Yes — ScaleXP automates both revenue and expense accruals with complete accuracy and transparency.

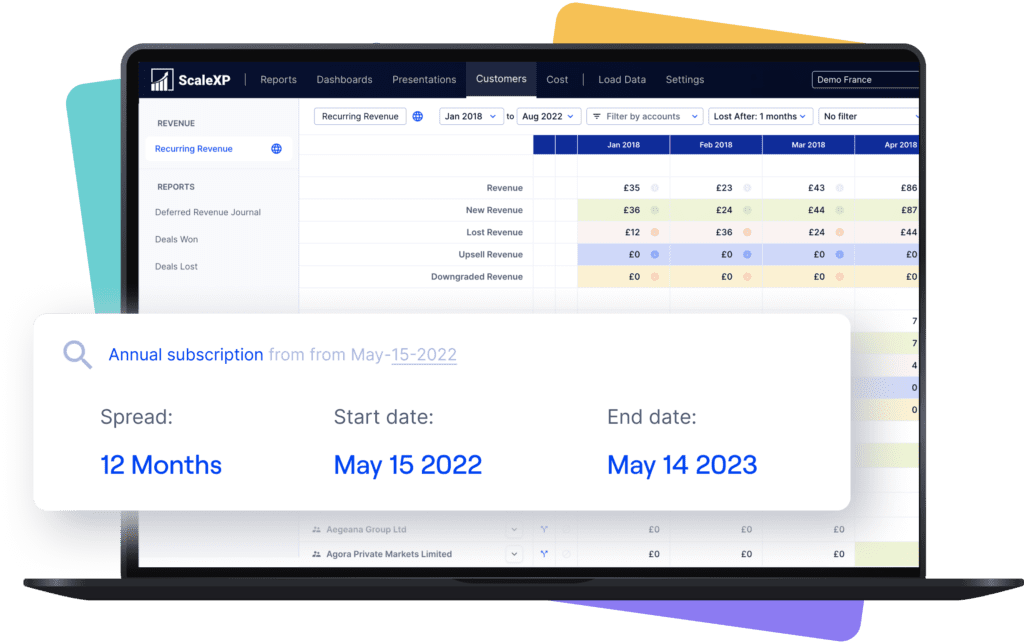

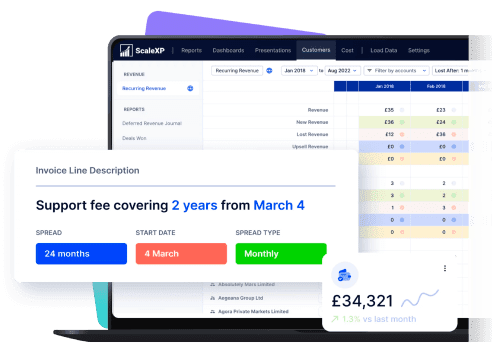

Our AI reads every bill, contract, and transaction line, identifying when costs or income should be recognised — not just when they’re received or invoiced.

That means your revenue and expenses are accrued automatically, even if the final invoice hasn’t arrived yet.

Expense accruals are built directly from your accounting data, with suggested entries based on historical patterns.

Revenue accruals are handled just as intelligently — ScaleXP aligns recognition with service periods, subscriptions, or project timelines, ensuring compliance with your accounting standards.

Once the actual bill or payment hits your system, ScaleXP auto-reconciles everything, updates the journal entries, and leaves a complete audit trail.

The result? A close process that’s faster, cleaner, and fully accurate — giving you confidence that every pound and every period is right, every time.

Read more