Instant clarity on SaaS metrics, from billing to boardroom

If you’re still running SaaS metrics and revenue recognition on spreadsheets, you’re flying blind. ScaleXP gives CFOs real-time clarity, data integrity, and investor-ready accuracy.

Real-time clarity for fast growing SaaS

When ARR and customer growth outpace finance infrastructure, spreadsheet reporting collapses. Version control breaks. Trust erodes. Decision-making slows.

ScaleXP connects billing, CRM, and accounting into one live, reliable view — giving CFOs and finance leaders accurate visibility across revenue quality, churn, customer cohorts, and growth efficiency.

Every number. Every day. Automatically up to date. Auditable. Defensible. Reliable.

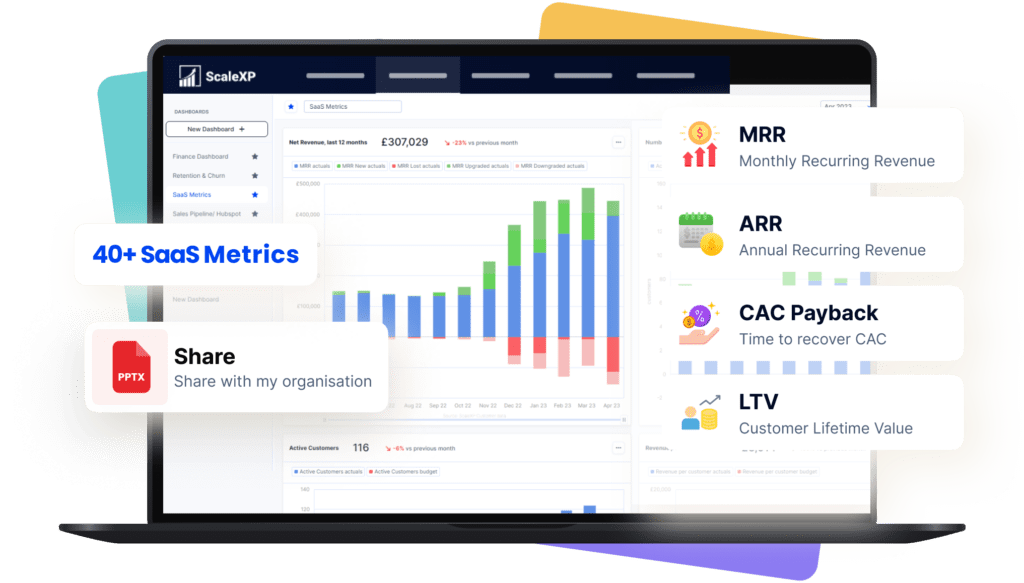

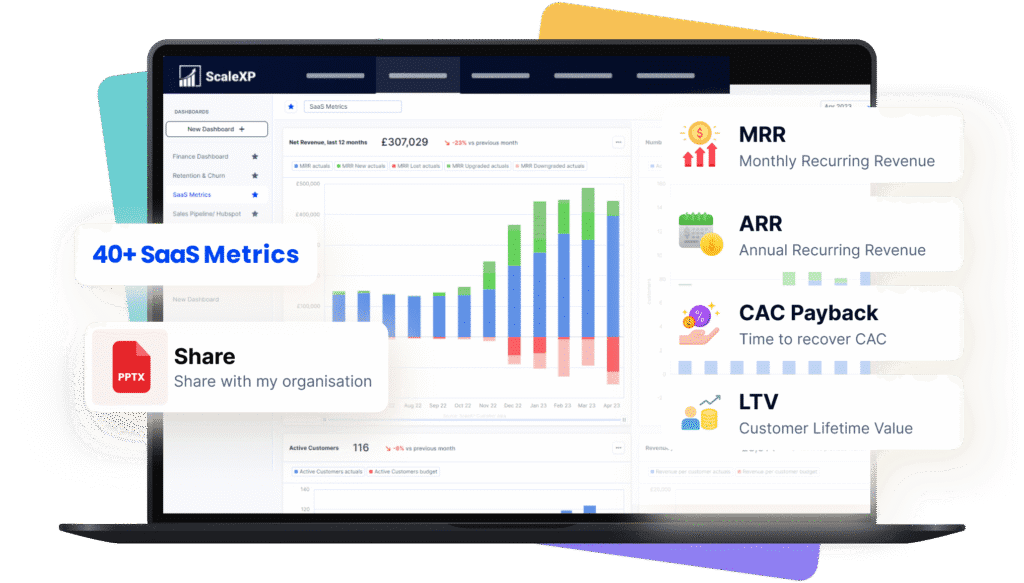

Automate SaaS Metrics, No Spreadsheets Required

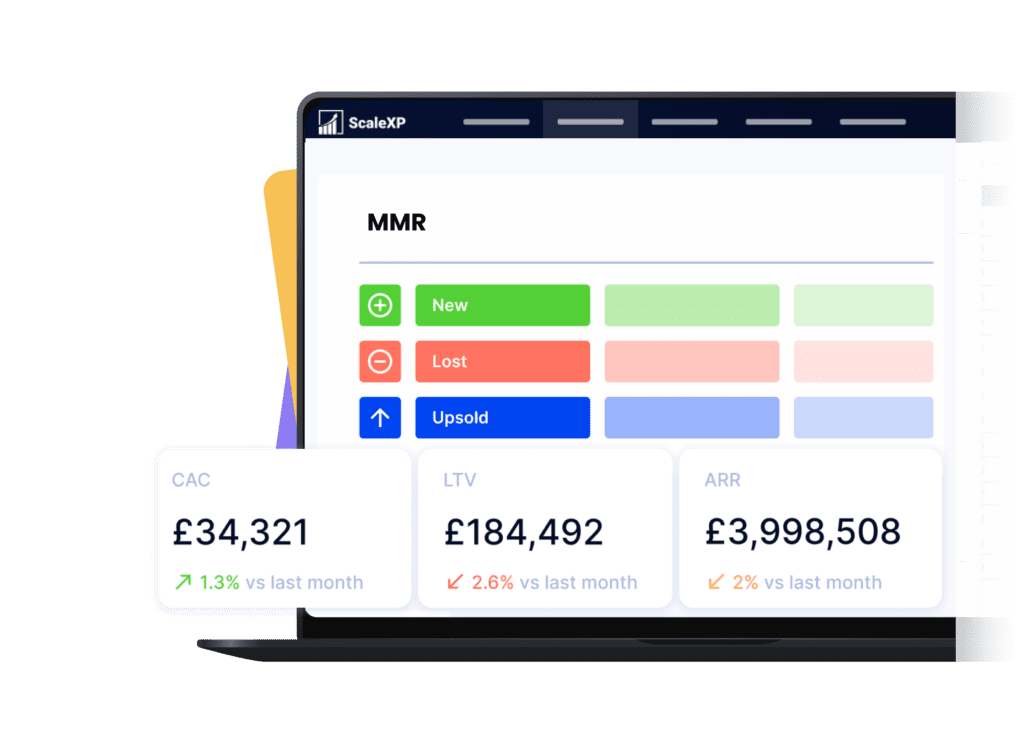

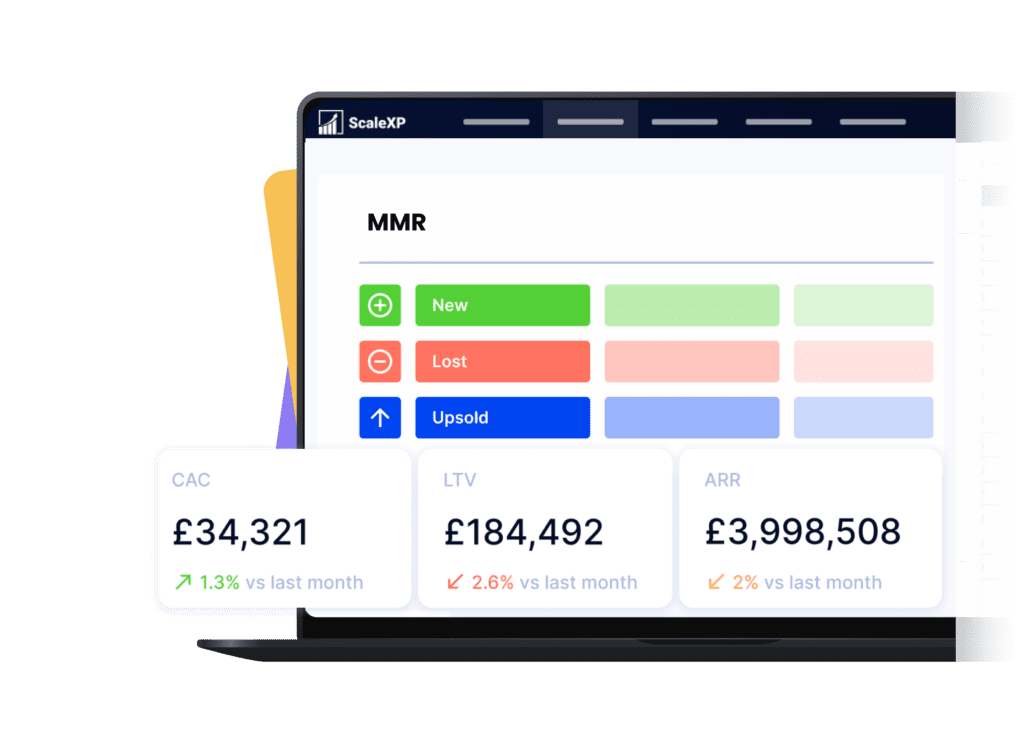

From MRR and ARR to churn, expansion, cohorts, and NRR — ScaleXP calculates SaaS metric automatically, using billing and subscription data.

Unlike expensive enterprise tools or lightweight spreadsheet-based solutions, ScaleXP gives growing SaaS companies the automation they need at a real-world price point.

ScaleXP makes CFOs the authoritative voice on growth quality and retention dynamics.

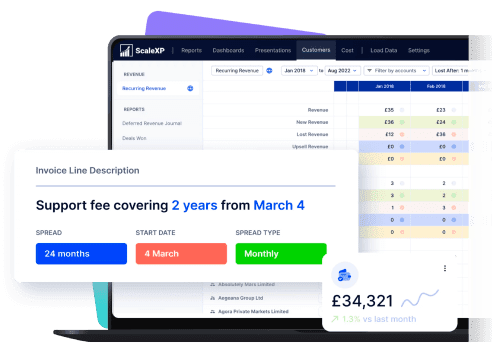

Automate Month-End Close, No More Manual Reconciliations

With ScaleXP, month-end becomes a review- not a rebuild.

- Automated accrued income & deferred revenue

- Automated prepayments and accruals

- Full audit trail & transparency

Most SaaS companies save 3–5 days per month and eliminate Balance Sheet reconciliation entirely.

Unify your entire SaaS stack

ScaleXP integrates seamlessly with Xero, QuickBooks, Stripe, HubSpot, and Salesforce and more, bringing sales, billing, and finance into perfect alignment.

One source of truth. Zero spreadsheet risk.

Scale your business, not your spreadsheets

Your product scales fast, your finance team should too. ScaleXP gives you automation, accuracy, and investor-ready insight, without the manual grind.

Close faster, grow smarter, and lead every conversation with confidence.

We're committed to the security and privacy of your data

B2B SaaS FAQs

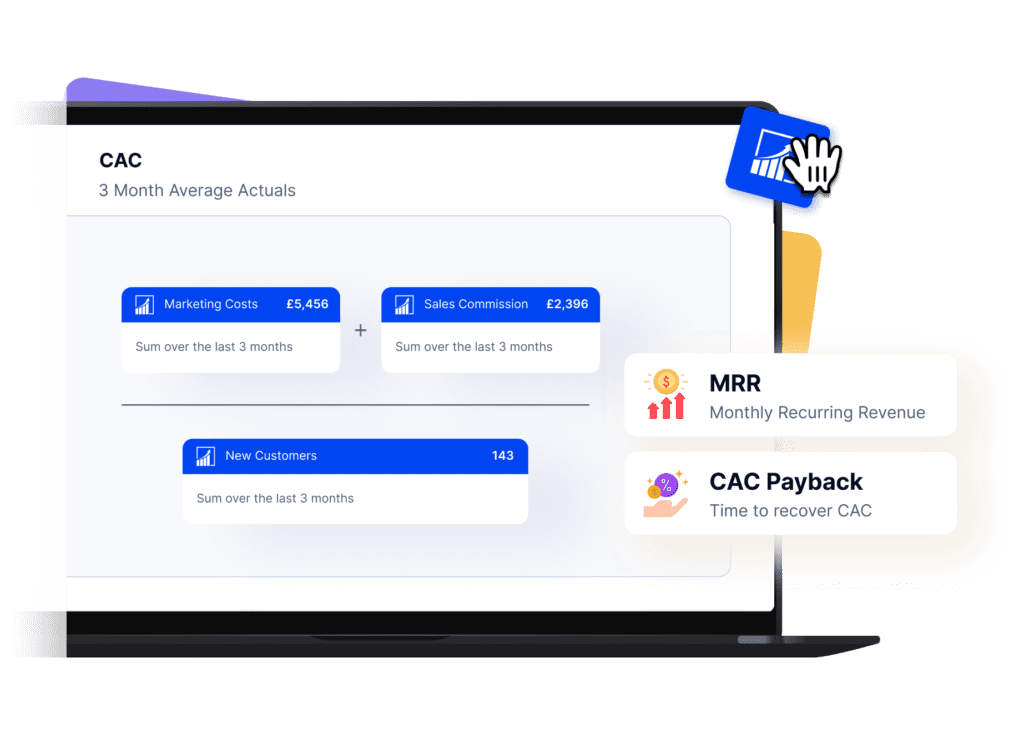

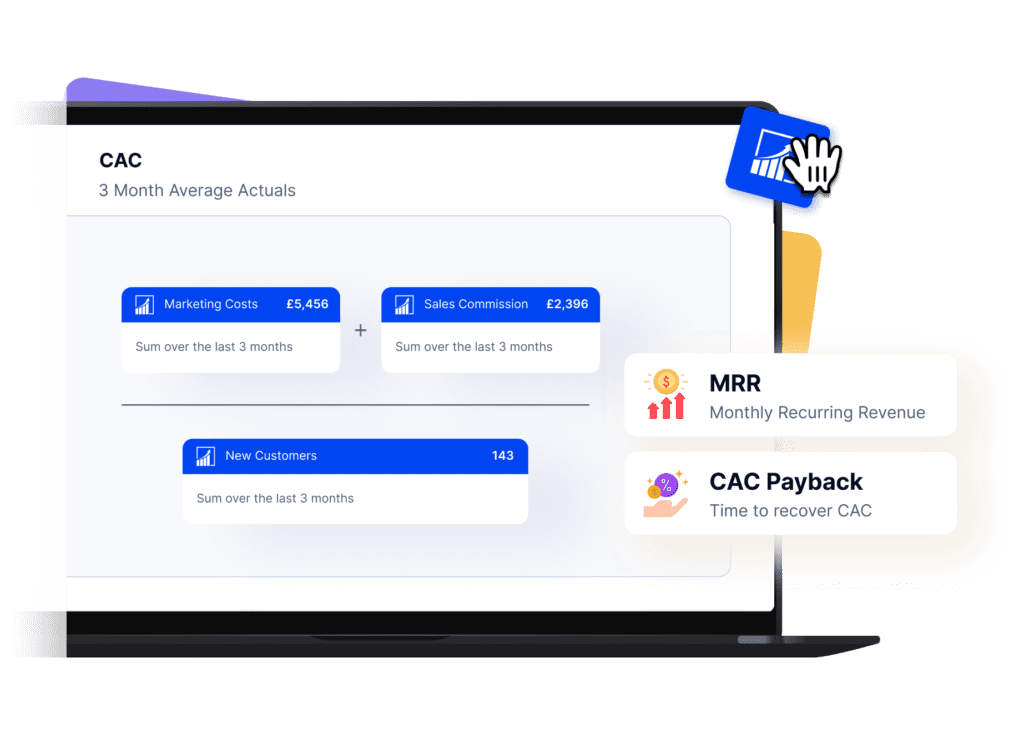

We ingest billing, subscription, and revenue data directly and compute ARR, churn, cohorts and retention without manual calculation.

This is done by using AI to read each bill and invoice and automatically extract key information.

ScaleXP is ideal for SaaS businesses from $1M to $50M+ in ARR, especially those running accounting in Xero or QuickBooks who have outgrown spreadsheet-based reporting and now require more sophisticated, automated SaaS finance capabilities.

At this stage of growth, companies typically need:

automated revenue recognition

ARR & MRR calculation

churn and expansion analysis

cohort metrics

consolidated reporting

board-ready analytics

multi-entity and multi-currency support

ScaleXP fills the gap between lightweight accounting tools and expensive enterprise solutions, giving growth-stage SaaS businesses enterprise-grade capabilities — without enterprise-grade pricing.

Yes — ScaleXP offers deep two-way integration with HubSpot, bringing your CRM and finance data together to give you real-time insight, streamlined billing workflows, and automatic SaaS metric calculations.

Here’s how it works:

- Seamless deal-to-invoice flow: Won deals in HubSpot automatically create draft invoices – ready for your review and approval.

- Unified customer and financial data: Customer records, subscriptions, payments and billing status sync directly between HubSpot and Xero or QuickBooks

You keep your existing stack. HubSpot remains your CRM. ScaleXP flips on the finance automation and insight layer — so your finance team moves from hoops of manual work, to proactive leadership.

ScaleXP automates the entire invoicing workflow by connecting your CRM (e.g., HubSpot), billing systems, and accounting ledger. When a deal is marked won or a renewal is due, ScaleXP automatically generates a draft invoice, applies correct currency, tax and discounts, and syncs it to your accounting system (like Xero or QuickBooks). The result: fewer manual entries, faster billing cycles, improved cash flow and real-time visibility of invoice status across systems.

Yes — ScaleXP supports full multi-entity and multi-currency consolidation, giving you a unified view of your performance across businesses, regions, and currencies.

- Import data from any accounting system — Xero, QuickBooks, ZohoBooks

- Consolidate instantly once subsidiaries complete month-end close

- Exchange rates are automatically applied and compliant with both IFRS and US GAAP standards

- No requirement for identical charts of accounts across entities — ScaleXP allows flexibility to combine data in the format that works best for you

- Report by entity, department or business unit — with real-time drill-down from group-level to subsidiary-level analytics

ScaleXP turns complex organisation structures into one living dataset, so your leadership can review consolidated P&L, balance sheet and KPI reporting — without manual spreadsheet stitching.

ARR & MRR

Gross & net churn

NRR & GRR

Cohort analysis

Retention and churn

Expansion vs contraction

CAC recovery & payback

LTV

Deferred revenue waterfalls

No SQL. No BI tools. No spreadsheet engineering. All automated from your accounting and CRM data.