For SaaS companies, the quote-to-cash (Q2C) process isn’t just administrative- it’s strategic. It’s the full journey from a signed deal to cash in the bank and revenue on the books. When it’s optimized, you invoice faster, collect cash sooner, and report metrics with confidence.

But when your CRM, billing, and finance systems don’t speak to each other, quote-to-cash can easily become a manual tangle of approvals, Slack messages, spreadsheets, and delays.

In this post, we’ll break down the quote-to-cash process, identify where it breaks in SaaS, and show how platforms like ScaleXP can automate it, turning friction into a fast, seamless revenue engine.

What Is the Quote-to-Cash Process and Why It Matters in SaaS

From Quote to Invoice to Cash Collection

Quote-to-cash refers to the entire lifecycle that begins when a sales rep generates a quote and ends when cash is received. It typically includes:

- Configuring and approving quotes

- Creating and managing contracts

- Generating and sending invoices

- Tracking payments and collections

- Recognizing revenue over the contract term

The best processes build this data into your revenue or ARR forecast and your renewals schedules.

Unique Challenges in SaaS: Recurring Revenue, Custom Contracts, Renewals

For SaaS businesses, this cycle is especially complex. Common challenges include:

- Multiple revenue streams which frequently include subscription billing, professional services and usage-based pricing

- Contract changes mid-term

- Multi-year or multi-currency deals

- Multiple legal entities or billing companies

- Renewals logic

- Compliance with ASC 606/IFRS 15 for revenue recognition

A fragmented quote-to-cash process slows down billing, causes revenue leakage, and introduces risk at every stage.

What Breaks Down in SaaS Quote-to-Cash Workflows

Manual Quotes and Delayed Approvals

When quotes are manually built in PDFs or spreadsheets, they require back-and-forth emails for review and approval, often delaying deal closure.

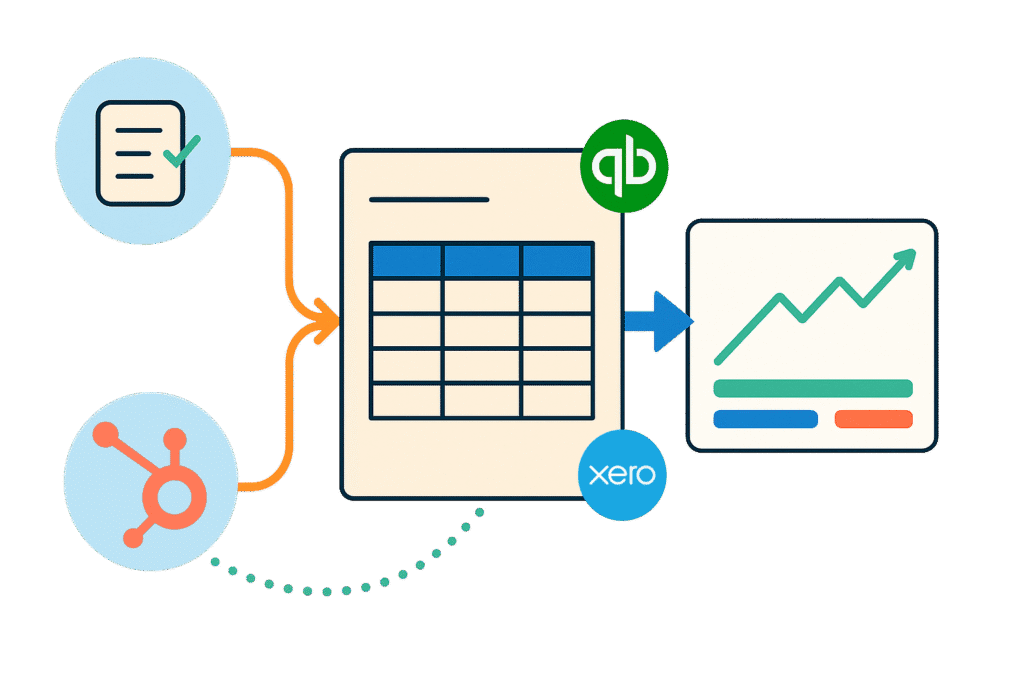

CRM and Finance Tools That Don’t Sync

Deals may close in HubSpot or Salesforce, but billing teams often don’t see the data until days later. Without integration, teams rely on manual data entry to generate invoices- introducing errors and delays. In the worst case, finance teams don’t even know that an invoice needs to be sent because of a missed email or Slack message.

Revenue Recognition Errors After the Deal Closes

Finance teams frequently rely on spreadsheets to track recognition schedules, especially for deferred or usage-based revenue. It’s not only inefficient but also error-prone. Spreadsheets undermine credibility because other teams can rarely see or understand the calculations.

Missed Renewals and Poor Forecast Accuracy

Without visibility into renewal dates or upcoming payments, revenue forecasting becomes guesswork. Teams miss upsell opportunities or renewals altogether.

Best Practices to Streamline the Quote-to-Cash Process

- Align Sales, Finance, and Customer Success

Start by mapping how data flows between departments- from quotes to invoicing to renewals. Break down silos by choosing tools that integrate natively across teams. - Automate Quoting and Contract Generation

CRM tools include integrated quoting tools – often with the ability to collect e-signatures. - Integrate CRM and Accounting for Real-Time Data Flow

Connect tools like HubSpot or Salesforce directly to QuickBooks or Xero. - Build Revenue Recognition into Billing Workflows

Choose platforms that extract service periods, create journal schedules, and post them back into your accounting system. - Track Key Metrics including future revenue

Your CRM deals hold valuable data on future revenue. Capturing full contract details and integrating it instantly into your forecast is best practice. - Use a Unified Platform to Avoid Data Hand-Offs

Every spreadsheet adds risk. Integrated systems reduce both errors and time.

How ScaleXP Automates the Entire SaaS Quote-to-Cash Journey for HubSpot users

Auto-Generate Invoices from HubSpot Deals

With ScaleXP, when a deal closes in HubSpot or Salesforce, an invoice is automatically generated based on the contract terms. No manual handoff. No missing deals.

Sync Payments, Invoices, and Revenue Schedules with QuickBooks/Xero

ScaleXP posts the invoice to your accounting system, tracks payment status, and builds a revenue recognition schedule using AI-powered parsing of service periods. When approved, journals are automatically posted, fully audit-ready.

Forecast Renewals and Revenue with Real-Time CRM + Finance Data

Upcoming renewals, contract expansions, and churn risks are visible in ScaleXP’s forecasting engine, which blends actual finance data with CRM pipeline insights. Teams gain a single source of truth for future revenue.

Eliminate Manual Spreadsheets for Recognition and Reporting

With built-in SaaS metrics dashboards (ARR, CAC, LTV, NRR), ScaleXP replaces manual spreadsheets entirely. Board-ready views are updated in real time, eliminating manual reporting prep.

Ready to Unify and Automate Your Quote-to-Cash Process?

If your SaaS revenue workflows still rely on spreadsheets and siloed systems, you’re not alone. But you’re also not stuck.

Explore how ScaleXP streamlines SaaS quote-to-cash workflows