2023 Benchmarks: ARR Valuation

This article focuses on 2023 SaaS benchmarks relating to revenue and specifically ARR, answering the following questions:

What is ARR?

How are ARR and MRR used in company valuations?

What is an ARR valuation multiple and how is it calculated?

How does ARR impact your ability to secure financing?

What are ARR valuation trends in 2023?

As a Saas CFO or Founder, how can you respond?

What is ARR?

ARR stands for “Annual Recurring Revenue”. It represents the amount of recurring revenue a company expects to receive on an annual basis from its subscription-based products or services. ARR is a key metric for businesses that operate on subscription models such as Software as a Service (Saas) companies. It is often used by investors and analysts to assess the value of a company.

ARR (Annual Recurring Revenue) is calculated by multiplying the Monthly Recurring Revenue (MRR) by 12.

What is MRR?

MRR, or Monthly Recurring Revenue, represents the predictable and recurring revenue generated from subscriptions on a monthly basis. MRR includes all regular, ongoing subscription payments made by customers, excluding any one-time or non-recurring charges.

Current ARR is often estimated by taking the most recent one month of revenue for all subscription customers and multiplying by twelve. So for example, if a company has a total of £10,000 per month in recurring revenue from current customers, then that company’s ARR is 12x £10,000 = £120,000.

How are ARR and MRR used in company valuations?

Many investors and analysts look at ARR valuation multiples, also known as sales multiples or revenue multiples, as a key factor in determining company valuation.

What is an ARR valuation multiple and how is it calculated?

ARR multiples are the company’s value divided by ARR. For example, if a company is valued at $100m and has ARR of $10m, then its ARR valuation multiple is 10. For public companies, company value is updated regularly by trading in the public markets: it is the company’s Enterprise Value, that is, the value of all publicly traded shares plus other investments such as debt financing. For private companies, values are based on the latest round valuation.

How does ARR impact your ability to secure financing?

Historically, ARR and ARR growth rates have been critical to securing funding from investors for SaaS and other subscription businesses.

Seed Round: At the seed stage, investors are generally focused on the potential for ARR growth and market opportunity. Although there may be less emphasis on the current ARR, a higher ARR can demonstrate that the company has an established customer base and a product that resonates with users. Key factors that investors will look into at seed stage are: sales traction, team expertise, prototype or MVP quality, market opportunity, and total available (or addressable) market (TAM).

Series A Round: As a SaaS company grows and becomes more established, investors will expect to see a significant increase in ARR every year, or high ARR growth rates. This is a key indicator that a company is ready to scale. In this phase, the key valuation metrics include: annual recurring revenue (ARR), ARR growth rate, net retention revenue, customer acquisition cost (CAC), and customer lifetime value (LTV).

Series B and Later Rounds: By the time a company reaches a Series B or later round, investors will be looking for a proven track record of sustained ARR growth and a clear path to profitability. Key valuation metrics include: ARR, ARR growth rate, net retention revenue, gross margin, CAC payback period, and market sentiment or valuation multiples.

What are ARR valuation trends in 2023?

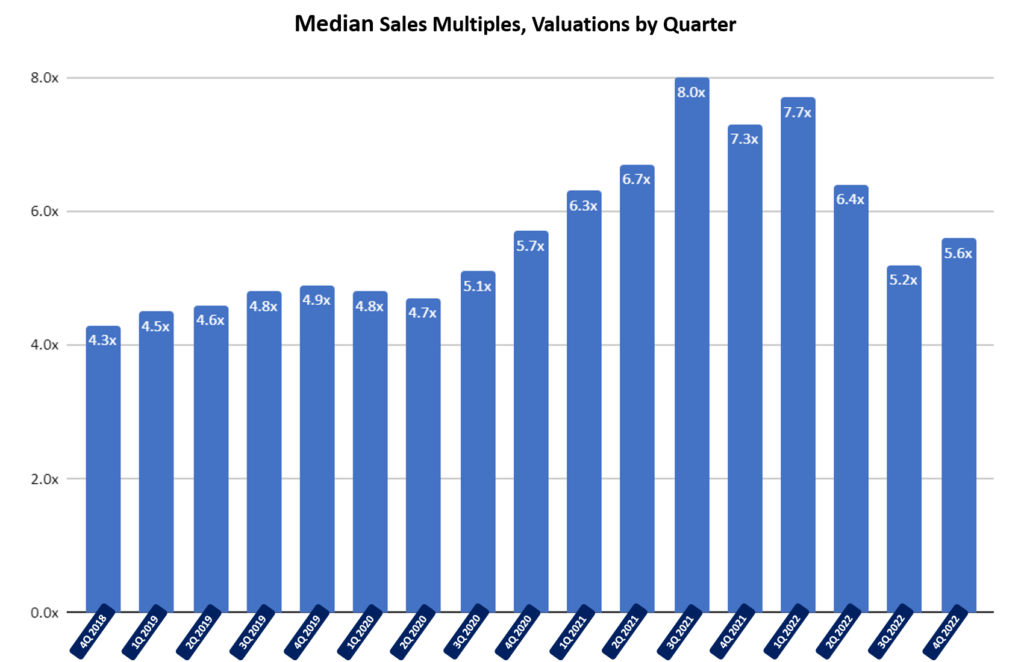

Heading into 2023 found revenue multiples for SaaS companies averaging at 5.6x sales, based on actual transactions from mergers and acquisitions. This means that an average SaaS company generating $10 million in revenue was worth around $56 million.

Valuations were at their lowest at the start of the pandemic in early 2020 and peaked during the pandemic, reflecting the spectacular growth of remote working and SaaS opportunities in that period. With new challenges of high inflation and borrowing costs, valuations softened again in 2022 but appear to be stabilising again at levels higher than before the pandemic.

Public company sales multiples have been more volatile over the past few years but also peaked during the pandemic, peaking in 2021 at around 14.7x (above private multiples) and falling to around 5.4x by the end of 2022 (below private multiples). (Source: SEG Research – 2023 Annual SaaS Report). Valuations stabilised in 2023, with Q2 2023 averaging 6.6x in 2023, down just slightly from 6.8x in Q2 2022. (Source: OpenView 2023 SaaS Benchmarks Report).

Source: : OpenView 2023 SaaS Benchmarks Report

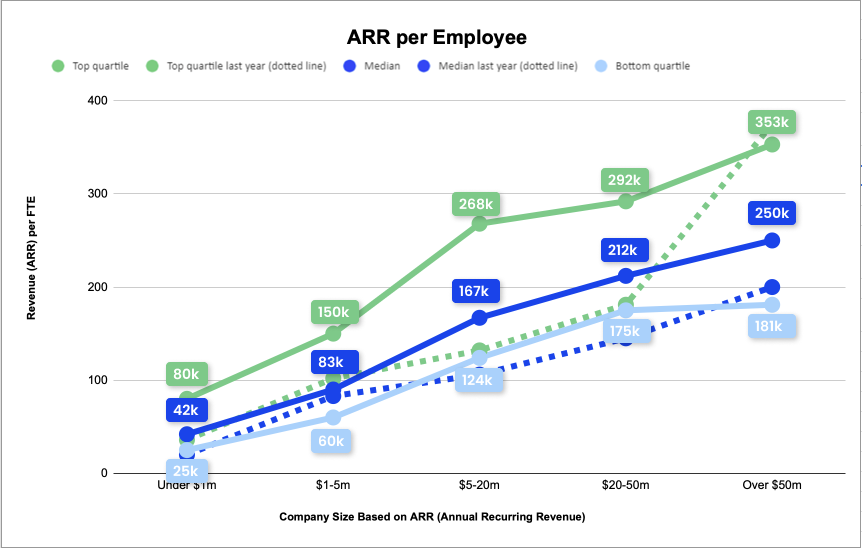

Another interesting valuation trend is the increasing importance of ARR per FTE. While investors recognise that this will be quite low in early stage companies, they are looking for a scalable model in which ARR per FTE is at least $200k – $250k by the time a company has reached scale. The below chart illustrates how successful SaaS companies have been able to growth their ARR per FTE with scale. (Source: OpenView 2023 SaaS Benchmarks Report)

As a SaaS CFO or Founder, how can you respond?

Our top advice is:

Understand and monitor your cash burn rate so that you can fundraise confidently and at the appropriate time.

Focus on efficiency and profitability, not just sales.

Shift your focus from “Grow at any cost” to “Smart growth”. One simple way to do this is to monitor CAC Payback and focus on reducing it. Read more on CAC benchmarks here.

Watch metrics such as Rule of 40, as it is a key driver of valuations in the current market.

As you work to make your cash work harder, the ScaleXP platform can help. The system sits on top of your existing accounting and sales data and uses a series of smart algorithms to automate all SaaS KPIs, from MRR, to cash burn, to Rule of 40 to CAC Payback. Click here to learn more.