If you’re a SaaS or subscription-based company, getting a real-time, comprehensive view of your revenue is critical. Integrating your customer relationship management (CRM) system with your accounting software provides this advantage, bringing together data across both platforms – including future sales projections.

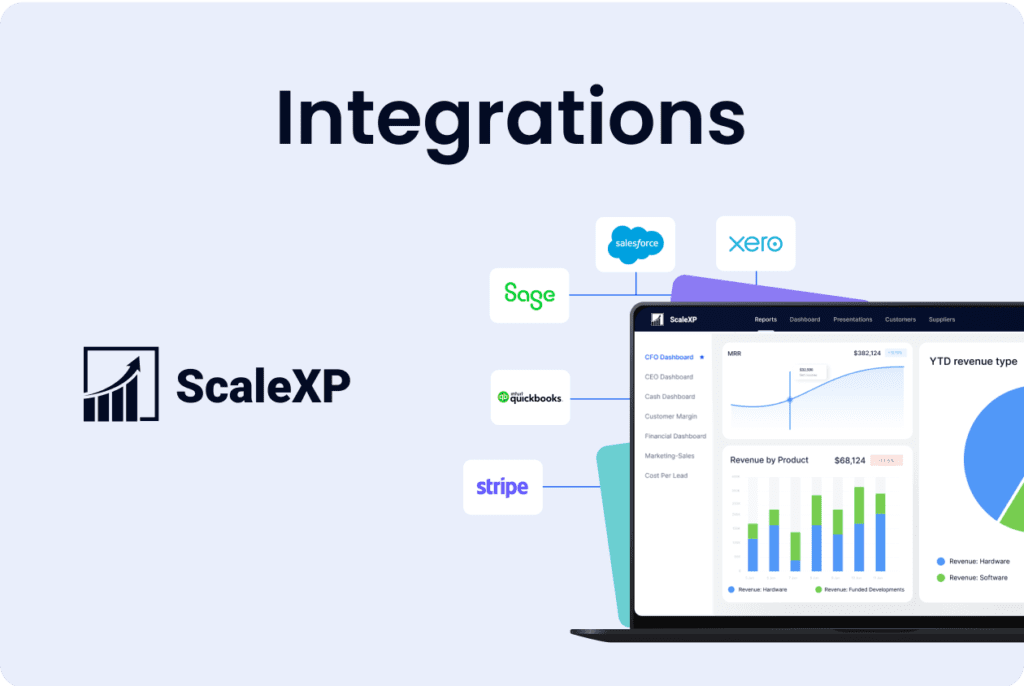

Salesforce is a powerhouse for managing customer interactions, sales pipelines, and service operations, while QuickBooks excels at the nuts and bolts of accounting. Integrating these platforms ensures that your sales and finance teams are aligned and working towards the same business goals.

ScaleXP is a fantastic tool that simplifies this integration.

The importance of sales-finance alignment

When Salesforce and QuickBooks operate as a unified system, the benefits are undeniable:

No more data silos: Disconnected data leads to miscommunication and wasted time. Integration creates a single, reliable source of information accessible to everyone.

Real-time financial visibility: No more updating spreadsheets. No more waiting for reports. Integration means crucial data is always synced and up-to-date, so you can react quickly to market shifts or internal trends.

Comprehensive insights: See your financial metrics alongside sales data for a total picture of business performance and KPIs.

Data-driven strategies: Ditch spreadsheets and guesswork and make informed decisions based on real time insights. Fine-tune your sales approach, boost efficiency, and drive revenue growth.

Proactive planning: Spot trends early and adjust your strategies accordingly for the best possible outcomes.

Decoding MRR and ARR: what do they mean?

Simply put, MRR (Monthly Recurring Revenue) is your company’s predictable monthly income from subscriptions, and ARR (Annual Recurring Revenue) projects that monthly figure over an entire year. Think of them as your financial heartbeat and your yearly forecast, respectively.

- MRR: Your Monthly Financial Snapshot MRR keeps you on top of your monthly revenue flow, helping with budgeting and day-to-day decisions.

- ARR: The Big Yearly Picture Multiply that monthly MRR by 12, and you’ve got your ARR. This metric gives you a long-term view of your company’s growth trajectory.

Want to find out more about MRR and ARR?

For precise definitions on all things related to ARR, MRR and other SaaS metrics, head over to the ScaleXP SaaS Metrics Library.

Interested in SaaS ARR benchmarks? See how your business measures up against the competition with the ScaleXP SaaS Benchmarks for ARR and MRR in 2023

Want to find out more about MRR and ARR?

For precise definitions on all things related to ARR, MRR and other SaaS metrics, head over to the ScaleXP SaaS Metrics Library.

Interested in SaaS ARR benchmarks? See how your business measures up against the competition with the ScaleXP SaaS Benchmarks for ARR and MRR in 2023

Why MRR and ARR matter

Investors love MRR and ARR, especially in SaaS and other subscription businesses, because they reflect reliable, future revenue. A healthy, growing ARR is typically indicative of a stable, expanding company, making it an attractive metric for valuation.

Managing the metrics: integrating QuickBooks and Salesforce with ScaleXP

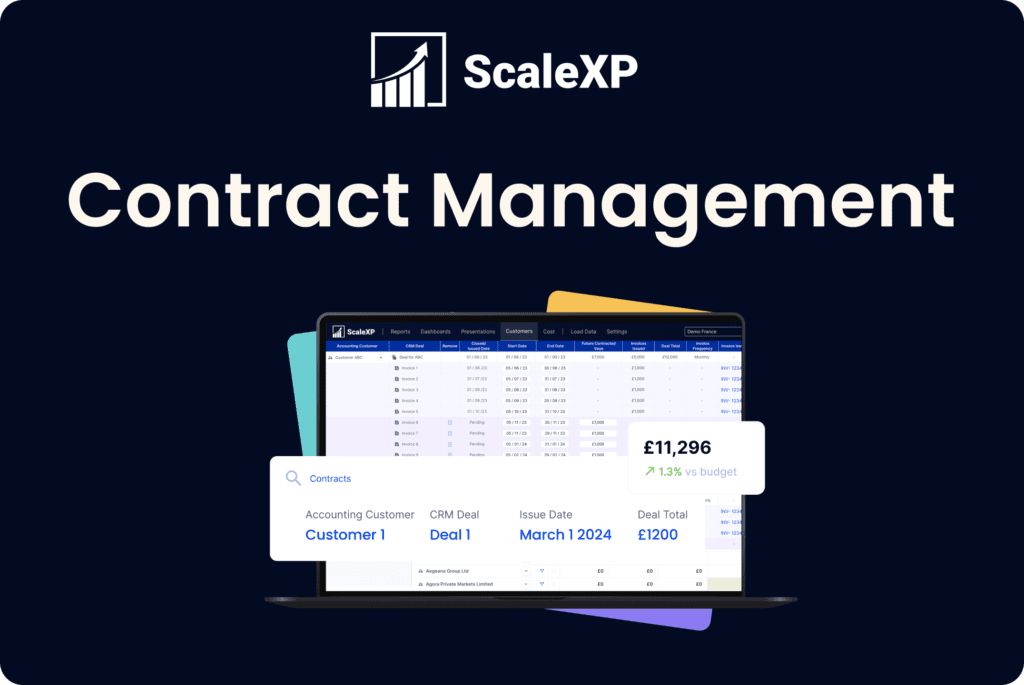

Keeping an eagle eye on MRR and ARR can be tricky – especially if your financial data lives in different systems. That’s where a tool like ScaleXP comes to the rescue. By linking QuickBooks and Salesforce through ScaleXP, you get a clear, automated view of your metrics.

ScaleXP streamlines the process of MRR and ARR management by offering you a consolidated platform where sales and financial data are synchronised automatically and consolidated across entities, even across currencies. This allows you to maintain a competitive edge while fostering transparency and informed decision-making across departments.

The intuitive interface of ScaleXP allows for straightforward management of financial data and SaaS metrics, enabling you to maintain up-to-date key performance indicators (KPIs) like churn and customer revenue growth quickly and easily. Furthermore, ScaleXP supports you in your financial planning and analysis by automating an MRR forecast based on existing Salesforce data.

By leveraging ScaleXP, companies benefit from real time, integrated revenue forecasting taking into account information across finance and sales teams. This enables more informed decision-making.

Understanding and tracking past and future MRR and ARR is vital. And with a tool like ScaleXP enabling Salesforce and QuickBooks to work together across currencies and entities, you’ll always have these financial powerhouses at your fingertips!

Unlock your business potential

Ready to revolutionise your revenue tracking, forecasting and decision-making? Discover how ScaleXP’s Salesforce QuickBooks integration can fuel your growth.

Book a demo today and see the transformative power of ScaleXP in action.

Check out more from ScaleXP

How to automate prepaid expenses

Automating prepaid expenses, the costs a business pays upfront for future goods or services, not only saves time but also

How to automate Hubspot invoicing in QuickBooks

Easily invoice Hubspot deals in QuickBooks using ScaleXP Looking to streamline your invoicing process between HubSpot and QuickBooks? If your

Revenue recognition automation

Revenue recognition: a guide Revenue recognition is a crucial aspect of financial reporting, ensuring that companies accurately reflect their earned