For many small businesses and start-ups, revenue reporting rules may seem daunting. Fortunately, technological advances have streamlined revenue reporting by automating manual processes and enhancing financial visibility, allowing you to get the best view of when revenue should be recognised and when the cash will arrive – in a few simple clicks.

What is revenue recognition?

Investors and accountants periodically refer to correct revenue recognition. What does this mean, and why does it matter?

Revenue recognition simply means that revenue is shown in the P&L when it is earned, rather than when it is received or when it is invoiced.

Businesses across various industries accept upfront payments for goods or services, which can be helpful to boost cash flows. However, this advanced payment is treated as unearned revenue until the goods or services have been provided.

Examples of deferred revenue include:

- Retainers received by lawyers or accountants.

- Subscriptions and memberships paid quarterly or annually in advance.

- Upfront payments for rent, insurance, or anything else.

Why does revenue recognition matter?

So why does revenue recognition matter? For two simple but significant reasons.

First, investors and banks expect revenue to be shown when earned. Early stage venture capitalists tell us that half of the companies that seek investment do not recognise revenue correctly, which makes it impossible to assess investment. Sadly, this means that a VC may give a polite no, meaning your company could be missing out on well deserved investment. However, this also means that if you do recognise revenue correctly, you’re already a step ahead of half the competition!

Second, and perhaps more importantly, showing revenue as it is earned provides the clearest view of business performance. An accurate monthly view of revenue is critical to understanding customer buying behaviour and monitoring who is buying more (or less) over time.

Nearly half of surveyed leaders stated that without clear revenue processes, they are less able to strategise, forecast, and budget.

Reporting income when it’s earned is essential for financial and directional planning purposes and to spot trends early.

What is the difference between billed and earned revenue?

Billed revenue is when an invoice is sent to a customer. Earned revenue is when a service or product has been provided. As an example, if a software company issues an annual invoice for $12k, the billed revenue will be $12k as soon as the invoice is sent to the customer. The earned revenue will be $1k per month.

Showing all $12k of revenue in a single month is not correct revenue recognition, and it does not reflect the ongoing relationship that you have with the customer.

How to recognise revenue correctly

Revenue is correctly shown when it is earned. In the case of our software company, $1k of revenue should be recognised each month. This principle is simple; sadly, the accounting is laborious. Here is a sample of the accounting entries for our software company, assuming that the $12k invoice is issued on 15 Dec 2023:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 15 Dec 2023 | Cash | 12,000 | |

| Deferred Revenue | 12,000 |

A manual journal then needs to be recorded each month, for 12 months:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 01 Jan 2024 | Deferred revenue | 1,000 | |

| Sales / Revenue | 1,000 |

In most cloud based accounting systems, including Xero and QuickBooks, this annual invoice will require at least 13 accounting entries as well as spreadsheet tracking, a time-consuming and laborious process! We go into more detail of how much this could be costing your business here.

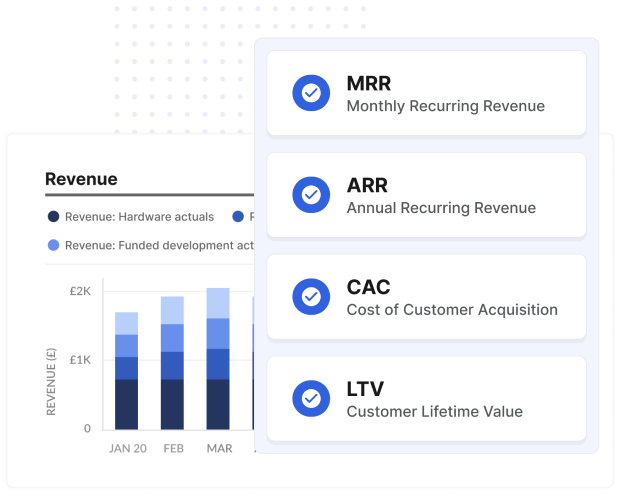

For many, this will make you sigh (very deeply) and wonder if you just ignore revenue recognition. While this would simplify the accounting, you will lose visibility of key metrics: active customers, customer contract renewal dates, even churn metrics. As an alternative, we recommend using software to streamline revenue recognition and gain instant access to business critical metrics.

How can automation help?

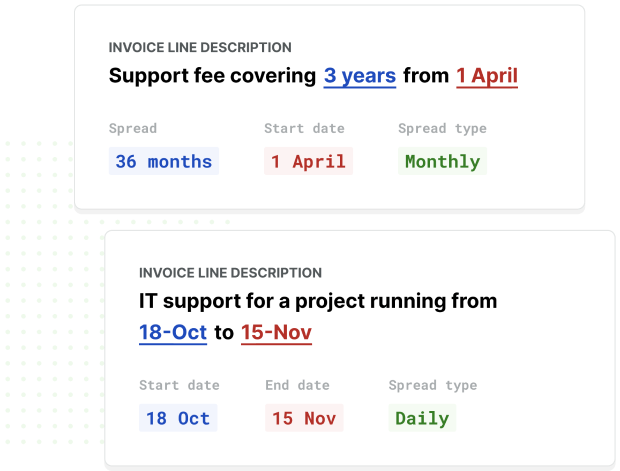

Systems, such as ScaleXP can ensure that your revenue recognition is always correct, without any tedious accounting journals. The system automatically scans all invoices issued in your accounting system (Xero, Quickbooks, Sage, Zoho Books and more) and allocates revenue to the correct month based on text in the invoice itself, splitting ‘annual’ invoices over 12 months without any spreadsheet tracking.

Why ScaleXP is the best solution for unearned revenue recognition

ScaleXP fully automates deferred or unearned revenue recognition, automatically showing it by month as it is earned. The system is fully compliant with IFRS and GAAP accounting standards. Companies onboard in less than one hour, with their revenue recognition schedule fully prepared and ready to review. Book a demo to learn more.