Deferred Revenue

Automate deferred

revenue recognition

Eliminate the need to track deferred revenue in long and tedious spreadsheets. Ensure your calculations are always accurate, up to date and easy to audit.

- Close the month up to 3 days faster.

- Eliminate spreadsheet errors.

- Ensure data is always up to date and fully auditable.

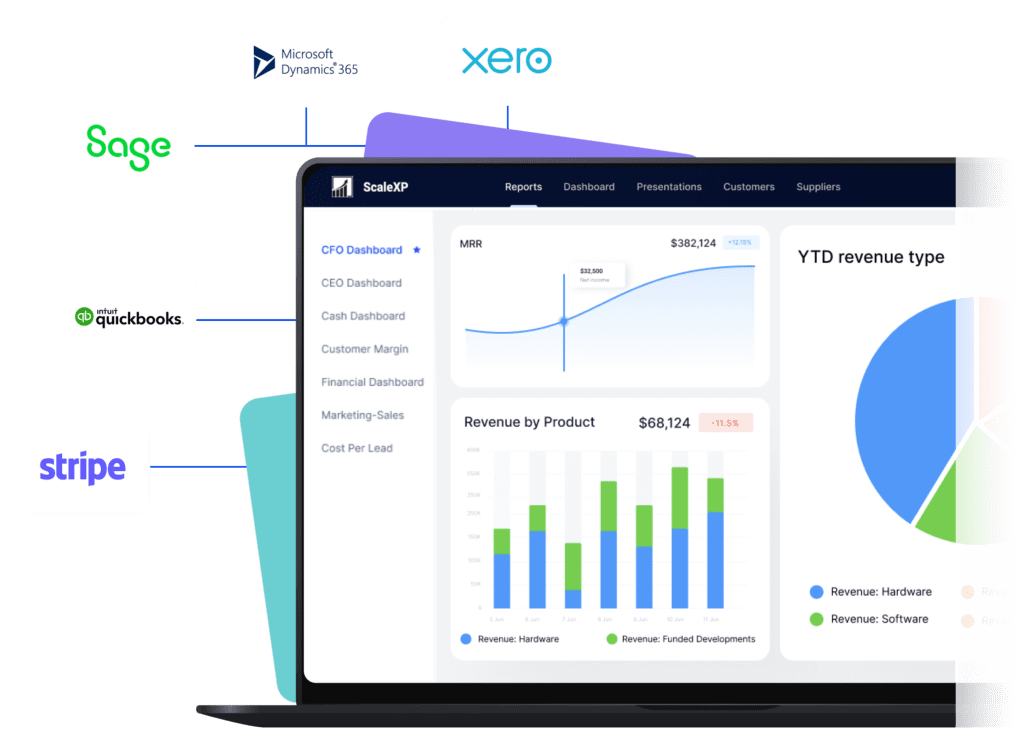

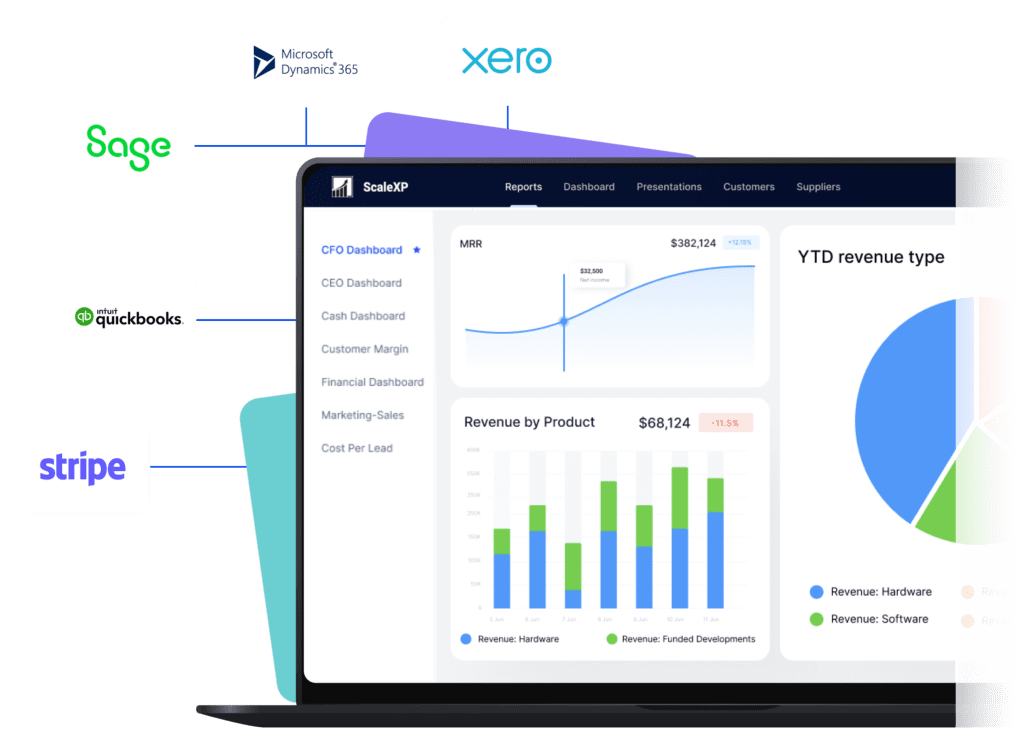

ScaleXP fully integrates with all leading accounting systems & more. See all accounting integrations.

Save 3 days per month with ScaleXP automation software

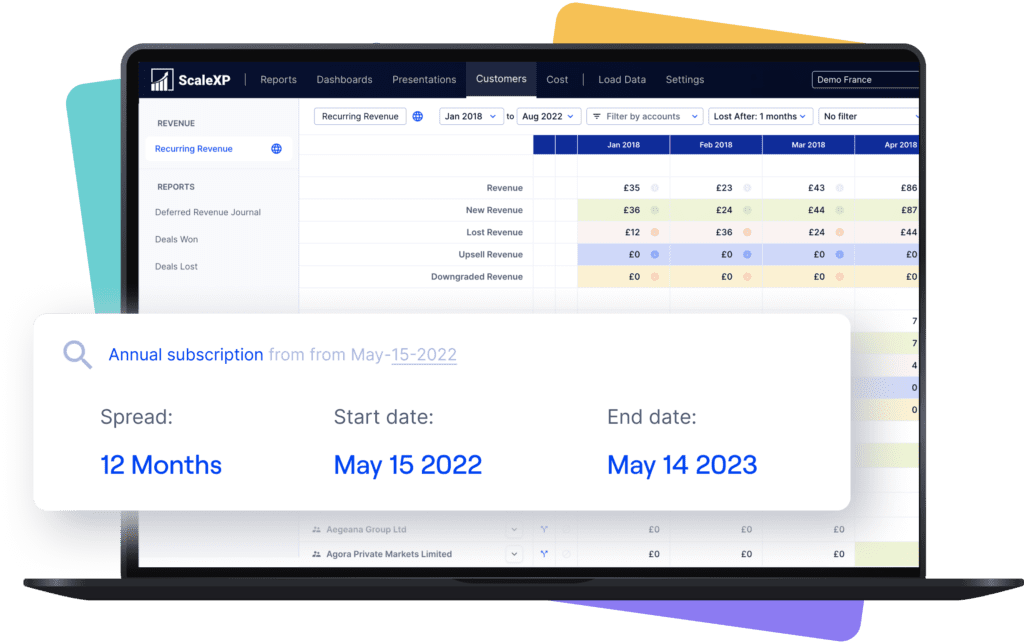

ScaleXP is a smart finance automation which uses leading technology to fully automate deferred revenue.

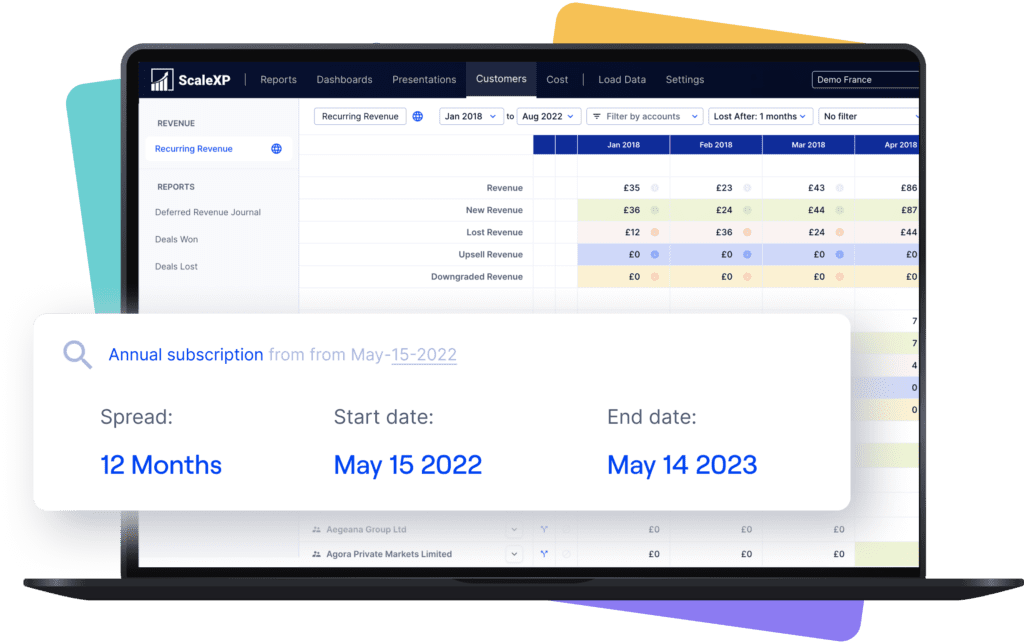

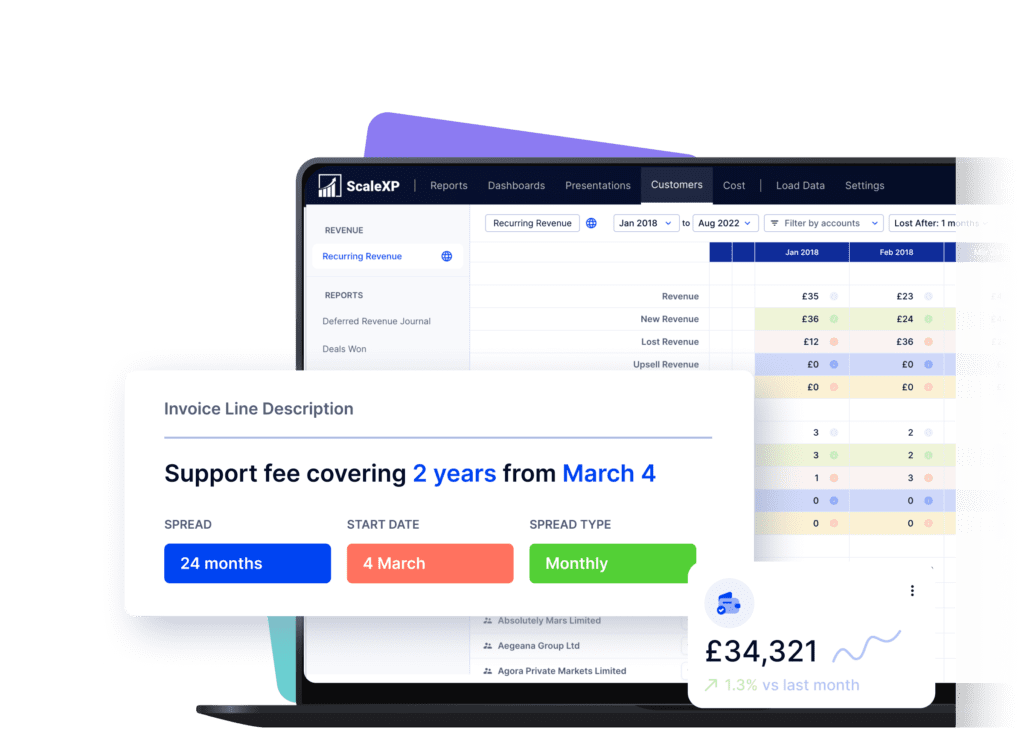

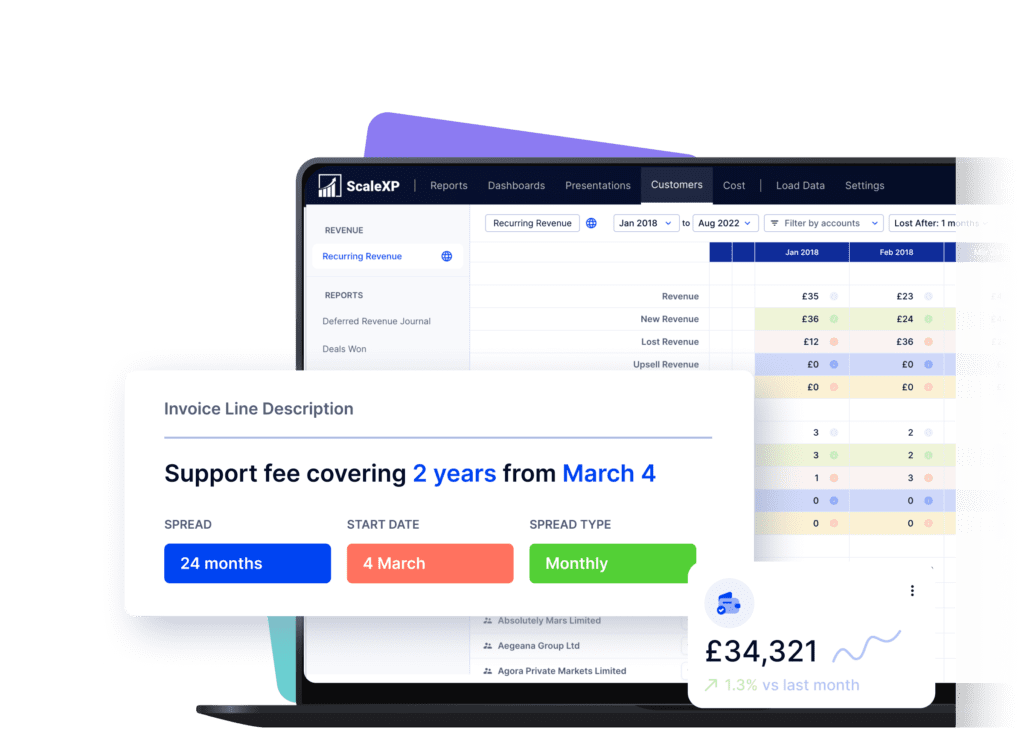

- A sophisticated series of natural language algorithms read and process all data and text on your invoices.

- Revenue recognition schedules are prepared, ready for your review.

- Schedules are real-time, ensuring you have an accurate view of revenue during the month and shortening the month-end process by up to 3 days.

Save time. Improve accuracy.

ScaleXP recognises the amounts, dates, and frequencies of each invoice, preparing automated IFRS15 and ASC606-compliant revenue recognition schedules.

- Spreadsheet errors are eliminated.

- Data is available in real time.

- Detailed schedules are fully auditable, broken down by customer, invoice, and general ledger code.

Onboard & get set up in one hour

Connect your accounting system. Sync. Review the data with our product specialist to ensure maximum accuracy.

- Don’t spend days and weeks getting set up in a new system.

- ScaleXP will prepare your revenue recognition schedule in one hour.

- All you need to do is review, edit, and confirm the automatically prepared IFRS & ASC606-compliant revenue recognition schedules.

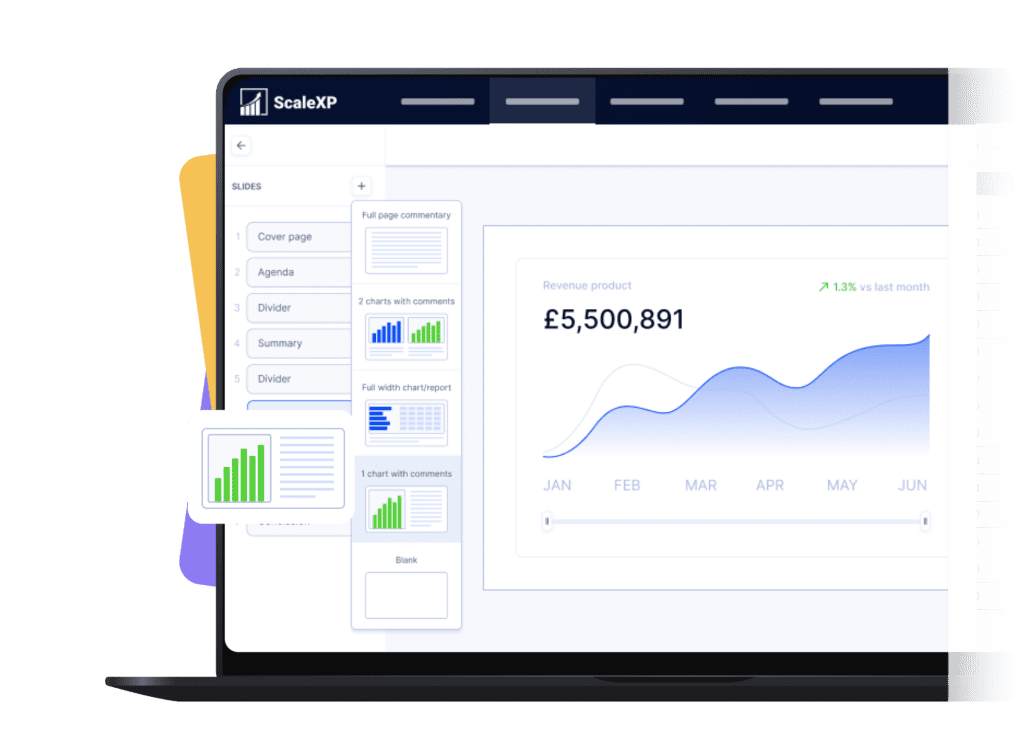

With the ScaleXP platform you can

Be prepared

for the future

Calculating deferred revenue in spreadsheets is not scalable. Employee turnover, or even holidays, can create issues. ScaleXP creates a sustainable platform for growth.

Avoid typos or missed credit notes

ScaleXP moves in lock step with your accounting system. Invoice modifications, credit notes and late changes are all imported.

Create confidence

in your data

Sharing spreadsheets can be complex. With ScaleXP, revenue schedules can be shared in a few simple clicks, creating transparency and building confidence in the data.

What our customers say

We are using ScaleXP to untangle a number of complexities in our business model. ScaleXP is giving us the agility we need to make business decisions in a more informed way and at a faster pace than we've even been able to before. The client support team has been exceptional in digging into our needs and ensuring the platform is delivering!

We are using ScaleXP to untangle a number of complexities in our business model. ScaleXP is giving us the agility we need to make business decisions in a more informed way and at a faster pace than we've even been able to before. The client support team has been exceptional in digging into our needs and ensuring the platform is delivering!

Xero App Store Review

Xero App Store Review  Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Xero App Store Review

Xero App Store Review  Excellent system, the team are extremely knowledgeable and help set everything up. Super easy to use.

Excellent system, the team are extremely knowledgeable and help set everything up. Super easy to use.

Xero App Store Review

Xero App Store Review  We are using ScaleXP to untangle a number of complexities in our business model. ScaleXP is giving us the agility we need to make business decisions in a more informed way and at a faster pace than we've even been able to before. The client support team has been exceptional in digging into our needs and ensuring the platform is delivering!.

We are using ScaleXP to untangle a number of complexities in our business model. ScaleXP is giving us the agility we need to make business decisions in a more informed way and at a faster pace than we've even been able to before. The client support team has been exceptional in digging into our needs and ensuring the platform is delivering!.

Xero App Store Review

Xero App Store Review  Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Thanks to ScaleXP we're now producing more insights, faster and with greater accuracy.

The system is intuitive, user friendly and constantly improving. The team made us

successful with the product from the outset.

Xero App Store Review

Xero App Store Review  Excellent system, the team are extremely knowledgeable and help set everything up. Super easy to use.

Excellent system, the team are extremely knowledgeable and help set everything up. Super easy to use.

Xero App Store Review

Xero App Store Review Who uses ScaleXP to automate deferred revenue?

Get real time access to your data, without waiting for spreadsheets to be updated. Review and share your data, creating impact across the company.

Close the month faster. Improve accuracy and create a strong platform for growth with robust and sustainable processes.

Eliminate inevitable spreadsheet errors. Build confidence in your numbers with schedules that are easy for others to review and understand.

ScaleXP deferred revenue automation FAQs

ScaleXP smoothly integrates with renowned accounting platforms like Xero, QuickBooks, Sage and several major accounting systems. See the full integrations list ->

Yes, ScaleXP works with all major currencies, over 90 in total. If you want to check if the system is integrated with any specific currency, just send us an email (support@scalexp.com).

ScaleXP has deep links into the accounting data, allowing us to detect changes to invoices. All modifications and credit notes are imported and processed by the system.

It’s time-consuming and costly to manually calculate and allocate revenue over annual, or even quarterly contracts. Research suggests Small and Medium Businesses (SMBs) could save thousands per year by using automated tools. Read more ->

Deferred revenue recognition is crucial as it aligns with accounting standards, ensuring accurate financial reporting. It matches revenue with the service period, enhancing transparency for investors and providing management with clear operational insights.