Consolidate data from any – or all – of these accounting systems:

Close each month faster

ScaleXP’s financial consolidation software works alongside your existing accounting systems, importing all financial data.

- Once imported, financials are consolidated instantly, ensuring that group results can be produced as soon as the subsidiaries have completed their month-end close.

- Exchange rates are imported automatically and applied following IFRS and GAAP standards.

Report with ease

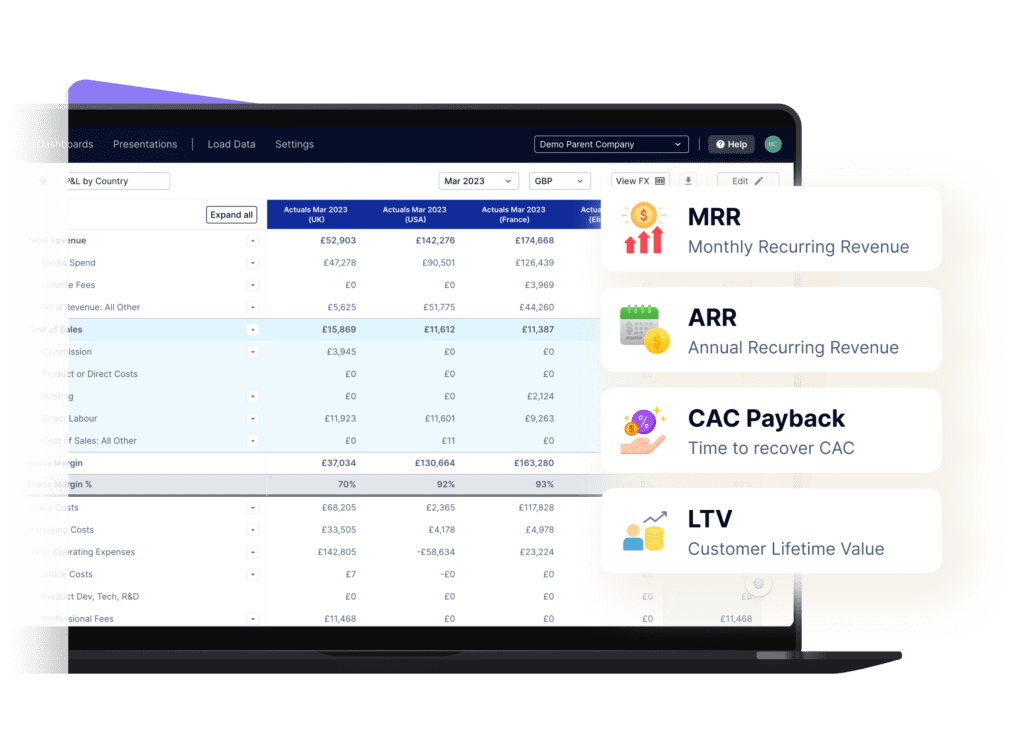

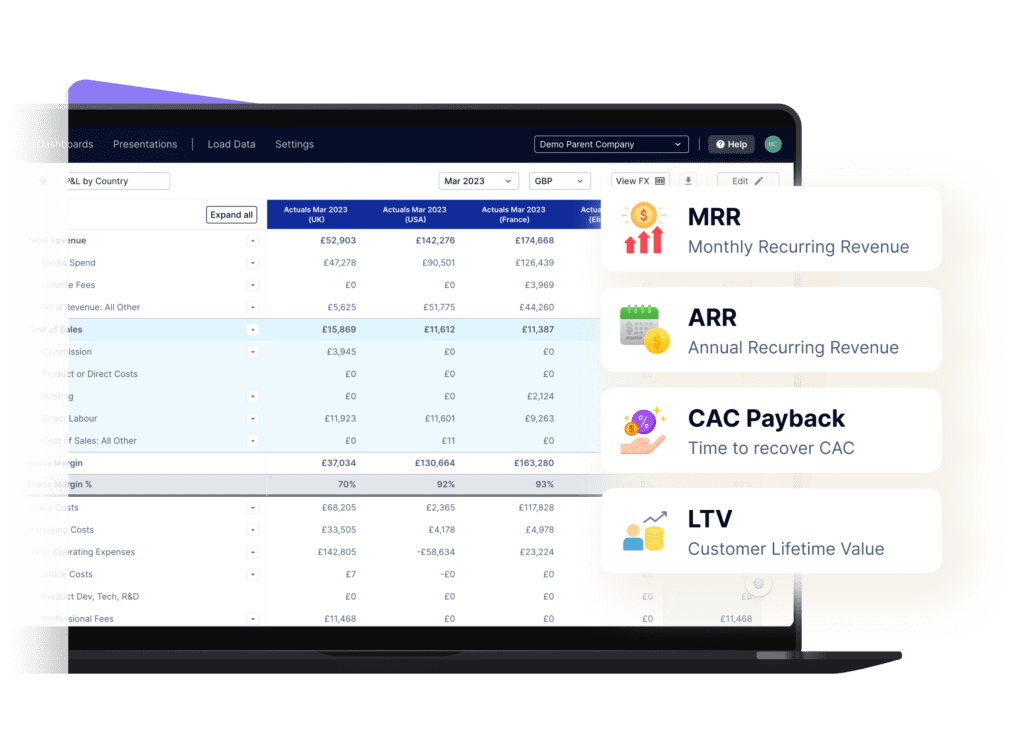

With all your team’s data imported and consolidated, you can view your company’s financial performance across any subsidiary or at the consolidated level.

- Load budgets and forecasts into the system, either from your accounting software or by importing spreadsheets or CSV files.

- Integrate Xero Tracking Codes and QuickBooks Classes into your consolidation, making it easy to report by department or business unit.

Increase accountability

ScaleXP smart reporting templates make it easy to report by team, business unit, or department.

- Financials are consolidated instantly, ensuring that group results can be produced.

- For international subsidiaries, exchange rates are imported and applied automatically.

- We follow IFRS and GAAP standards ensuring the highest degree of accuracy.

With ScaleXP you can

Use any accounting system

Import data from any of our accounting systems, with no need for the same general ledger, providing the greatest flexibility to automate financial consolidation whatever systems you use.

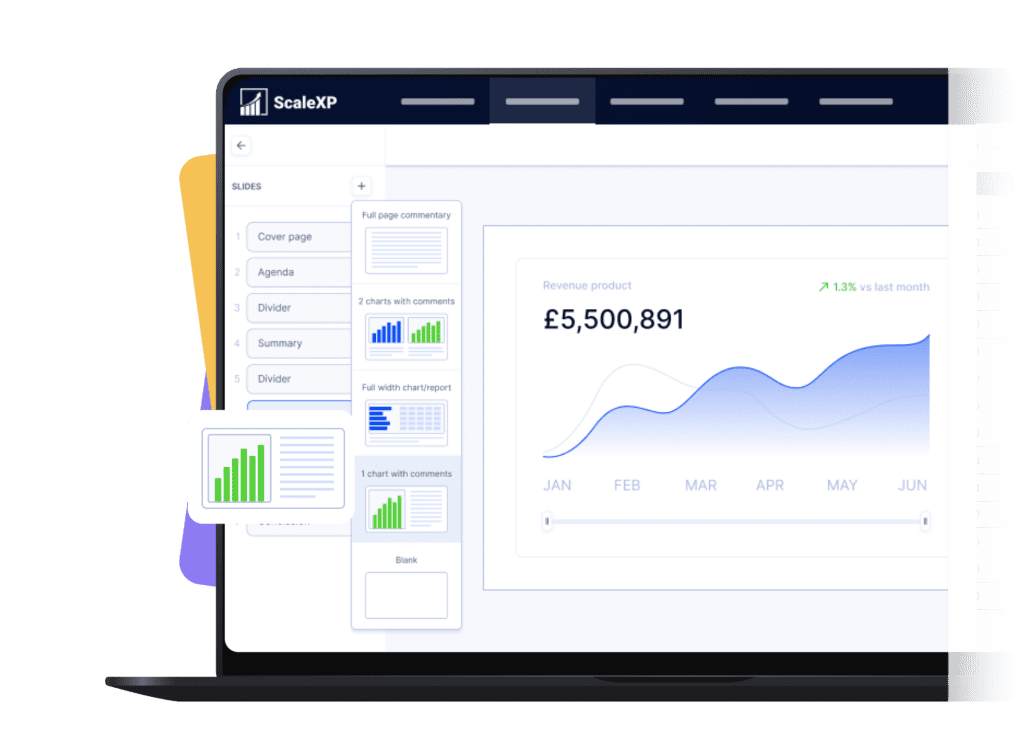

Impress your colleagues

Built-in presentation templates allow you to create sleek board or management account packs, seamlessly integrating graphs, metrics and reports, with data that is always up to date and easy to share.

Get fully setup in one hour

There is no need to spend days or weeks configuring ScaleXP. Connect your data now. Then book a short Zoom call with one of our product specialists to optimise the system to your requirements.

What our customers say

Who uses ScaleXP?

Access financial data anytime, on-demand. Integrated with key business KPIs, available via user-friendly online dashboards.

Streamline the month end process. Instantly consolidate P&L, Balance Sheet and Cashflow, using IFRS and GAAP compliant FX rates.

Simplify and streamline month-end process. Instantly consolidate P&L, Balance Sheet and Cashflow, using IFRS and GAAP compliant FX rates. See all accounting integrations here.

Financial consolidation FAQs

ScaleXP automatically imports foreign currency exchange rates and ensures that IFRS compliant rates are always used. Once consolidated, ‘drill down’ into the data with instant click-through, to understand anomalies and get answers quickly. The system can provide FX rates with any currency in the world.

| Europe Bulgarian Lev (BGN) Croatian Kuna (HRK) Czech Koruna (CZK) Danish Krone (DKK) Euro (EUR) Gibraltar Pound (GIP) Norwegian Krone (NOK)Polish Zloty (PLN) Pound Sterling (GBP) Romanian Leu (RON) Swedish Krona (SEK)Swiss Franc (CHF) Turkish Lira (TRY) | Oceania Australian Dollars (AUD) Fijian Dollar (FJD) New Zealand Dollar (NZD) | North America American Dollars (USD), Canadian Dollars (CAD), Cayman Islands Dollars (KYD), Mexican Peso (MXN) | Asia Brunei Dollar (BND) Hong Kong Dollar (HKD) Indian Rupees (INR) Japanese Yen (JPY) Singapore Dollar (SGD) Taiwan New Dollar (NTD/NWD) Turkish Lira (TRY) | South America Brazilian Real (BRL) Colombian Pesos (COP) | Africa Egyptian Pound (EGP) Kenyan Shilling (KES) Moroccan Dirham (MAD) Nigerian Naira (NGN) South African Rand (SAR) | Middle East Bahraini Dinar (BHD) Israel New Shekel (ILS) Jordanian Dinar (JOD) Kuwaiti Dinar (KWD) Libyan Dinar (LYD) Omani Rehal (OMR) Saudi Riyal (SAR) UAE Dirham (AED) |

Absolutely. You can include a budget for the entire group, or roll up individual budgets from each entity. You can then perform actual vs. budget analysis in our reports and dashboards.

A consistent chart of accounts isn’t necessary. ScaleXP allows you to combine data in the format that works best for you, creating a custom Profit & Loss or Balance Sheet for the consolidated company.

By default, you can consolidate up to 20 entities in ScaleXP. If you need more than this, get in touch with our team – we’d be happy to work out a solution with you!

Please click here for details on how you can consolidate your financials with ScaleXP.