Stripe + QuickBooks Integration Built for Accurate Accounting

Turn Stripe payments into reliable, reconciled numbers inside QuickBooks.

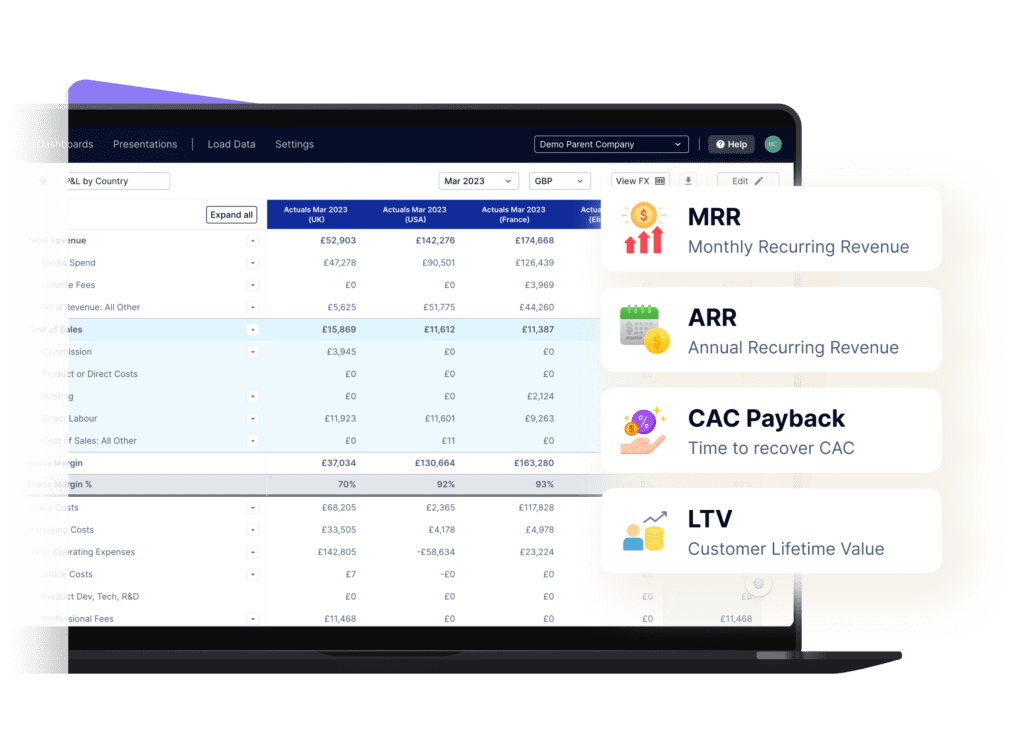

- Most teams connect Stripe and QuickBooks, but finance still relies on spreadsheets to fix revenue timing, deferrals, and performance metrics.

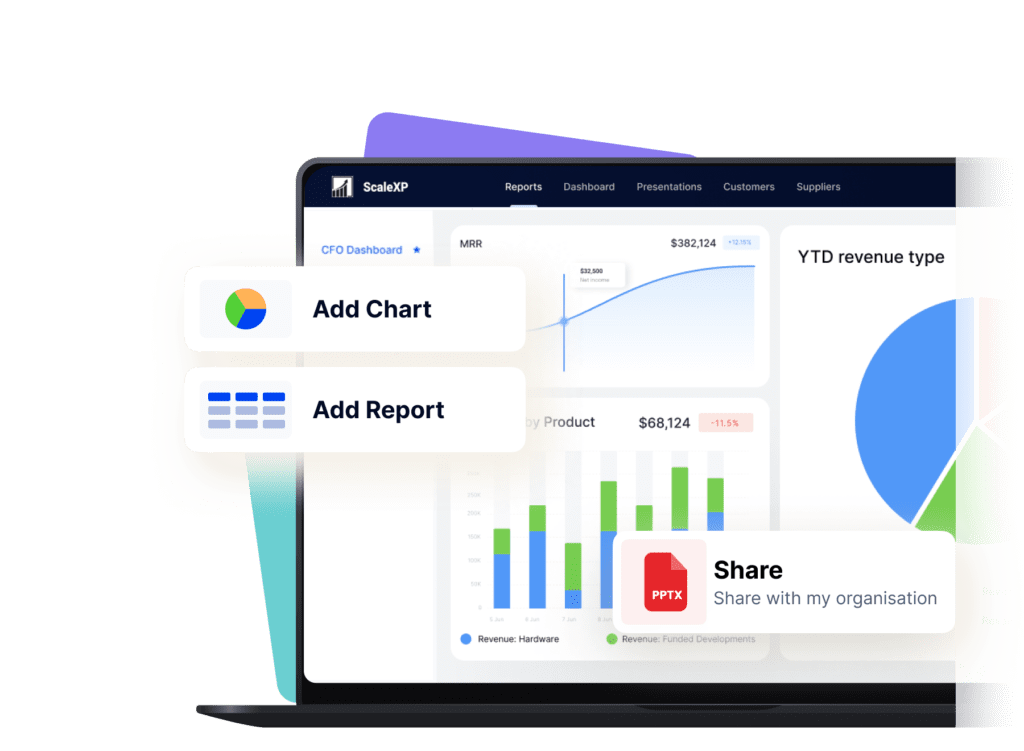

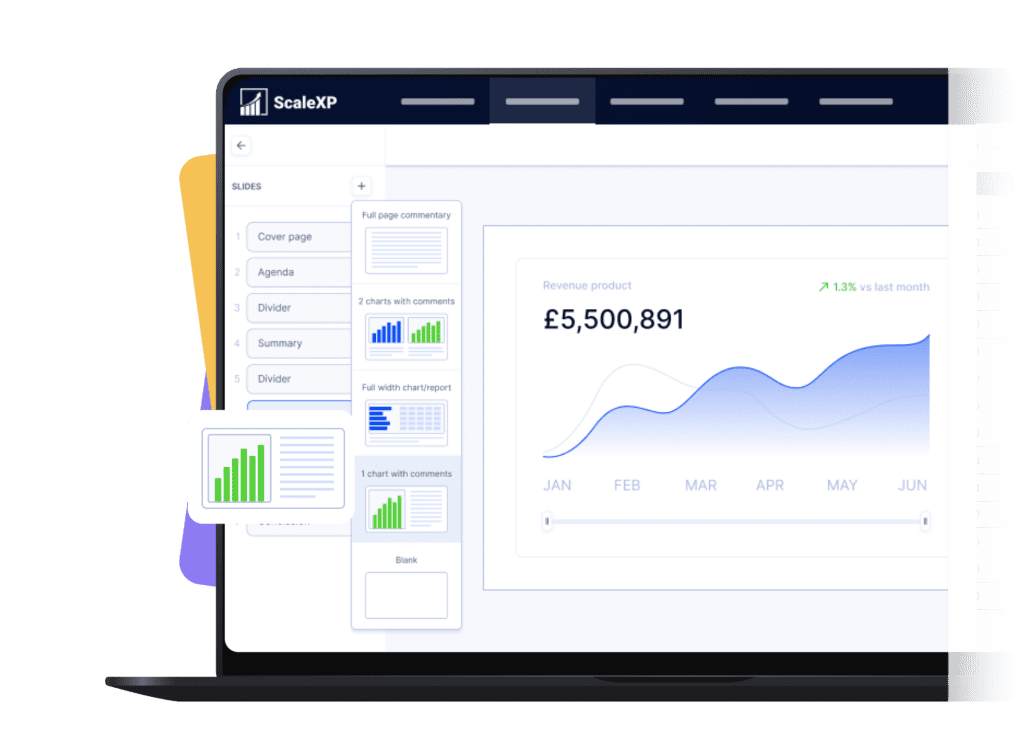

- ScaleXP adds the finance layer in between, so your numbers stay accurate, auditable, and ready to report as you scale.

This app has made my team’s life a lot easier by simplifying and automating the revenue recognition from Quickbooks. The tool also has a lot of great SaaS reporting.