gained through upselling or cross-selling.

Usually quoted an on annual basis. This an be measured either over a year or annualised from a shorter time period.

Indicator of customer satisfaction and long-term revenue stability.

How is gross revenue retention calculated?

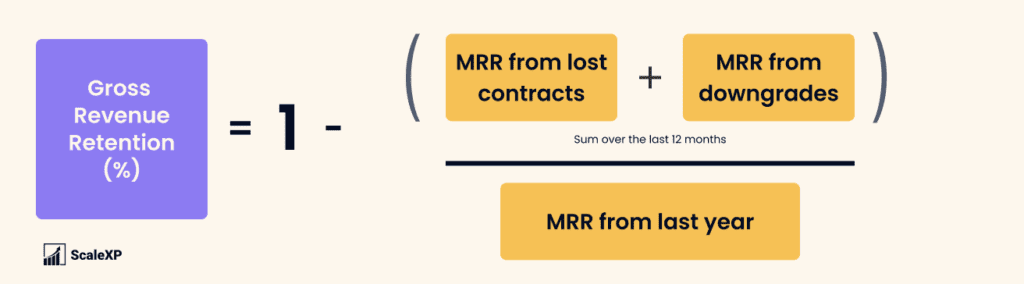

Gross revenue retention is calculated as shown below.

Gross revenue retention formula by ScaleXP – https://scalexp.com

Gross revenue retention is generally calculated as one minus the sum of annual revenue from all lost and downgraded contracts divided by recurring revenue a year ago. In other words, 100% less the % revenue lost over the course of the year. In many cases, the churn rate is calculated on a monthly basis and multipled by 12 to get to an annual rate. Similarly a quarterly rate can be annualised by multiplying churn by 3 and then subtracting from 100%.

What is net revenue retention?

Net revenue retention refers to the percentage of recurring revenue retained from existing customers over a specific period, usually a year, including any additional revenue from upsells, cross-sells, or price increases, while also accounting for churn and downgrades. It provides a view of customer retention which includes increases in the base retained.

Key points about net revenue retention:

- Measures churn impact: Like gross revenue retention, net revenue retention accounts for lost revenue due to customers cancelling (churn) or downgrading their services.

- Includes revenue expansion: Unlike gross revenue retention, net revenue retention includes upside from existing customers to partically offset the impact of customers lost or downgrades. Net revenue retention is therefore generally higher than gross revenue retention and, unlike gross revenue retention, can be greater than 100%. This is because net revenue retention includes additional revenue gained from existing customers through upsells or service enhancements.

- Usually quoted as an annual rate. This is similar to gross revenue retention.

- Indicator of customer loyalty and revenue predictability. Like gross revenue retention, net revenue retention is an important indicator of the long term viability and health of recurring revenue streams

How is net revenue retention calculated?

Net revenue retention is calculated as shown below.

Net revenue retention formula by ScaleXP – https://scalexp.com

Net revenue retention is calculated by taking all expansion revenue generated over the period and subtracting all revenue lost or downgraded. This is divided by total recurring revenue from the prior period to get the net churn rate as a percentage which is then added to 100% to get the net revenue retention rate. The usual measurement period is one year. Often this is generated by calculating the net revenue churn rate for a shorter period and multiplying by the number of periods in a year — so 12x monthly net churn or 3x quarterly net churn. This is then added to 100 to get the annual revenue retention rate.

How is customer retention different from revenue and logo retention?

Customer retention rate refers to the ability to retain customer numbers, irrespective of relative size.

Revenue retention looks at the monetary value of customer retained rather than the number of customers.

Customer retention and churn rates are also sometimes called logo retention and churn rates to indicate that it is the customer group being measured rather than the individual person.

Importance of revenue retention for SaaS companies

Revenue retention is critical for company valuation as it proves long-term value and profitability. Investors are now placing more emphasis than ever on long-term strategic advantage built on strong product and high levels of customer loyalty as evidenced by high retention rates.

Here are some of the reasons high revenue retention rates are so highly valued by investors:

Long-term customer relationships: High retention rates indicate that customers find continuous value in the product, leading to a stable and predictable revenue stream. High gross revenue retention rates reflect customer satisfaction and the perceived value of the product, as customers are willing to spend more over time.

Lower cost of sales: Acquiring a new customer can cost significantly more than retaining an existing one. A focus on retention improves the company’s overall efficiency and profitability.

Upsell opportunities: A retained customer base presents opportunities for upselling and cross-selling, contributing to revenue growth without the corresponding increase in acquisition costs.

Higher lifetime customer value . Customer Lifetime Value (CLV or LTV) is a measure of the total value of each customer to the business over time. Higher customer retention means lower churn and higher value per customer.

Growth Indicator: Gross revenue retention is a powerful indicator of organic growth. A rate over 100% signifies that revenue from existing customers is growing, which is crucial for long-term success without solely relying on new customer acquisition. Investors often favour SaaS companies with high revenue retention, as it indicates a sustainable and expanding revenue base.

Market competitiveness: In a crowded market, strong revenue retention can set a company apart, indicating a robust business model capable of thriving through upselling and cross-selling opportunities.

In addition, understanding revenue retention helps companies make informed decisions about product development, pricing strategies, and customer success initiatives.

What are the latest SaaS revenue retention benchmarks?

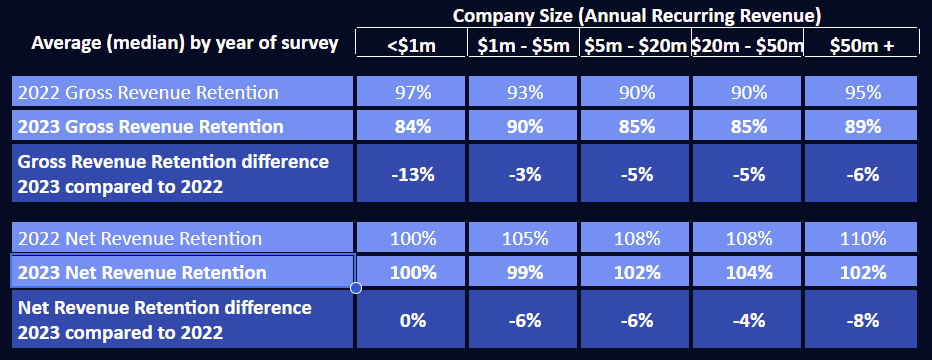

The table below shows the average net revenue retention rate and gross revenue retention rate for SaaS companies by size in 2023 and prior years. This reflects a survey of over 3,500 SaaS companies across the globe by OpenView Partners.

Despite increased investor focus on revenue retention as a measure of success, many SaaS companies found 2023 challenging as their customers were also under increased pressure to demonstrate efficiency and cut costs. Median gross and net retention rates were flat or reduced versus the prior year for companies of every size, in most cases dropping 5 percentage points or more in gross revenue retention 0 from the low/mid 90s to the 80s – and falling closer to 100% on a net revenue retention basis.

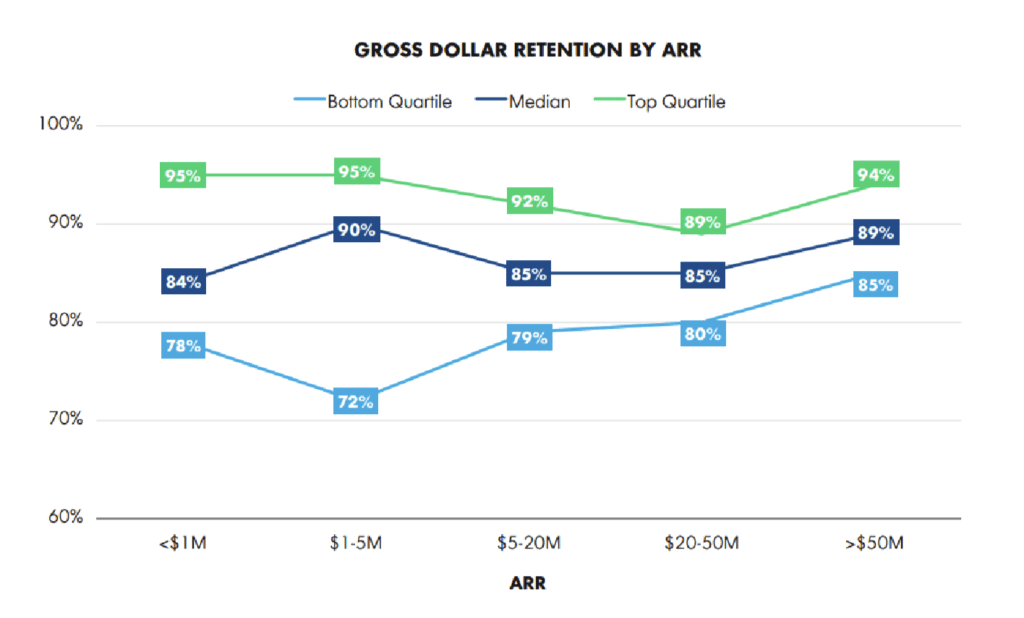

The chart below illustrates the challenges faced by SaaS companies this year, with even the top quartile generally retaining only 95% or less of customer revenue before taking into account offset from price increases, some 5 percentage points lower than last year. This reflects the impact of challenging economic conditions and high levels of scrutiny of purchases, including consolidation of vendors by purchasers.

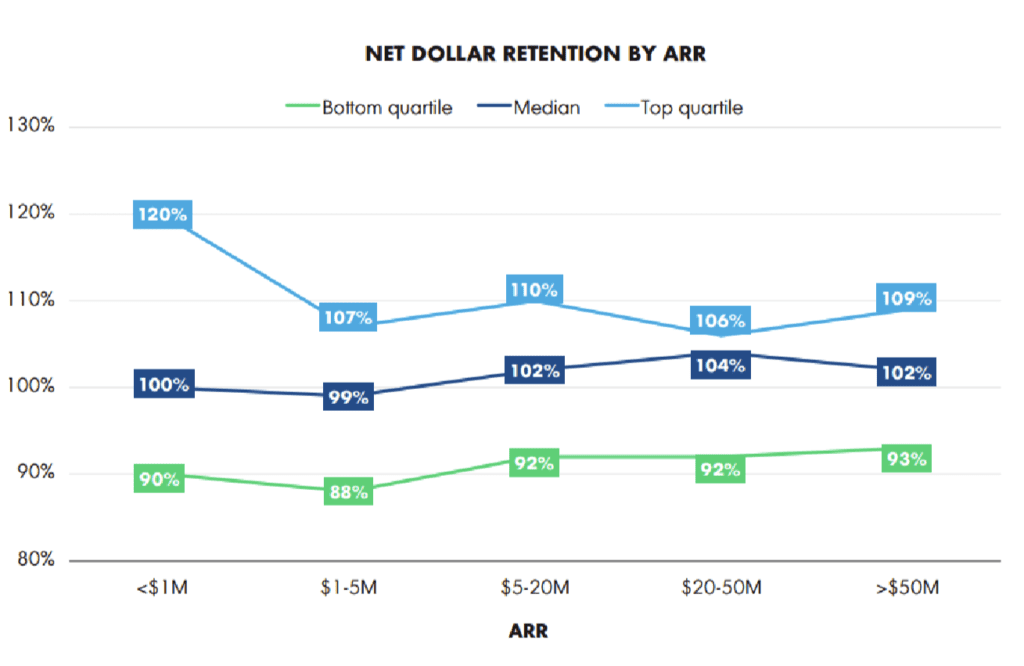

Net revenue retention was also signficantly lower than last year, most notably for larger and higher performing companies who tended to be more reliant on expanding existing customer revenue relative to gaining new customers. Net revenue retention was, on average, at or near 100% across most revenue bands.

Strategies for improving revenue retention

- Personalized customer experiences: Tailoring the customer experience based on individual needs and feedback. This works well in small, early stage SaaS companies and in larger SaaS businesses able to systematise and automate the abilty to segment needs and personalised service via the latest technology, increasing incorporating elements of AI.

- Focus on customer success: Developing a robust customer success strategy that ensures customers achieve their desired outcomes with your product. As SaaS companies grow, having a professional, dedicated focus on helping existing customers retain and expand upon the value they receive is critical for customer retention.

- Product improvement: Continuously enhancing the product based on customer feedback and evolving market needs.

- Proactive engagement: Regularly engaging with customers to understand their challenges and pre-empt potential churn.

What can we expect in 2024?

As we move into 2024, the focus on revenue retention is expected to intensify. SaaS companies that can demonstrate strong retention metrics are likely to see continued investor interest and market success.

Conclusion

At ScaleXP, we undertand the importance of revenue retention in SaaS businesses. Our platform provides comprehensive automated insights into your revenue retention metrics, integrating seamlessly with your accounting and CRM systems. To explore how ScaleXP can help you optimise your revenue retention strategies and automate your SaaS metrics, click here.