See the 2023 SaaS benchmarks relating to ARR here.

This article on 2022 SaaS benchmarks focuses on ARR and ARR multiples, answering the following questions:

- What is ARR?

- What is an ARR valuation multiple and how is it calculated?

- How does ARR affect your company’s ability to secure funding?

- What are ARR valuation trends in 2023?

- As a SaaS CFO or Founder, how can you respond?

Our objective is to give you insights on the current market trends in a concise [3] min read.

If you would like to read any of our other benchmarks you can find them all by clicking here.

What is ARR?

ARR stands for Annual Recurring Revenue. It is a metric used by SaaS businesses to measure their recurring revenue over a 12-month period. ARR is a critical component of a SaaS business’s valuation and is watched by investors to measure a company’s financial performance and potential for growth. It reflects the company’s subscription-based revenue stream and can be used to estimate future revenue and growth potential.

What is an ARR valuation multiple and how is it calculated?

ARR multiple is calculated as company value divided by ARR. For publicly traded companies, company value is Enterprise Value. For private companies, it is the latest round valuation. As an example, if a company has ARR of $10M and is valued at $100M, their ARR valuation multiple of 10.

SaaS Funding & Valuation Multiples: Understanding the Connection

Historically, ARR and ARR growth rates have been critical to securing funding from investors.

Seed Round

At the seed stage, investors are generally focused on the potential for ARR growth and market opportunity. Although there may be less emphasis on the current ARR, a higher ARR can demonstrate that the company has an established customer base and a product that resonates with users. Key factors that investors will look into at seed stage are: sales traction, team expertise, prototype or MVP quality, market opportunity, and total available (or addressable) market (TAM).

Series A Round

As a SaaS company grows and becomes more established, investors will expect to see a significant increase in ARR every year, or high ARR growth rates. This is a key indicator that a company is ready to scale. In this phase, the key valuation metrics include: annual recurring revenue, ARR growth rate, net retention revenue, customer acquisition cost (CAC), and customer lifetime value (LTV).

Series B and Later Rounds

By the time a company reaches a Series B or later round, investors will be looking for a proven track record of sustained ARR growth and has a path to profitability. The key valuation metrics include: ARR, ARR growth rate, net retention revenue, gross margin, CAC payback period, and market sentiment or valuation multiples.

What are ARR valuation trends in 2023?

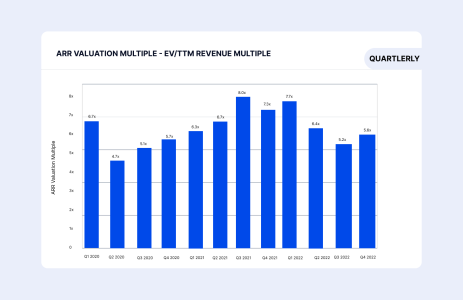

ARR valuation multiples currently stand at 5.5x. This means that an average SaaS company generating $10M revenue can expect a valuation of $55M. This is the lowest valuation seen in the last three years.

The graph below tells the story the clearest. In Q1 2020, as covid overtook the world, SaaS ARR multiples were around 5.6. The climbed steadily throughout the pandemic as investors invested heavily into technology companies and away from retail, consumer products and other sectors. In 2022, as lockdowns were lifted, money flowed back out of technology. However, valuations didn’t stop at pre-covid levels. Inflation, the collapse of crypto, fears of recession, and insecurity about banking contagion continues to weigh on ARR multiples, bringing them below Q1 2020.

Source: SEG 2023 SaaS survey

As a SaaS CFO or Founder, how can you respond?

While the chart above paints a bleak picture in the short term, it is important to remember that the market will recover. In the meantime, our top advice is:

- Reduce your cash burn rate so that you can fundraise in better times. Even a delay of six months will create additional options.

- Shift your focus from “Grow at any cost” to “Smart growth”. One simple way to do this is to monitor CAC Payback and focus on reducing it.

- Watch metrics such as Rule of 40, as it is a key driver of valuations in the current market.

As you work to make your cash work harder, the ScaleXP platform can help. The system sits on top of your existing accounting and sales data and uses a series of smart algorithms to automate all SaaS KPIs, from MRR, to cash burn, to Rule of 40 to CAC Payback.

ScaleXP provides SaaS companies with a market-leading, fully automated view of all their key metrics, including those most vital to investors in 2023. By connecting with both your accounting data and your CRM platform, our solution empowers you to track benchmarks and measure performance with unparalleled ease.

If you’re ready to take your metrics tracking and benchmarking to new heights, click here to get started with ScaleXP. Enhance your company’s data-driven decision-making and stay at the forefront of the curve with ScaleXP

Subscribe to our newsletter

If you found this article or any other article on our website helpful, you can join our monthly newsletter where we will be sharing all of our new reports exclusively with you.