What is accounting consolidation?

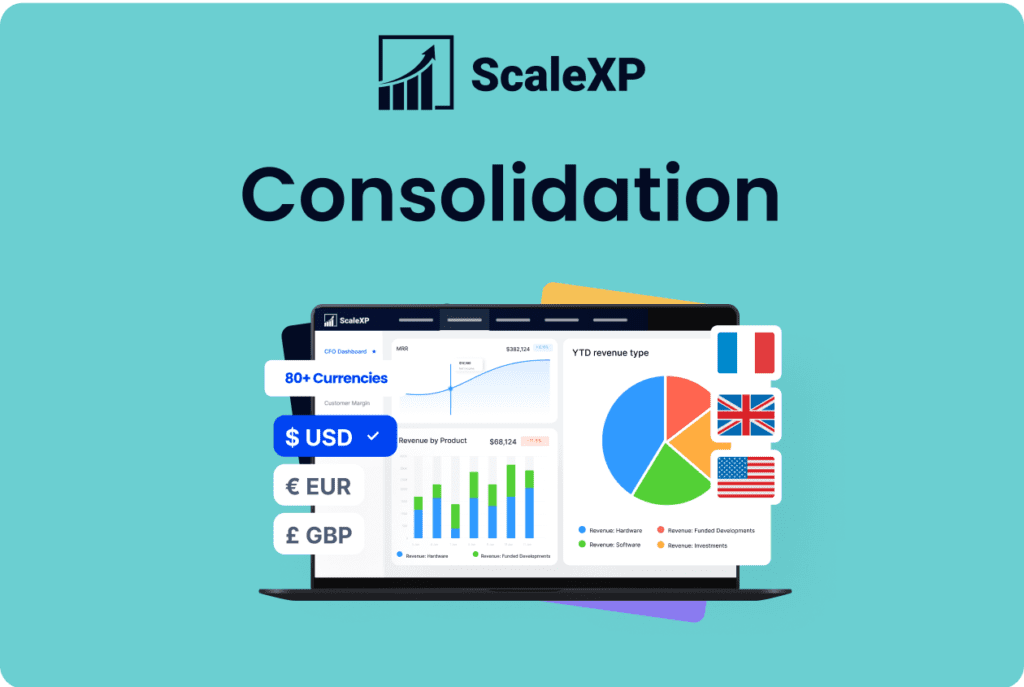

Accounting consolidation, also known as financial consolidation, is the process of preparing a single set of accounts across multiple legal entities. For example, if a company has a trading subsidiary in the UK and one in the USA, the combined financials represent a consolidated view. These accounts are also called group accounts.

The concept of creating consolidated accounts is simple, but the devil is in the detail (as is so often the case). During the consolidation process, it is critical to:

- Identify and eliminate intercompany accounts including intercompany sales, cost recharges, intercompany loans and intercompany investment

- Ensure exchange rates reflect IFRS guidelines. IFRS states that the balance sheet should be converted using the average daily rate on the last day of the month. The P&L, on the other hand, should be converted at the average rate throughout the month.

- Ensure that for metrics and KPIs, information is included from all subsidiaries.

While these steps sound straightforward, complexity increases over time. Consider calculating a YTD figure.

Best practice would stipulate that each monthly value is calculated, the appropriate FX rate for that month is applied, and then the individual monthly numbers are totalled. Tracking the correct FX rate for each number soon becomes tedious.

How does ScaleXP consolidate my financials?

The consolidation process in ScaleXP takes just 2 minutes:

- You click one button to import the data from your accounting systems.

- You review the results, with any potential errors automatically flagged for you.

That’s it, it’s so simple. And just in case you are worried about step two, the potential errors, this is typically the result of a new nominal accounting or general ledger code. When this happens, we flag the account for you, so you can ensure that it is correctly mapped in the group accounts.

Our studies have found that companies save a whopping 1.5 days during the close process by using ScaleXP to consolidate. Now that’s huge!

What are the benefits of using software for consolidation?

Financial consolidation software simplifies one of the most tedious aspects of the close process. The benefits are numerous:

- Your accounts are always up-to-date

- You will save 1.5 days during the close process

- Comparisons across the group – including tracking a budget or the latest forecast – are easy

- Errors are reduced, and the results are fully audit-ready.

Can I import data from different countries and from different accounting systems?

Yes, absolutely. ScaleXP connects with the following accounting systems: Exact Online, FreshBooks, Kashflow, MYOB, Microsoft Dynamics, NetSuite, Netvisor, QuickBooks, Sage 50, Sage Cloud, Sage 200, Xero, and Zoho Books.

Do all entities need a consistent chart of accounts?

No, a consistent chart of accounts is not required. The ScaleXP software is flexible enough for you to have a different chart of accounts in each entity.

At the group level, you can combine accounts from the subsidiaries exactly as you want to see them, providing you maximum flexibility.

Can I perform budget vs. actual reporting for my consolidated group?

Yes, of course! You can include a budget for the entire group, for one specific legal entity, or even for a single department. Budget data can be imported from the accounting system or loaded directly into ScaleXP from a spreadsheet.

What is the maximum number of companies in a consolidated group?

You can consolidate up to 50 entities.

If you need more than this, just get in touch, and we’ll see if we can help.

Does ScaleXP support intercompany eliminations?

Yep! The software makes it easy to eliminate entire accounts at the consolidated level. We also support consolidation journals.

Ready to save money and receive automated data insights?

Check out more from ScaleXP

How to automate prepaid expenses

Automating prepaid expenses, the costs a business pays upfront for future goods or services, not only saves time but also

How to automate Hubspot invoicing in QuickBooks

Easily invoice Hubspot deals in QuickBooks using ScaleXP Looking to streamline your invoicing process between HubSpot and QuickBooks? If your

Revenue recognition automation

Revenue recognition: a guide Revenue recognition is a crucial aspect of financial reporting, ensuring that companies accurately reflect their earned