Share this article on:

Churn is the silent killer of ARR and Growth. It saps momentum from SaaS businesses, adds unnecessary costs, and can leave companies chasing their tails. In this article, we offer some practical steps to assess and reduce churn.

How is churn calculated, and why is it the silent killer of ARR?

Churn is the revenue lost from customers who cancel or don’t renew their subscriptions.

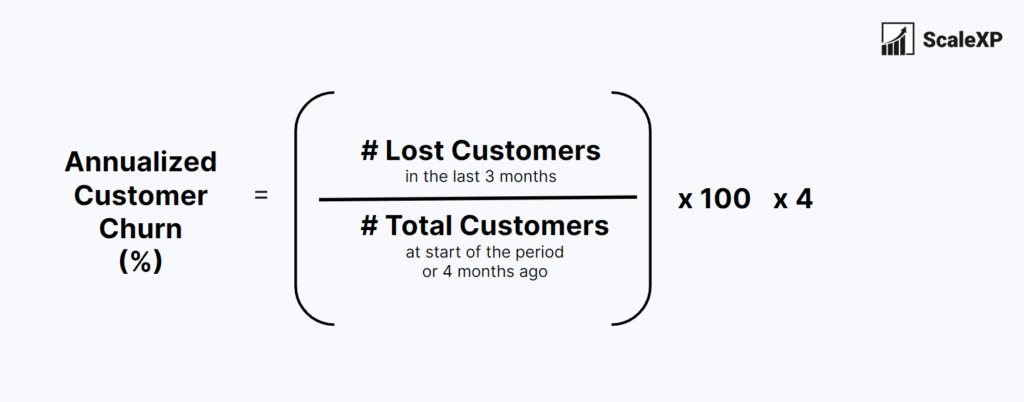

Customer churn is calculated as the number of lost customers divided by total customers. Monitoring annual churn is most common. However, we also recommend monitoring a shorter time frame, such as three-month churn, as shown below. Comparing a short time period with an annual number provides insights around whether churn is increasing or decreasing. This feedback is critical, particularly as churn reduction initiatives are put in place.

High churn escalates costs, and has the potential to damage a brand’s reputation. It forces SaaS companies to drive much higher acquisition costs, just to maintain flat revenue or ARR. As a simple example, if a company experiences a 20% annual churn, it needs to achieve 20% new customer growth just to maintain its position. This results in 20% more acquisition costs and lost hours spent by the customer success team, just to maintain revenue.

How do I know if my churn is too high?

To effectively determine if churn is excessively high, compare it to your company’s historical performance. By taking factors such as seasonality into account, this active approach provides the most accurate indication of whether churn is moving in a favourable direction.

Benchmark comparisons can be valuable as well; however, it is crucial to actively use granular data, based on churn expectations for your specific customer profile. At ScaleXP, we continuously evaluate the market to identify the best SaaS benchmarks. To access the most recent articles, simply click here.

How can I decrease my churn?

To decrease your churn, concentrate on enhancing your customer experience and proactively tackling issues that may lead to cancellations. Naturally, that’s general advice, so if you’re seeking more specific guidance, consider the following practical steps:

Identify the key drivers of churn

Determine the primary reasons customers are cancelling or not renewing their subscriptions. Collect data through customer feedback, surveys, support tickets, and even customer interviews. If possible, create a weighted list of factors.

Segment customers

Categorise customers based on demographics, usage patterns, and other relevant factors. This approach helps pinpoint which segments face the highest churn rates.

Analyse customer behaviour

Delve into customer behaviour to comprehend how they use the product and why they cancel their subscriptions. This analysis may involve examining user activity data, support tickets, and customer feedback.

One of my favourite tools for analysing churn is Cohort Analysis, focusing on elapsed time. For instance, 20% of customers churn within the second month, which is alarmingly high. This finding suggests that the company might not be providing a comprehensive onboarding experience.

It’s worth mentioning that 15-30% of churn can be resolved in the moment of cancellation according to data by OpenView, so it is critical to create programmes to save customers during the cancellation process.

As you start to implement initiatives, monitor progress, using the metrics shown below.

What are the best metrics to monitor churn?

Our three favourite metrics to assess churn are:

- Customer Churn: % of customers who cancel

- Gross Revenue Churn: % of revenue lost due to cancellations

- Net Revenue Churn: Difference between revenue lost and revenue gained from existing customers

A full definition for each metric is included in our SaaS metric library.

By conducting a churn analysis, SaaS companies can gain insights into the underlying issues causing churn and take steps to address them, which can help improve customer retention and increase ARR.

How can ScaleXP help?

ScaleXP is the leading SaaS finance tool, able to provide a full suite of SaaS metrics, automatically calculated each month. The system connects to and imports data from both your accounting (Xero, QuickBooks, NetSuite) and CRM (Pipedrive, HubSpot, Salesforce) systems. As data is imported, a series of smart algorithms prepare a full ARR schedule, broken down by customer. Algorithms tag customers based on past buying behaviour, providing churn metrics which are always up-to-date without the need for laborious spreadsheets. To understand if ScaleXP integrates with your systems, click here. Alternatively, to learn more about how all SaaS KPIs can be automated, click here.

Enjoyed this article?

Subscribe to our newsletter for more great content straight to your inbox.