Deferred revenue refers to the money a business receives as an advance payment for services or products to be delivered in the future. Examples include annual invoices, quarterly invoices or invoices which cover a future event, such as a conference or a future deliverable or service. Deferred revenue is commonplace, particularly for SaaS or subscription businesses.

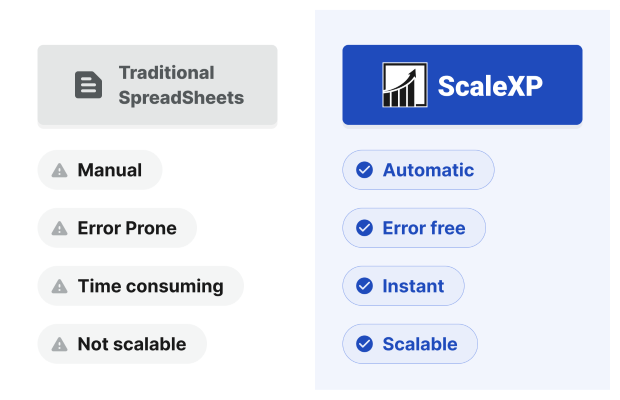

Too often, tracking deferred revenue is a tedious manual process which slows down both finance and sales teams. This article identifies the hidden cost of manually tracking deferred revenue and highlights how it can be improved, so if you’re looking to improve revenue recognition, keep reading.

How does deferred revenue slow down your business?

Manual deferred revenue tracking costs your business both explicitly through hours tracking invoices in spreadsheets and more subtly through lack of clarity.

1. Finance teams spend up to 3 days per month tracking deferred revenue accounting

Finance teams can spend days each month updating deferred revenue schedules. Each invoice needs to be exported to a spreadsheet. Revenue is then manually spread by month, and the deferred revenue journal is typed back into the accounting system.

Any invoice modification or credit note needs to be captured in the spreadsheet, creating additional complexities. As invoices accumulate over months and years, spreadsheets become harder and more time-consuming to maintain. Typos are inevitable, resulting in more time spent unwinding mistakes.

Finance teams can feel like they are chasing their tails just to get an accurate revenue reporting process. All in, the process takes 20 days per year, an entire month of lost productivity, just to create an accurate view of deferred revenue accounting.

2. Failure to comply with ASC 606 and IFRS 15

3. Missed or late invoices

ScaleXP data shows that 15% of invoices are sent more than a month late, resulting in inaccurate revenue recognition and delays in cash collection. Sales teams can close a deal and easily forget to send an invoice or notify the relevant finance team member.

4. Renewals are hard to track

Manual spreadsheets make it nearly impossible for teams to track client renewals and share the data with the relevant teams. Finance tracks revenue recognition in spreadsheets; Sales maintains different renewals schedules, resulting in inefficient processes, errors and lost revenue.

How can I save time and money calculating deferred revenue?

1. Finance teams save up to 2 days per month

ScaleXP automatically syncs with your accounting system (Xero, QuickBooks, Sage) and your CRM platform (Hubspot or Salesforce) to fully automate deferred revenue.

The system uses a sophisticated series of algorithms to identify all invoices which need to be deferred. Annual invoices, quarterly invoices, even invoices which cover a month and a day are identified by the system.

The result is a deferred revenue schedule, fully aligned to your accounting system and prepared in a single click. The system can even take care of the deferred revenue journal entry.

2. Integrate disparate systems

ScaleXP is an approved app partner for Xero, QuickBooks, Sage, HubSpot, Salesforce and more. These certifications ensure that all data remains fully synced, without any manual tracking.

Data across systems is seamlessly joined, providing a single view of data.

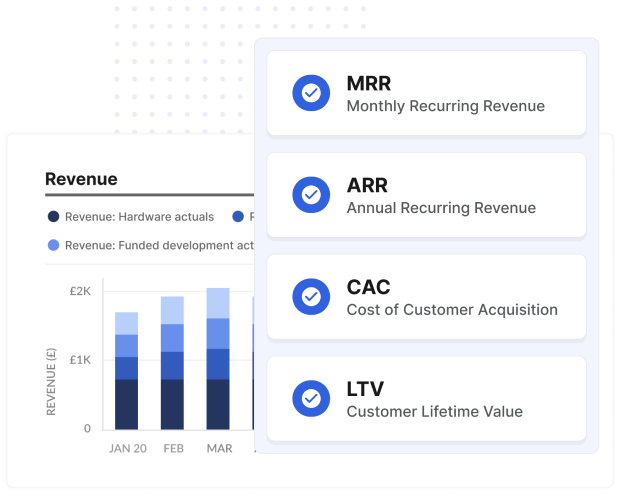

3. Automate SaaS metrics and KPIs

ScaleXP fully automates all SaaS metrics including ARR, MRR, Customer Acquisition Costs, Lifetime Value, net dollar retention, rule of 40, and so much more.

Automating MRR, precisely by customer, is the foundation for many SaaS metrics and reports.

Standard definitions can be customised to your specific business requirements, using any data field in your accounting or CRM systems.

The combination of automated SaaS revenue recognition, feeding into your MRR and ARR definitions, ensures that your KPIs and reports are always accurate.

4. Reveal customer insights

Automating deferred revenue enables ScaleXP to provide customer insights in real-time, making it easy to be proactive when opportunities arrive and increasing clarity on how to increase revenue and profitability.

5. Easily track retentions

Customer retentions are automatically flagged in ScaleXP based on the deferred revenue schedule the system creates – helping sales and finance teams work together to ensure that all renewals are in process, well before the renewal date.

6. Impress your board and investors

ScaleXP has fully integrated presentations and board packs. Graphs and KPIs can be added in a click, allowing you to prepare impressive and comprehensive packs, safe in the knowledge that your deferred revenue calculations and KPIs will always be accurate.

Learn more about ScaleXP and see how it can save you tons of hours and money. Spend less time on calculations and more time making decisions to move your business forward.

Find out how ScaleXP can automate your deferred revenue calculations