For SaaS companies, and finance teams in SMEs, Stripe and Xero are synonymous with payment processing and accounting. Being two of the largest players in the financial industry, many organisations rely on these two companies every day for payment processing, accounting, reconciling payments sending out invoices and more.

Why connect Stripe to Xero?

Despite Stripe and Xero being two market-leaders within the accounting and payments space, you shouldn’t use them in complete isolation from one another. Otherwise, this leads to lots of manual work, missed insights and time spent which could otherwise be focused on helping your business grow. Some key benefits include:

- Streamlined payment processing: With Stripe and Xero integrated, businesses can accept payments online quickly and easily using a range of payment methods.

- Improved cash flow: By automatically syncing Stripe payments with Xero, businesses can easily track their revenue and expenses. This can help businesses improve their cash flow and make better financial decisions.

- Reduced errors: When Stripe and Xero are integrated, businesses can reduce the risk of errors in their accounting records.

- Increased efficiency: By integrating Stripe and Xero, businesses can save time and improve their efficiency as they do not have to switch between different platforms to process payments and track their finances.

We’re going to explore the best options that SaaS companies and finance teams have for integrating Stripe and Xero. Every organisation is different, so depending on your size, organisational complexity, budget, and focus on having fully compliant, and accurate data, the options below should be a good place to start.

Manually connecting Stripe and Xero to accept payments

At the very basic level, Xero and Stripe have set up their own integration, which you can read more about here. This is a great approach for organisations that just want to be able to accept payments through Stripe and have the key info sent across to Xero. Unfortunately, there’s not the level of detail needed by most finance and accounting teams – so manual work and clean-up is needed to ensure accurate data.

Using third party tools for additional data

For slightly more flexibility, there are tools like Zapier, ChargeBee and Synder. Zapier is a paid tool which automates workflows and integrates different web based platforms, like Stripe and Xero. With it, you can do things like to reconcile payments in Xero, create Xero invoices for new Stripe payments, or update Xero contacts for new Stripe customers.

However, for organisations that want a more integrated, real-time Xero Stripe integration, Zapier falls short. That’s because it lacks the ability to update existing invoices and remove duplicates, send information like product codes, discount codes and tax codes between the two systems. It’s also not possible to include revenue recognition dates, meaning manual journals are needed. Read more here.

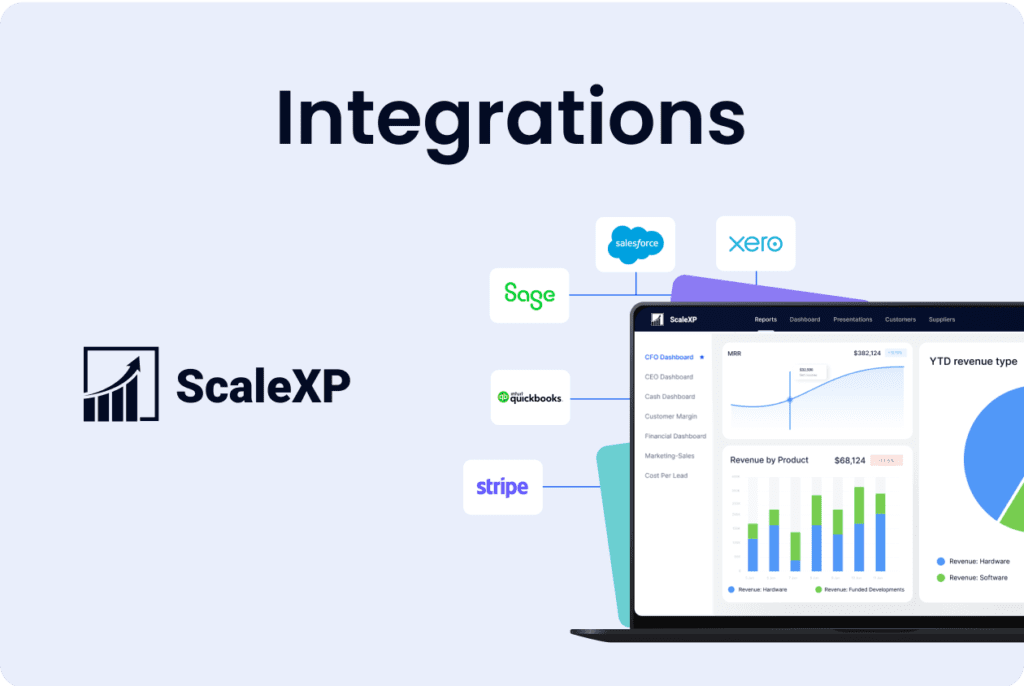

Using ScaleXP to fully integrate Stripe and Xero data

Finally, if you’re looking for the leading Xero Stripe integration for finance teams and SaaS companies, it’s worth considering ScaleXP.

Unlike other tools, ScaleXP ensures you have all the data you require, so you can fully connect Stripe and Xero. That includes both paid and issued invoices, tax data, discount codes and product codes. Any edits or deletions are also reflected in both systems. Plus, FX rates align with IFRS and GAAP standards, ensuring consistent data across markets and currencies.

ScaleXP doesn’t just connect Stripe and Xero though, we fully integrate with all the leading accounting and CRM systems including HubSpot, Salesforce, Pipedrive, QuickBooks and more. This means that you can have one, fully integrated platform providing you with a single source of truth, despite different markets, currencies, and departments. This helps ensure you can make better, data driven decisions and grow more quickly.

If you’d like to learn more about how ScaleXP’s Stripe/Xero integration could help your organisation, click here.