Stripe + Xero Integration Built for Financial Accuracy

Turn Stripe billing data into trusted, board-ready numbers inside Xero.

- Most teams use Stripe and Xero together, but finance is still in spreadsheets fixing deferrals and performance metrics before every board meeting.

- ScaleXP integrates with Stripe and Xero to turn billing activity into accounting-ready journals and reconciled metrics.

What problem does the Stripe + Xero integration fail to solve?

Stripe records billing activity. Xero records accounting entries. Neither system:

- Applies revenue recognition logic

- Aligns actuals to targets

- Produces metrics that reconcile cleanly to the P&L

Even when Stripe and Xero are connected, most teams still can’t see targets versus actuals without rebuilding reports manually.

ScaleXP exists to remove that gap.

Why connecting Stripe to Xero is not enough for finance teams

Where the Stripe–Xero workflow breaks down

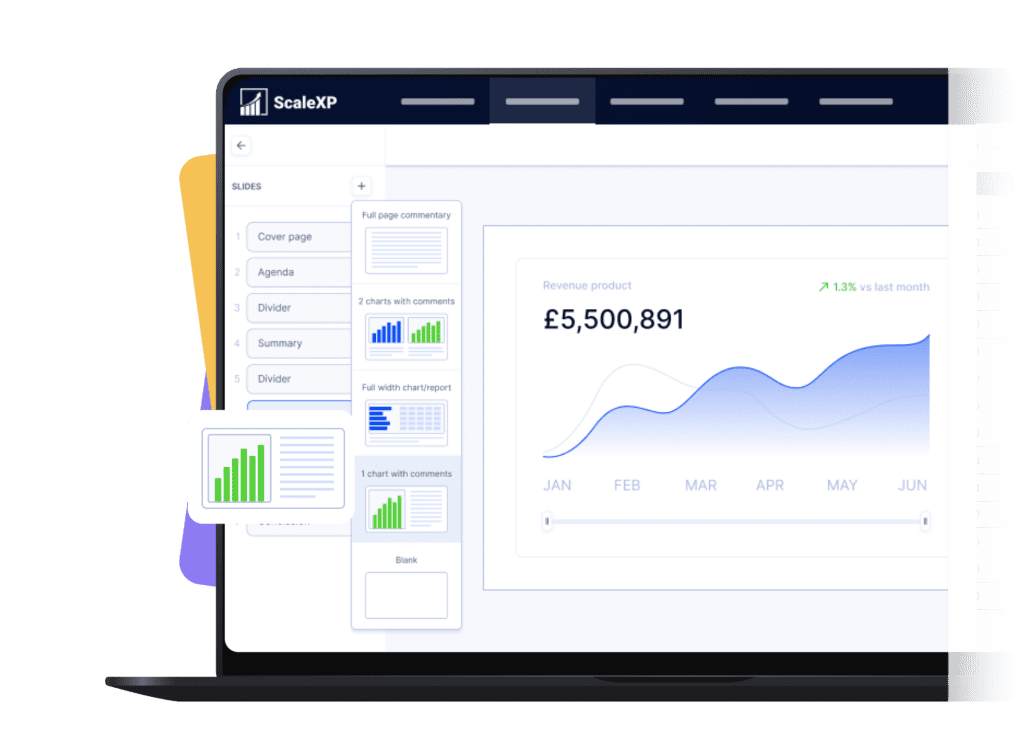

ScaleXP sits between Stripe and Xero as an intelligent finance layer. The flow is simple:

- Stripe sends billing and payment events

- ScaleXP interprets those events using finance logic

- Clean, accurate journals and live metrics flow into Xero

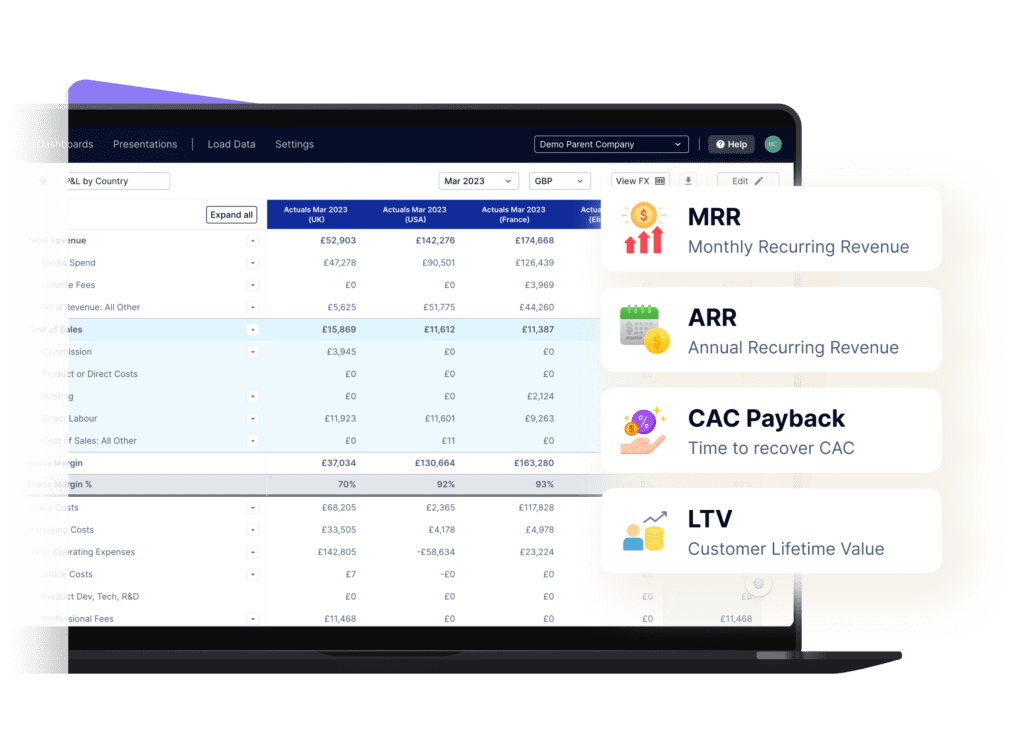

ScaleXP lets finance teams import Stripe metadata directly into their models. Choose any two metadata fields to flow through ScaleXP into reports, enabling deeper analysis, no custom development or spreadsheets required. Apply consistent rules across:

- Revenue recognition and deferred revenue logic

- Refunds, credits, upgrades, and plan changes

- Selected Stripe metadata fields for improved financial reporting

What does ScaleXP add between Stripe and Xero?

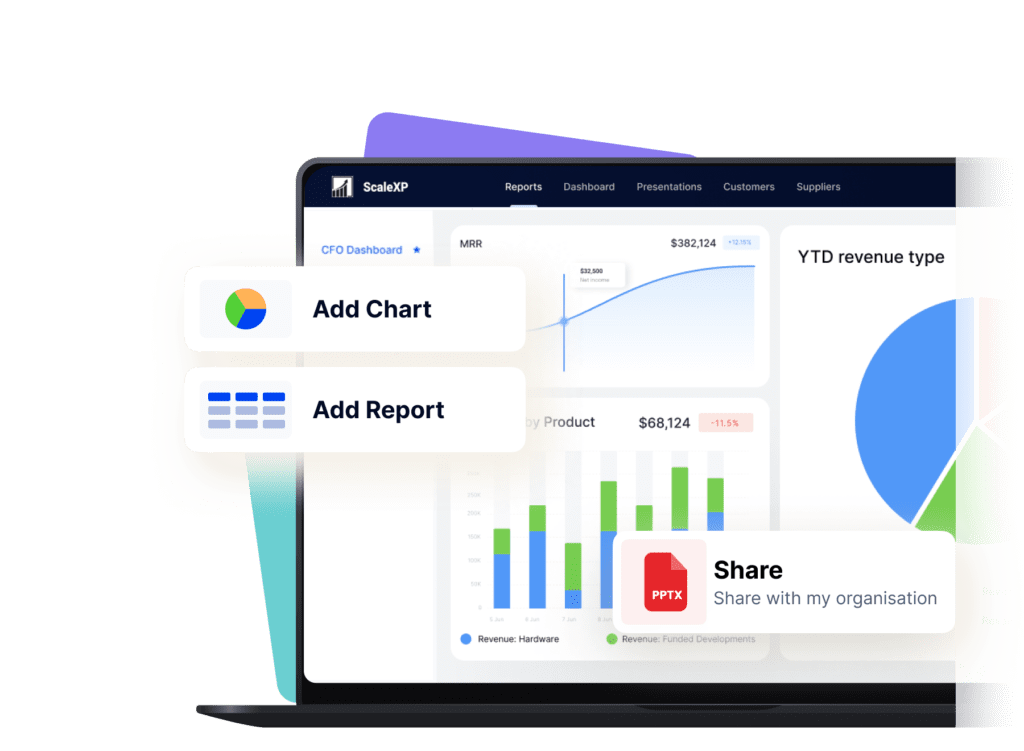

ScaleXP is used for revenue recognition, deferred revenue management, and board-ready financial reporting across Stripe and Xero.

By adding a finance logic layer between Stripe and Xero, ScaleXP interprets Stripe billing activity, applies revenue recognition rules, and produces accounting-ready journals and metrics that reconcile directly to the Xero P&L.

- Revenue and deferred revenue that reconcile cleanly to Xero

- Stripe metadata incorporated into finance reporting (choose any two fields)

- Metrics you can stand behind in board and audit conversations

- Live visibility into revenue and performance

- Clear targets versus actuals without spreadsheet rebuilds

- Confident answers without waiting for month-end

How does ScaleXP compare to native Stripe–Xero integrations?

Native Stripe–Xero syncs move data. Only ScaleXP applies finance logic across Stripe and Xero, and is the finance control layer missing from Stripe and Xero.

Capability

Payments & invoices

Revenue recognition logic

Manual

Deferred revenue tracking

Manual

Targets vs actuals

Manual

Metrics tied to P&L

Board-ready reporting

Error-prone

Who is the Stripe + Xero integration with ScaleXP built for?

ScaleXP is designed for finance teams, CFOs, and founders who run Stripe and Xero, that need:

- Accurate revenue and deferred revenue handling

- Metrics that reconcile directly to the ledger

- Clear visibility into targets versus actual performance

How Andy Mellor achieved a stress-free month-end close

With ScaleXP, Andy has replaced manual work with real-time automation. Invoices sync with Xero automatically, and gross margin reporting is now instant and effortless.

The difference has been amazing in terms of the clarity of insight into the margins that we have.

Andy Mellor

Fractional CFO

Is Stripe and Xero data secure with ScaleXP?

Stripe & Xero FAQs

Yes. ScaleXP allows finance teams to compare planned targets against actual performance using live, reconciled data. This supports more confident forecasting and board discussions.

Yes. ScaleXP is designed so metrics and reports tie back to the accounting ledger, reducing reconciliation work and surprises.

Yes. ScaleXP is built to handle increasing transaction volume, subscription complexity, and reporting requirements as companies scale.

ScaleXP automatically applies deferred revenue logic to Stripe billing activity and posts accurate schedules and journals into Xero. This ensures deferred revenue is tracked correctly and reconciles to the general ledger.

Yes. ScaleXP applies consistent finance rules to subscription changes, refunds, credits, and plan modifications so revenue and metrics remain accurate without manual intervention.

Yes. ScaleXP allows finance teams to select up to two Stripe metadata fields and incorporate them directly into financial reporting and analysis, without custom development or spreadsheets.

No. ScaleXP does not replace Stripe or Xero. Stripe remains the billing system, Xero remains the accounting ledger, and ScaleXP adds the finance logic layer between them.

Yes. ScaleXP produces reconciled metrics and reports that finance teams can confidently use in board packs, forecasts, and investor discussions.

Most teams can connect Stripe and Xero quickly and begin automating revenue logic and reporting without major system changes or reimplementation.

Yes. ScaleXP is designed for SaaS and subscription-based businesses that need accurate revenue recognition, deferred revenue handling, and reliable performance metrics.