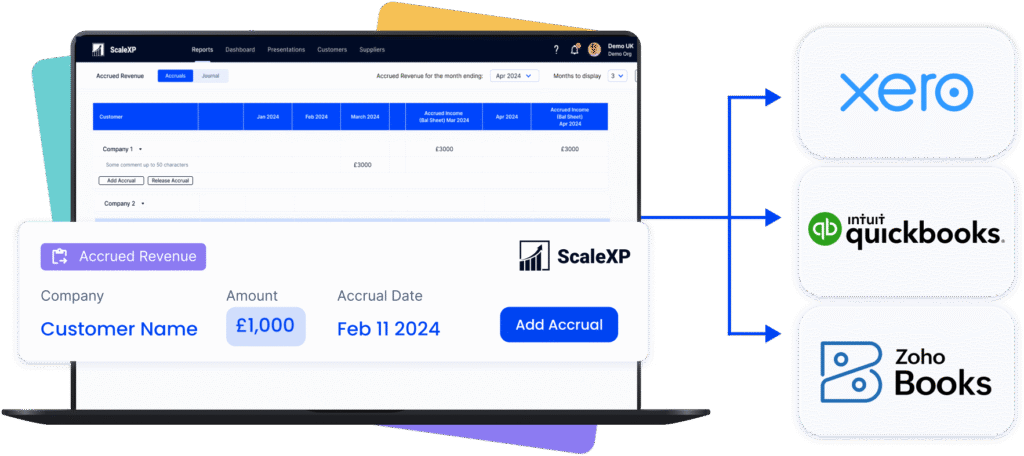

AUTOMATE Accrued revenue

Accrued income recognition software

Close faster with automated accrued income recognition. Eliminate the need to track accrued income and related invoices in tedious spreadsheets. Ensure your calculations are always accurate, up to date and easy to audit.