Cost of customer acquisition is a profound and critical metric for high growth companies. It indicates the cost of acquiring a new customer, and is notoriously difficult to pinpoint in the midst of rapid market success and the corresponding increase in size and overhead of one’s own organisation. However, not losing sight of the true CAC value is essential to creating sustainable growth and avoiding sudden cash issues that appear to come out of nowhere.

What is CAC?

CAC is an acronym for customer acquisition cost. It is the true cost incurred to acquire a new customer. CAC is common in many industries, particularly SaaS companies. It can also be called CCA, or the cost of customer acquisition.

How is CAC or CCA calculated?

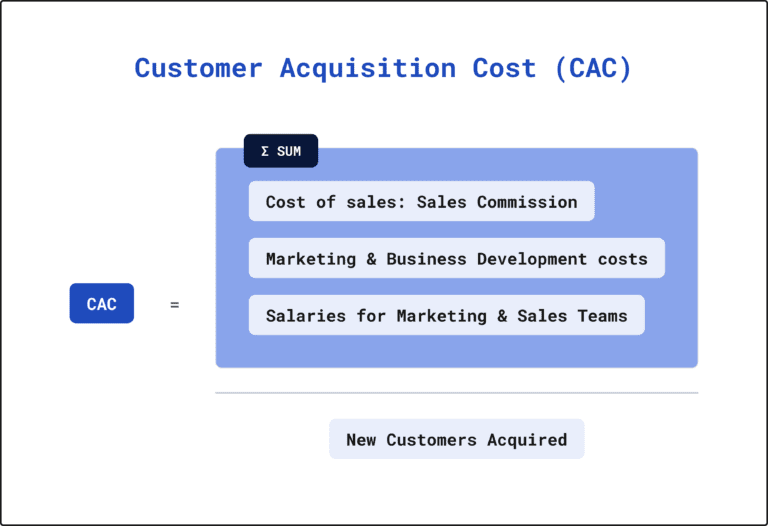

The formula to calculate CAC is fairly obvious; divide the total costs associated with acquiring new customers by the number of new customers acquired.

The real question is what are the true costs incurred to acquire new customers? While there are no set rules or IFRS/GAAP standards, there are accepted conventions which include these items:

- Marketing costs

- Sales team commissions

- Sales team salaries

- Other cost spent directly to acquire new customers, such as a monthly subscription fee for a CRM system

This diagram provides a helpful overview.

Expenses relating to existing customers are excluded. Marketing costs related to brand development can also be excluded.

Why is CAC important?

Understanding CAC is critical to creating sustainable growth, as it shows the cost of acquiring one customer and is a standard component of unit economics. By comparing CAC with customer lifetime value, it is possible to understand and project profit margins. For this reason, it is a critical metric for investors. Additionally, it can provide insights into which customer acquisition channels are the most effective.

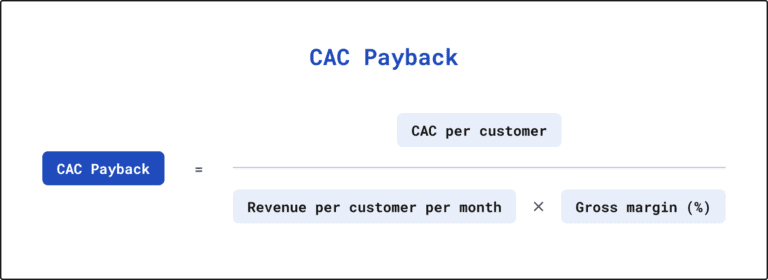

CAC is one of the top metrics requested by VCs. Investors will compare your CAC to the value delivered by a customer, frequently calculated as CAC Payback.

To calculate CAC Payback, simply divide the CAC per customer by the average profit margin per customer, as shown below. This will provide the time required to recoup the cost of acquiring a customer, in months.

How can I gauge my performance?

Most companies have a CAC Payback period of between 8 and 15 months, depending on their stage of growth. Companies tend to have a lower CAC as they gain initial revenue traction, but as they accelerate this tends to increase. Our detailed CAC benchmarking article here shows a range of performance for companies, based on their size.

Why ScaleXP is the best solution?

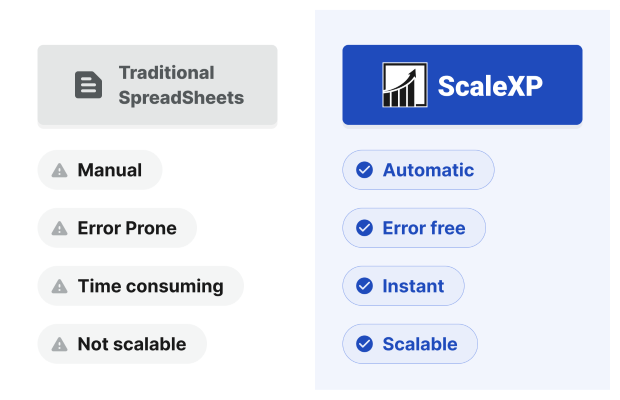

ScaleXP automatically calculates CAC and CAC Payback.

Learn more about CAC and its relationship to customer lifetime value here.

By importing information from accounting and CRM systems, the system automates all standard KPIs. Data is available in a single click, without the need for complex spreadsheets or data exports. Dynamic dashboards can be shared across the company in a click.

ScaleXP is built based on detailed feedback from investors. The system will recommend the right metrics for your company, taking into consideration your sector and stage of growth. All standard metrics are automated.

The convenience, accuracy, and insight gained from automating your CAC calculations ensures that you and your team can spend more time analysing and understanding the data rather than compiling it.

Ready to learn how ScaleXP can automate your CAC and CAC Payback calculations?