See how insightful financial reporting can drive your mission forward

ScaleXP automates revenue recognition, grant deferrals, and fund reporting, giving charity finance teams real-time visibility across every project and funding stream.

Close faster, report with confidence, and walk into every leadership, trustee, and funder meeting fully prepared, with numbers everyone trusts.

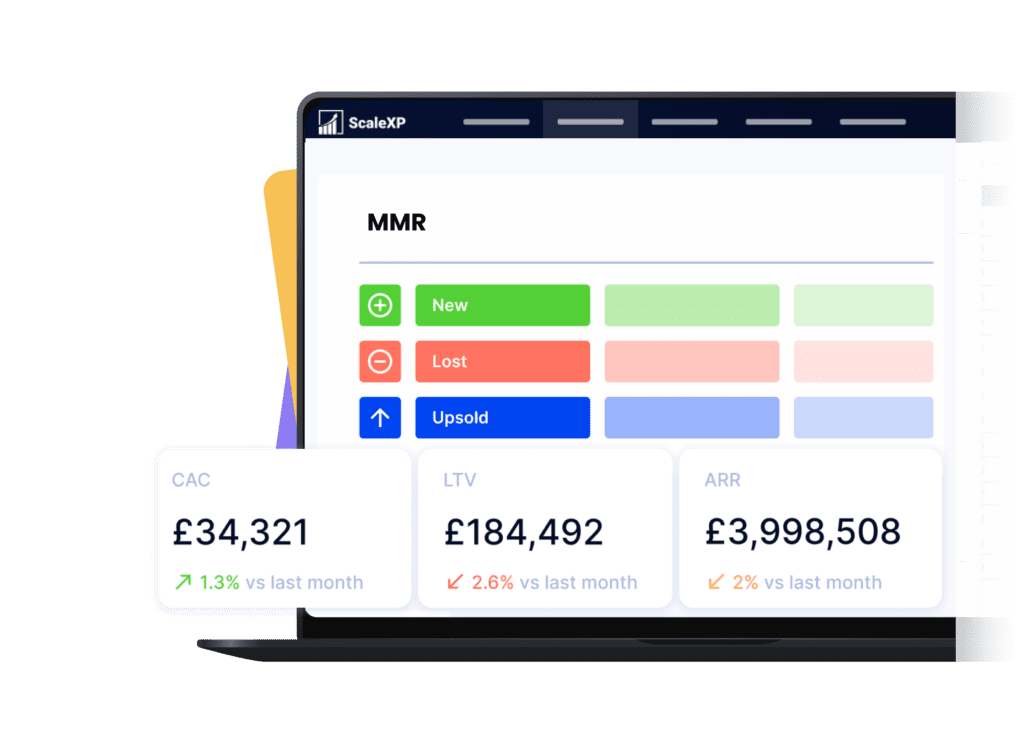

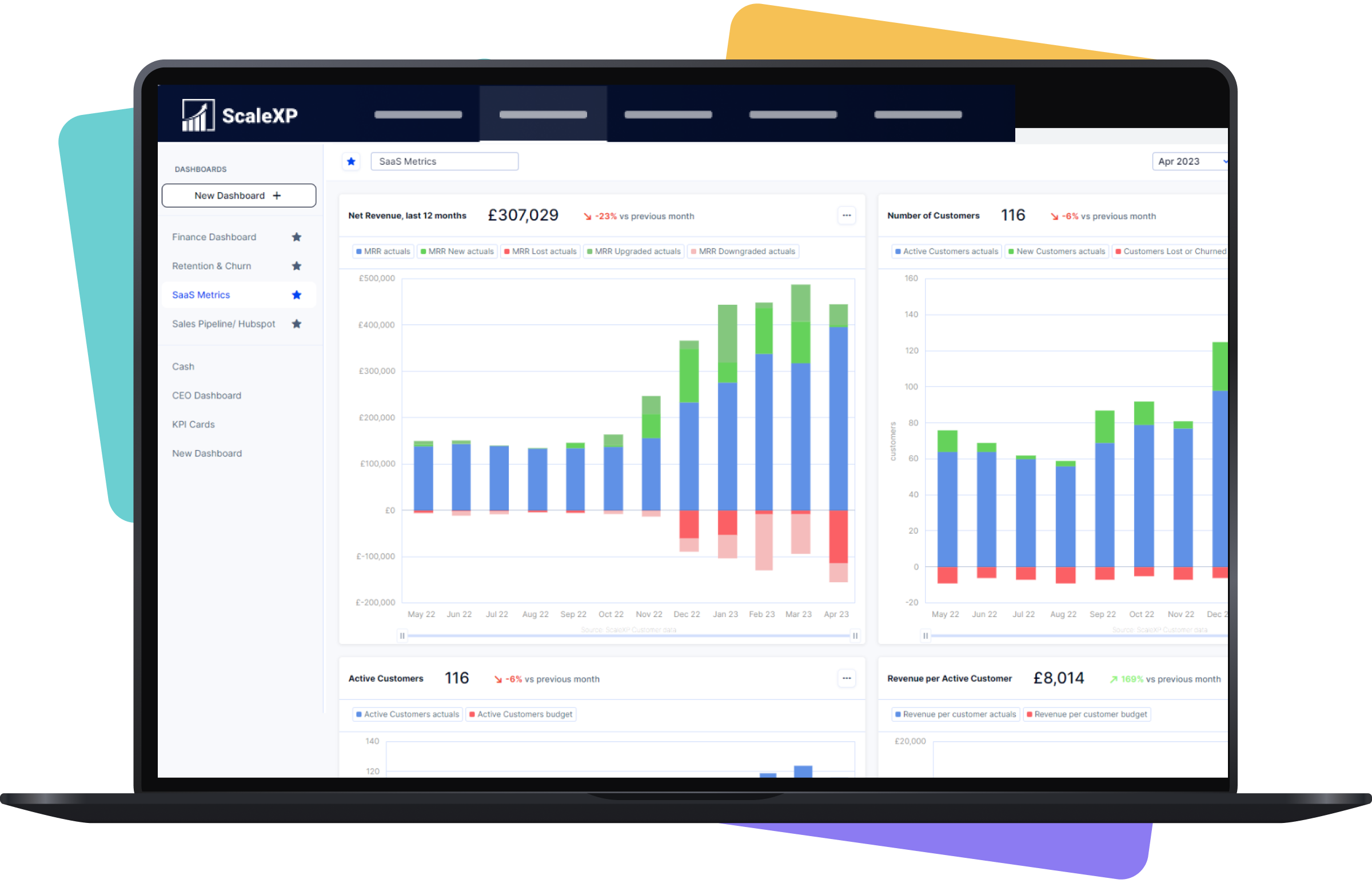

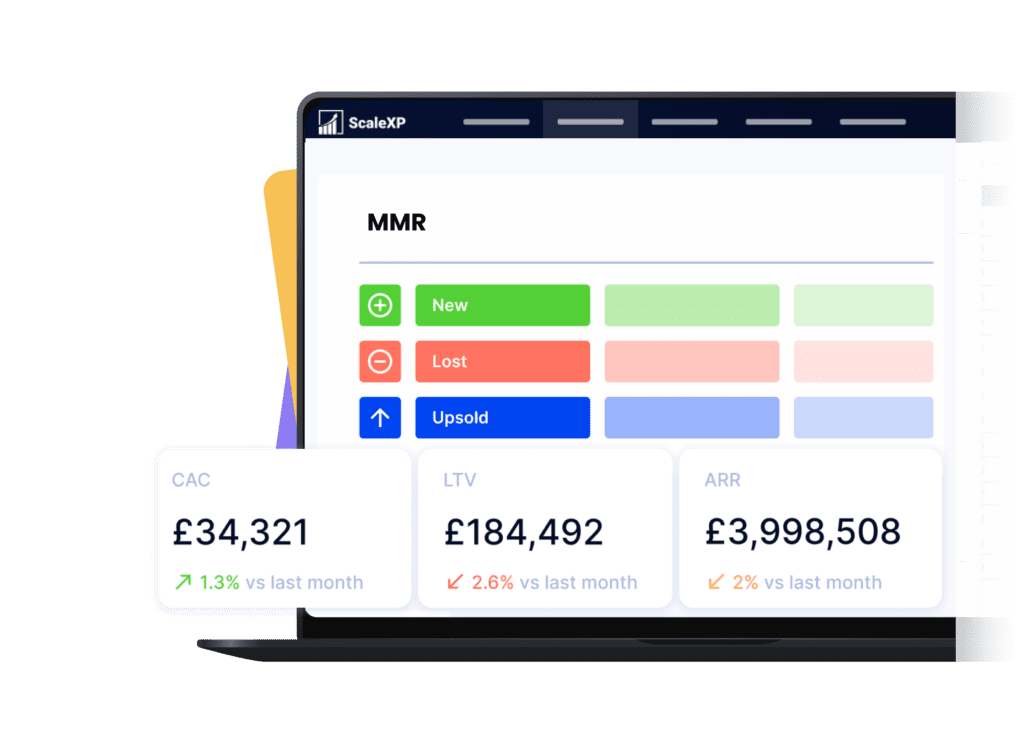

Real-time clarity for every fund and project

Charity finance teams balance multiple grants, donations, and restricted funds, all with their own reporting rules and timelines.

ScaleXP brings everything together automatically, replacing manual schedules with clear, live data.

When your CEO or board asks for funding status or project burn rates, you’ll have the answers instantly.

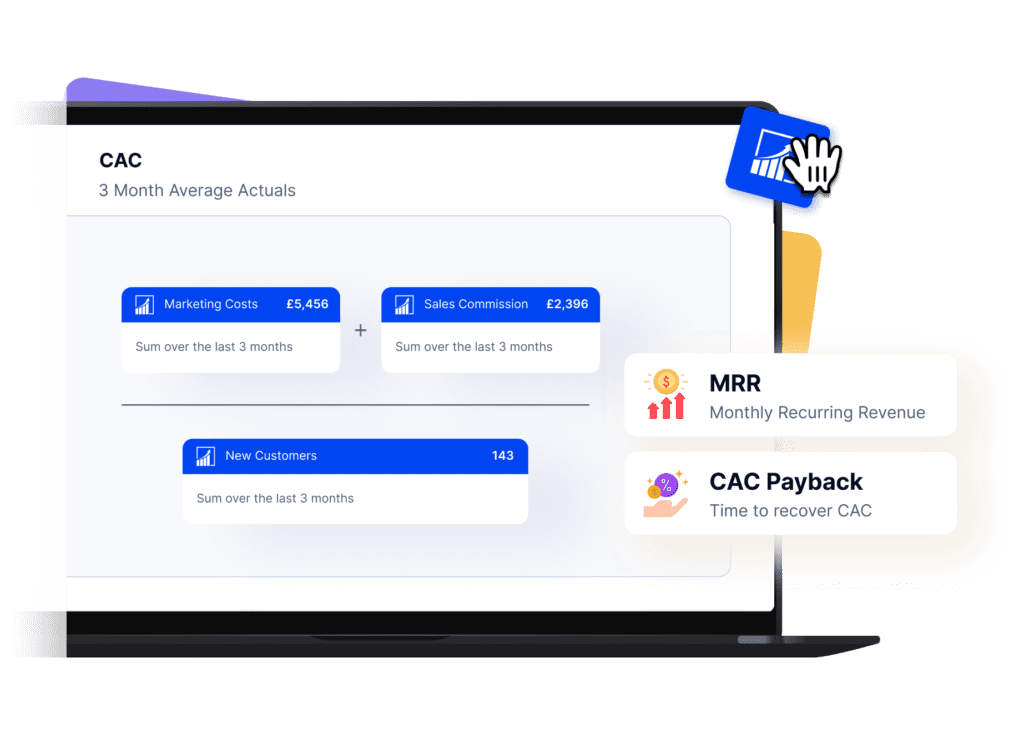

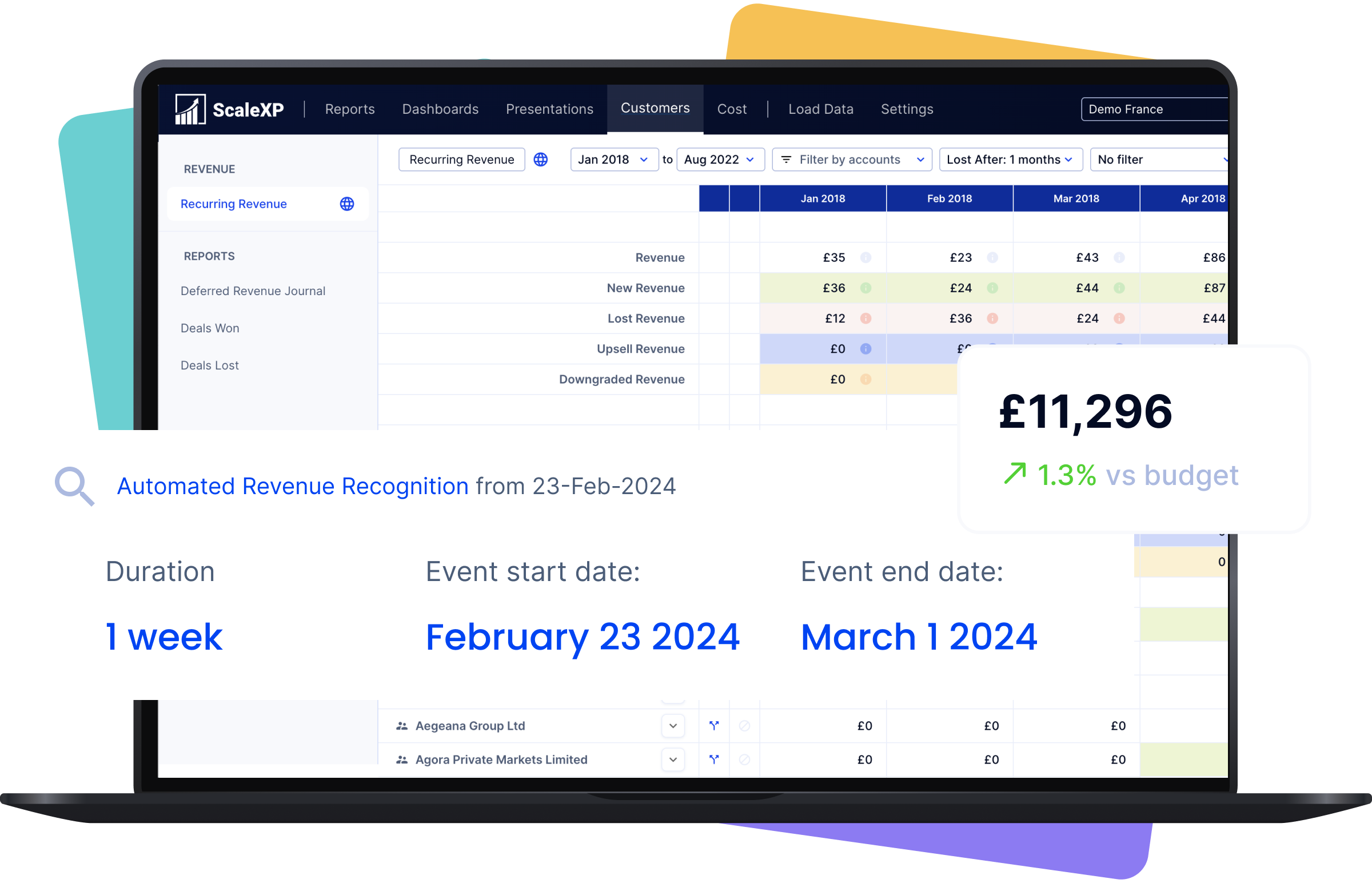

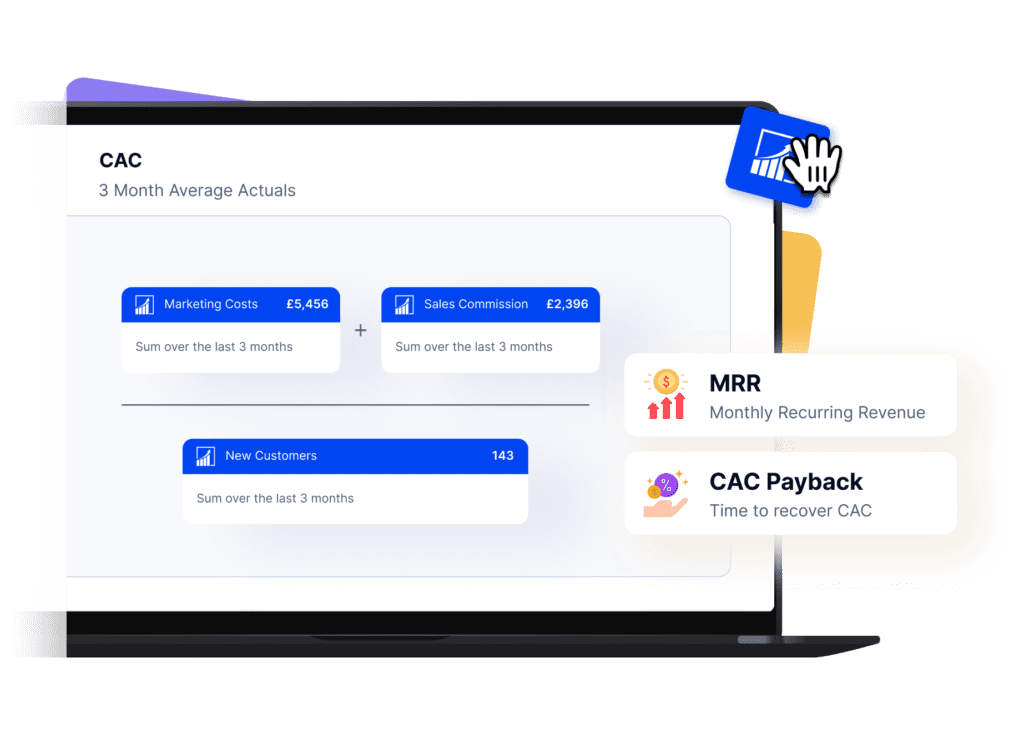

Automate fund deferrals and grant income — no manual schedules

Deferrals, prepayments, and adjustments are handled automatically.

ScaleXP recognises income for grants, donations, and recurring funding directly from Xero or QuickBooks, keeping your accounts clean, compliant, and audit-ready.

Your month-end closes faster, with zero spreadsheet effort.

Be audit-ready, every month

Audits shouldn’t mean extra work.

ScaleXP automatically produces audit-ready journals and reports, ensuring every transaction is traceable and aligned with your accounting policies.

Your audit committee, CFO, trustees, and funders will see clean, consistent, transparent data — every time.

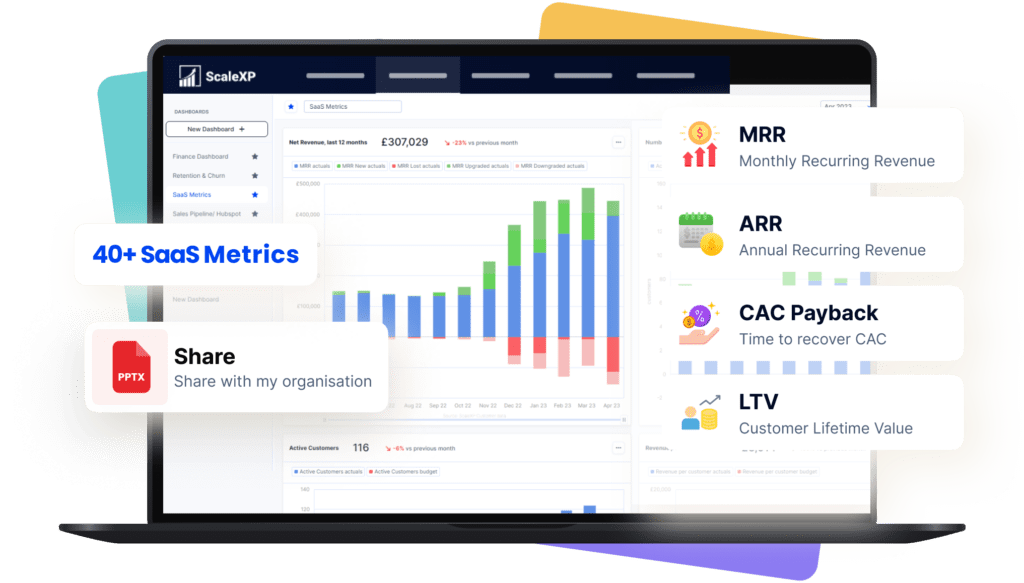

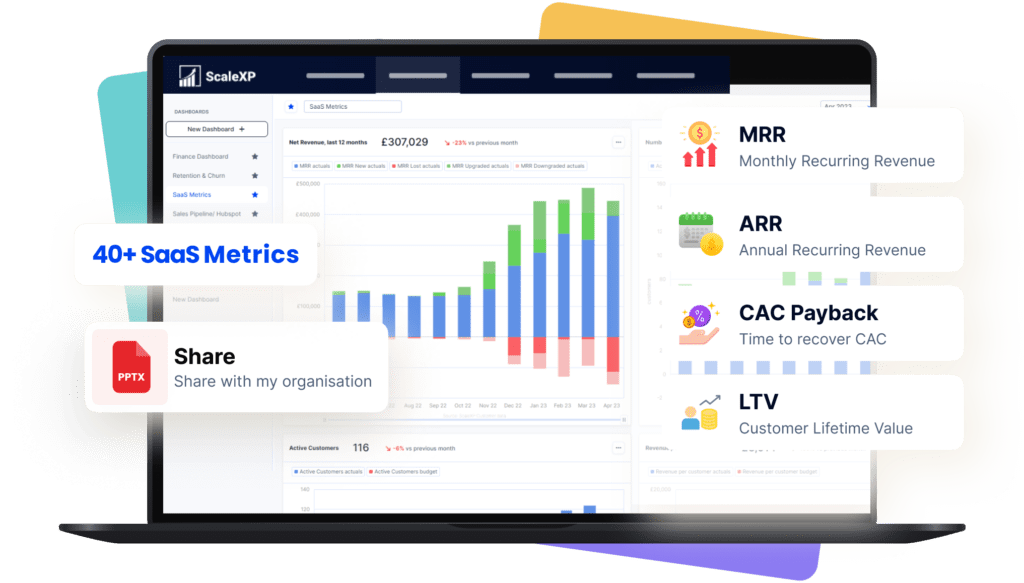

Impress and engage your CEO, trustees, and funders

When leadership asks:

- “How much restricted funding remains unspent?”

- “Which programs are under- or overspending?”

- “Are grant conditions being met in real time?”

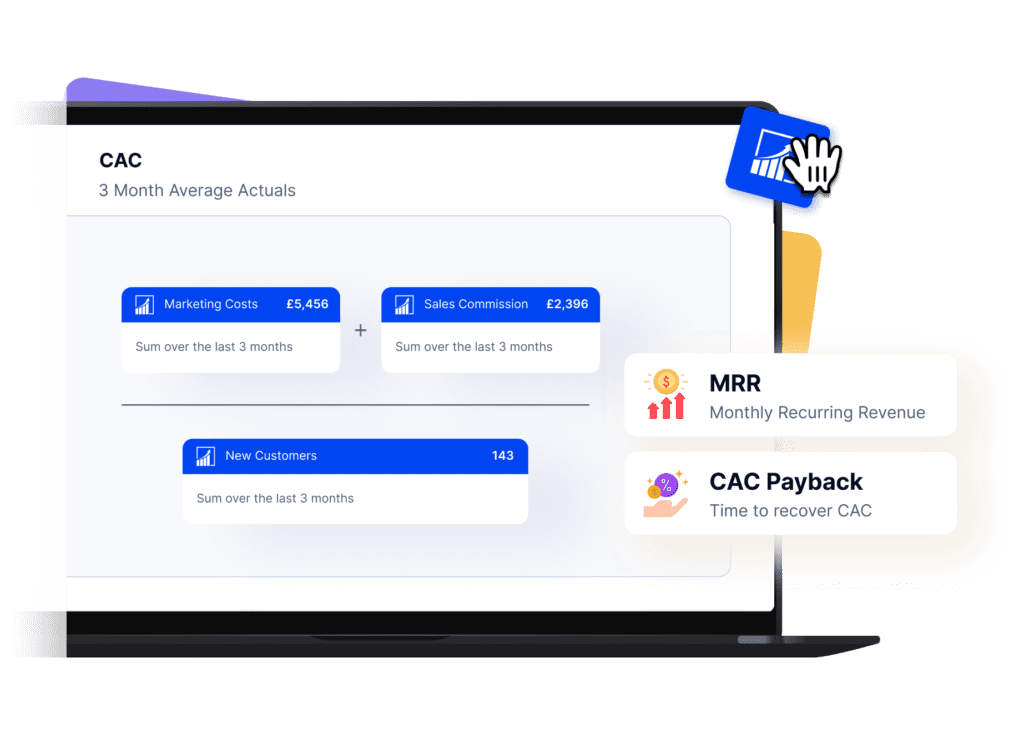

You’ll have the answers immediately, in clean visual dashboards.

Trusted by MSP finance teams worldwide

Join GivePanel & hundreds of other companies benefitting from smart finance automation

Hear directly from the CEO of GivePanel about how ScaleXP transformed their finance function — giving leadership real-time clarity and saving days every month.

GivePanel CEO and Founder Nick explains why he loves ScaleXP

Connect your systems and save days each month

ScaleXP integrates with Xero and QuickBooks, syncing income, expenses, and balances in real time.

No more re-keying data or reconciling multiple systems.

Finance, fundraising, and delivery teams all see the same numbers instantly.

Built for modern charity finance teams

ScaleXP was designed for organisations that:

- Manage multiple grants or restricted funds

- Use Xero or QuickBooks for accounting

- Need accurate, automated deferrals and clean fund reporting

From small teams to large foundations, ScaleXP empowers finance to become the analytical backbone of leadership — supporting strategic decisions with real-time insight.

We're committed to the security and privacy of your data

Charities FAQs

ScaleXP extracts fund and grant information from invoices and bills — using tags, project references, cost codes, or invoice metadata — and tracks the balances for each fund automatically. Unlike other systems, ScaleXP does this without requiring changes to your chart of accounts.

No. ScaleXP does not alter, expand, or interfere with your chart of accounts. Fund accounting is applied as a separate analytical layer on top of your existing general ledger — keeping your accounting structure clean and consistent.

No. You don’t need to create separate GL accounts for every fund. ScaleXP maps transactions to funds using data extracted from invoices and bills, not from the COA — preventing chart of accounts bloat.

Every transaction is linked to the correct fund based on source-document data. ScaleXP maintains real-time restricted and unrestricted fund balances, giving you confidence in every number presented to auditors, CEOs, trustees, and funders.

ScaleXP provides real-time visibility into grant balances, spending, burn rate, and remaining usable funds. You can report against fund, program, donor, or grant conditions — instantly and without spreadsheet reconstruction.

Yes. Every journal is traceable back to the originating transaction, with supporting calculations and allocation logic visible. Auditors can follow a transparent chain of evidence from invoice → fund → recognition.

Yes — ScaleXP sits on top of your existing accounting system. It does not require re-architecting your COA, changing posting structures, or redefining revenue accounts. You retain full ownership and control of your financial setup.

Yes. ScaleXP connects to Xero and QuickBooks, posting clean, auditable journals into your accounting system while preserving your ledger integrity.

Yes — ScaleXP is built with enterprise-grade security protocols. We are SOC 2 Type II certified, meaning our security controls are independently audited and verified over an extended period, not just in a point-in-time assessment. This is one of the highest security standards in the industry.

Most nonprofit teams are fully live within hours — not weeks. Our onboarding specialists help configure fund tagging, data capture, and fund visibility with minimal disruption.