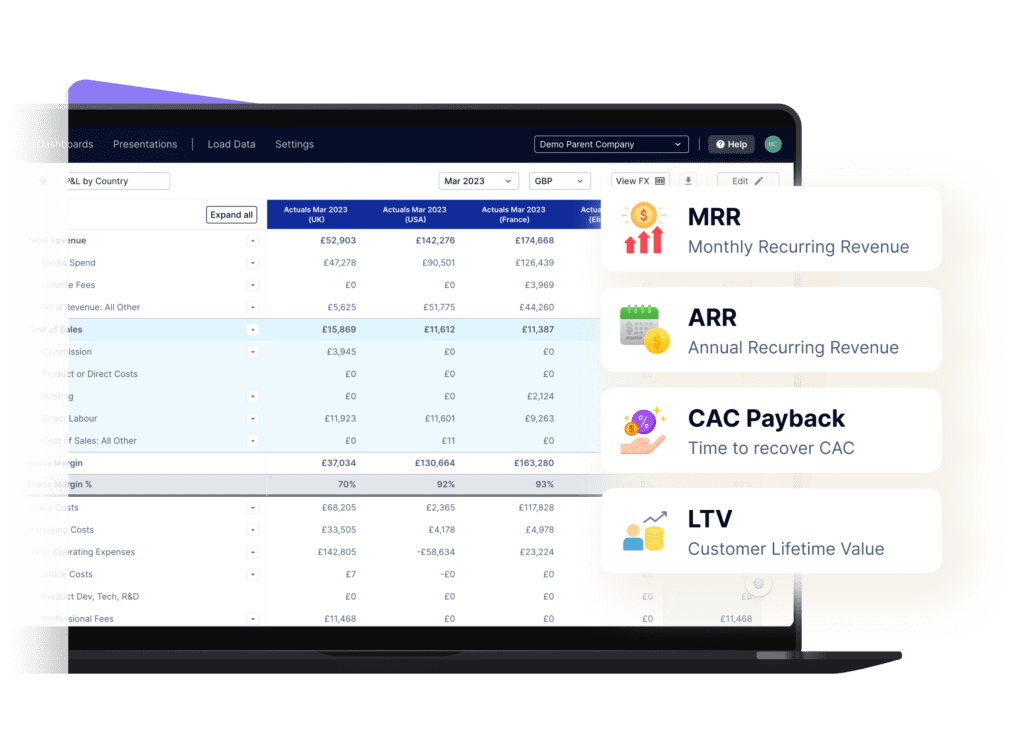

Yes. ScaleXP fully supports multi-entity and multi-currency consolidation, making it simple to view and report on group-level performance in real time. The platform includes automated exchange rate feeds, applied specifically to both profit & loss and balance sheet items, ensuring consistent and accurate currency translation across all entities.

You can also import and track budgets at a consolidated level, giving management a clear comparison between actuals and forecasts across the group. ScaleXP allows detailed departmental reporting, using Xero tracking codes or QuickBooks classes, so you can analyse performance by business unit, department, or region.

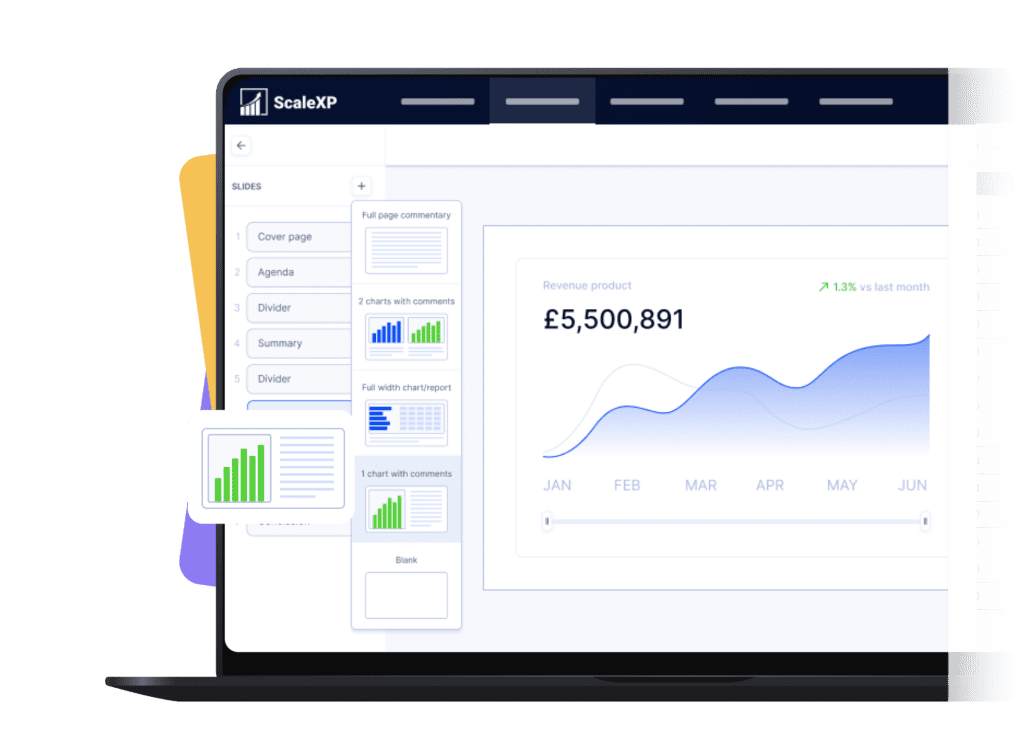

Consolidation is fast, accurate, and effortless — providing a unified platform to showcase reports and dashboards across all of your entities, without complex manual adjustments or spreadsheet consolidation.