Salesforce Accounting Integration Built for Finance Teams

Turn Salesforce activity into numbers Finance can stand behind.

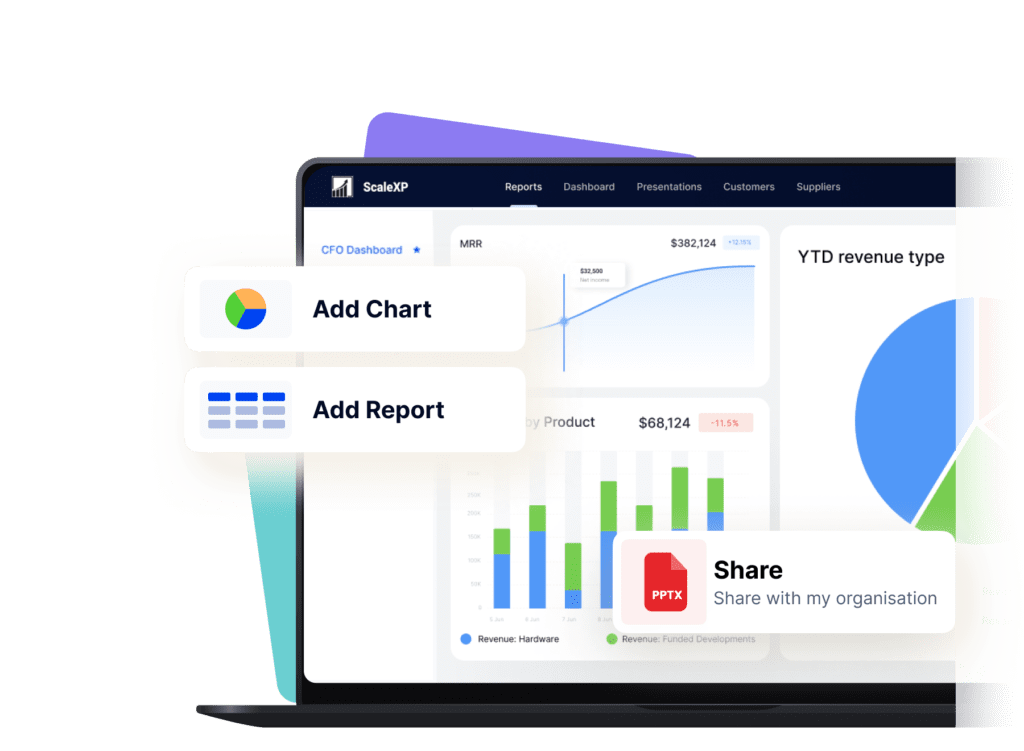

- Salesforce is where deals are won. Your accounting system is where financial truth lives.

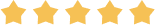

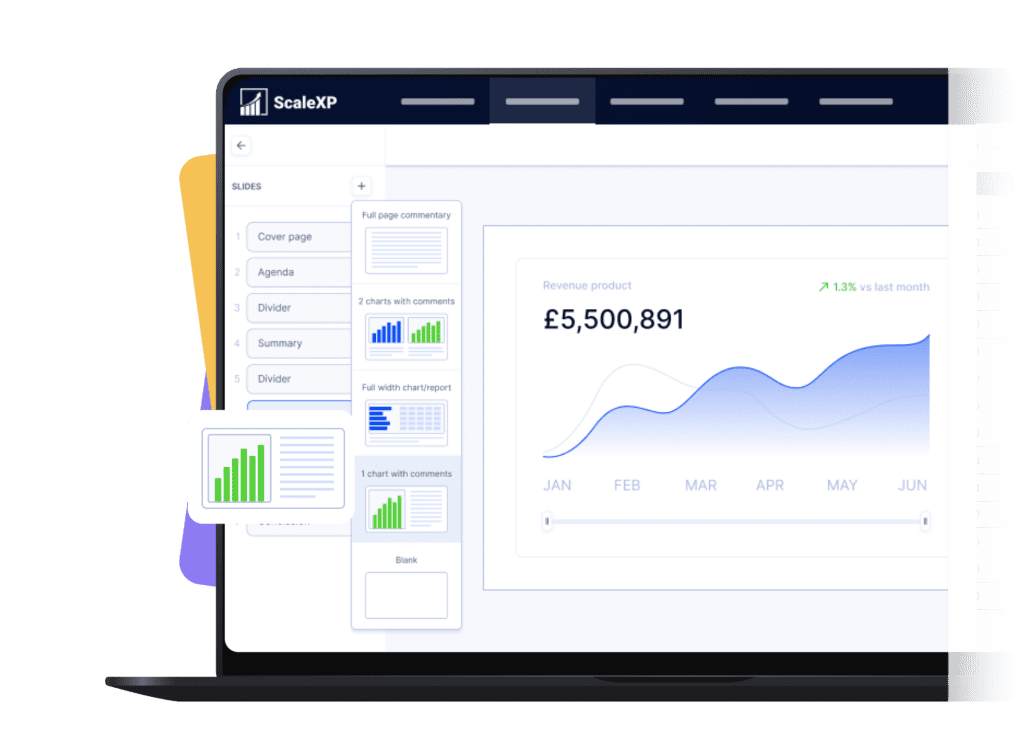

- ScaleXP integrates with Salesforce and accounting systems like Xero and QuickBooks, so Finance can produce reporting that reconciles, scales, and holds up in board discussions.

We have been able to significantly reduce the time to prepare our monthly reporting packs, feeding into a group board pack at the click of a button with 100% accuracy. We also have a real time view of our ARR bridge, are able to get to SaaS metrics quickly and also to sanity check that invoicing aligns with contracts.

We have been able to significantly reduce the time to prepare our monthly reporting packs, feeding into a group board pack at the click of a button with 100% accuracy. We also have a real time view of our ARR bridge, are able to get to SaaS metrics quickly and also to sanity check that invoicing aligns with contracts.