Share this article:

Introduction

The purpose of this article is to explain the link between Annual Recurring Revenue, ARR, and valuation. It provides a quick overview of how to calculate ARR, explains the direct link to valuation and provides some practical tips to increase ARR.

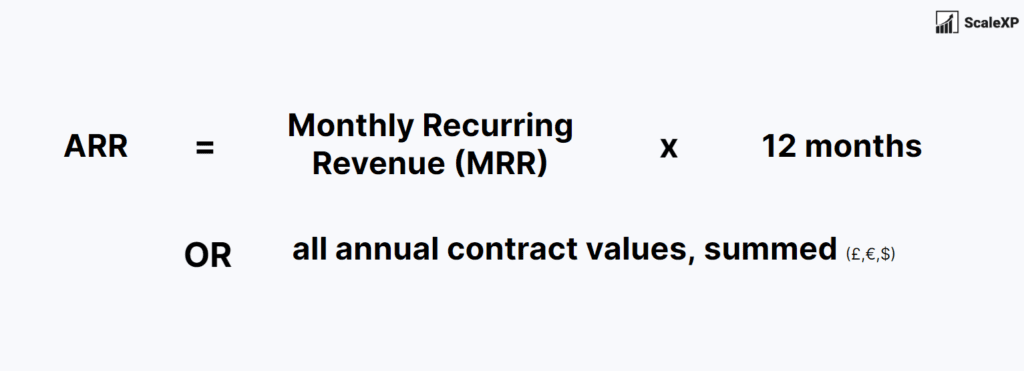

What is ARR?

ARR stands for Annual Recurring Revenue. It is the amount of revenue that a SaaS (Software as a Service) company can expect to receive from its customers each year. ARR is calculated by multiplying the monthly recurring revenue (MRR) by 12 or by assessing the annual value of all recurring contracts.

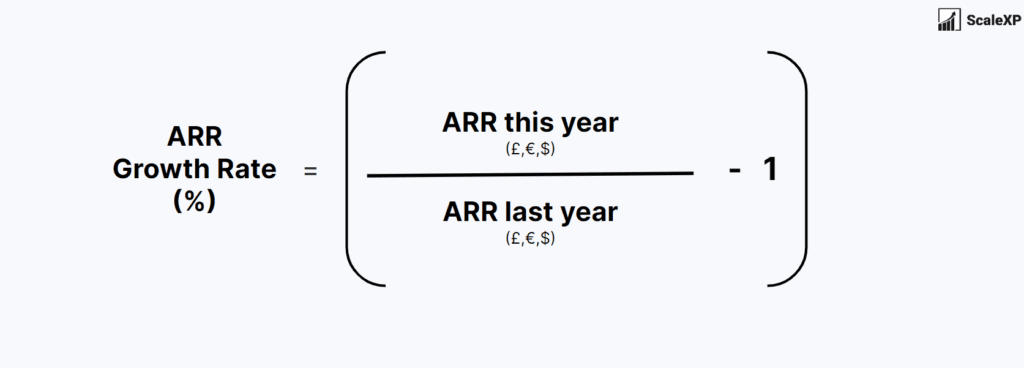

What is ARR Growth Rate?

ARR growth rate is the rate at which a SaaS company’s Annual Recurring Revenue is increasing year over year. It is calculated by assessing the change in revenue over a 12-month period. Here is the formula for calculating ARR growth rate below:

How is ARR linked to valuation?

Historically, investors have considered ARR Growth Rate as the single most important metric for determining the value and growth potential of SaaS companies.

Investors value SaaS companies based on their growth potential. Higher growth rates command higher valuations. Lower growth rates lead to lower valuations. This is because they can suggest that the company could be reaching a growth plateau.

How does the relationship between ARR and valuation change as SaaS companies grow?

As SaaS companies grow, the link between ARR and valuation can change. Early-stage companies may have high growth rates but lower ARR. Valuing such companies may depend on their potential for future growth. As companies mature and establish a more predictable revenue stream, ARR becomes a more important metric for valuation. It provides a clearer picture of the company’s stability and growth potential.

Benchmarking data provides the best view of the relationship between ARR and valuation. See our article on ARR Valuation Benchmarking here. The best benchmarks to consider:

- A company’s stage of growth, with specific metrics for smaller SaaS companies

- Customer profile: ARR growth rates can vary by ideal customer profile

- Public SaaS valuations

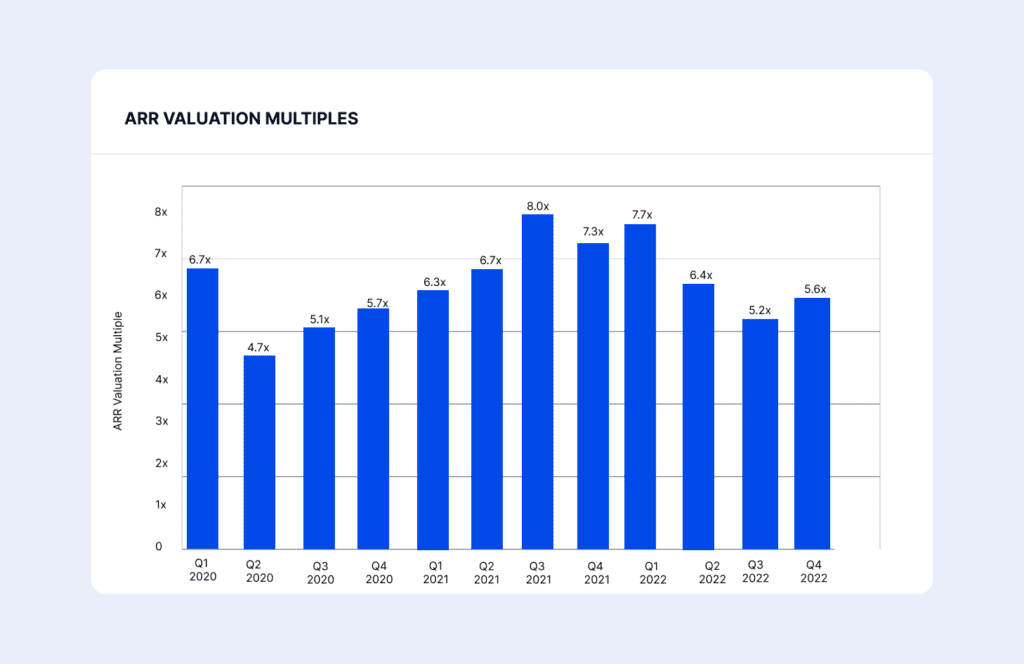

These factors are used to establish a multiple linking ARR and valuation. In Q4 2022, for example, publicly traded SaaS companies are trading around 5.6x ARR. This means that the company valuation is ARR multiplied by 5.6.

Source: SEG SaaS valuations, Q4 2022

This graph shows the ARR multiples over the last three years. Current multiples are at the lowest level since the onslaught of COVID-19 in Q1 2020.

What practical steps can you take to increase ARR?

There are several practical steps that SaaS companies can take to increase their ARR. Some of these steps include:

- Focusing on customer retention: Retaining existing customers is generally more cost-effective than acquiring new ones. Therefore, SaaS companies should focus on

- improving customer retention rates to increase ARR: Offering value-added services or add-on products: Offering additional services or features can help to increase the value of a SaaS product. This can make it more attractive to customers, which can ultimately lead to higher ARR.

- Increasing prices: If a SaaS company is providing value to its customers, it may be able to increase prices without losing customers, which can help to increase ARR.

- Expanding into new markets: this can help increase the customer base and revenue streams, which can lead to a higher outcome.

- Improving sales and marketing strategies: Improving sales and marketing strategies can help to attract new customers and increase revenue streams, which can lead to higher.

Ultimately, increasing ARR requires creating higher revenue through secure long term contracts.

Conclusion

ScaleXP is the leading SaaS finance tool, able to provide a full suite of SaaS metrics, automatically calculated each month. The system connects to and imports data from both your accounting (Xero or NetSuite) and CRM (HubSpot or Salesforce) systems. As data is imported, a series of smart algorithms prepare a revenue recognition schedules and a full ARR schedule, broken down by customer.

Keep on the pulse

Sign-up for our newsletter to receive new benchmarks, metrics and reports for the modern day CFO.

- Monthly newsletters – just the right

amount in our opinion. - Curated with top-level CFO content

you actually want to read. - Your data is safe and will never be

shared with any third party.

Check out more from ScaleXP

How to automate prepaid expenses

Automating prepaid expenses, the costs a business pays upfront for future goods or services, not only saves time but also

How to automate Hubspot invoicing in QuickBooks

Easily invoice Hubspot deals in QuickBooks using ScaleXP Looking to streamline your invoicing process between HubSpot and QuickBooks? If your

Revenue recognition automation

Revenue recognition: a guide Revenue recognition is a crucial aspect of financial reporting, ensuring that companies accurately reflect their earned