What is Customer Acquisition Costs?

Customer Acquisition Costs is the total cost incurred in getting one new customer. It is a common SaaS metric and can also be called Cost of Customer Acquisition, CCA, CAC. It includes all marketing and sales expenses incurred to acquire a new customer, such as marketing, advertising, sales commissions. Salaries for the sales and marketing teams are frequently included.

CAC is an important metric because it highlights the spend for attracting a new customer. It is used, over time, to assess if marketing and sales efforts are being more cost-effective. By comparing the CAC to the lifetime value of a customer, businesses can determine the return on investment of their customer acquisition efforts and make informed decisions about how to allocate their resources.

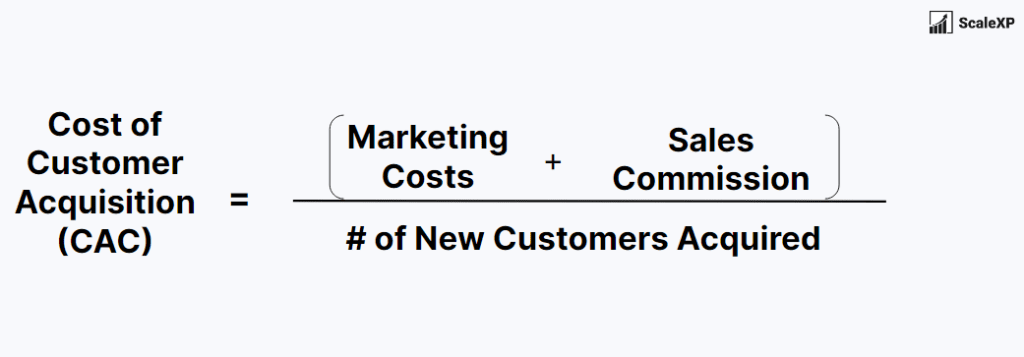

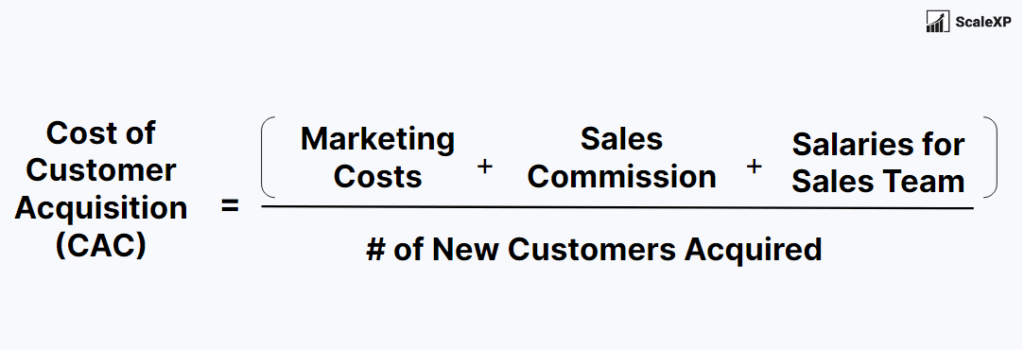

How is CAC calculated?

There are a few different ways to calculate CAC, but the most common method is to divide the total sales and marketing expenses for a given period by the number of new customers acquired during that same period. For example, if a business spent $100,000 on sales and marketing expenses in a month and acquired 100 new customers in that same month, their CAC would be $1,000 ($100,000 / 100 customers).

Here are two examples of common customer acquisition costs formulas. The most common definition includes marketing costs, sales commission and the full cost of the sales team.

It’s important to note that CAC should be calculated over a specific period of time, such as a month, or a quarter, to ensure that the costs and customer acquisitions are properly matched. Additionally, it may be helpful to break down CAC by different marketing channels or campaigns to understand which efforts are most effective at driving customer acquisition.

Automate Acquisition Costs

Empower your business with real-time, automated SaaS metrics from acquisition costs, MRR & ARR.

How is CAC used by SaaS companies?

Cost of customer acquisition is a key metric for SaaS (software as a service) because it highlights the efficiency and effectiveness of their sales and marketing efforts. SaaS companies typically generate revenue through recurring subscription fees, so it’s important for them to have a clear understanding of how much they are spending to acquire new customers and whether those efforts are cost-effective.

There are a few different ways that SaaS companies can use CAC to inform their business strategies:

- Setting sales and marketing budgets: By understanding the CAC, SaaS companies can make informed decisions about how much to allocate towards sales and marketing efforts.

- Optimising sales and marketing channels: By analysing the CAC for different channels or campaigns, SaaS companies can identify which channels are most effective at driving customer acquisition and allocate more resources towards those channels.

- Determining pricing strategies: By comparing the CAC to the lifetime value (LTV) of a customer, SaaS companies can determine the return on investment of their customer acquisition efforts and make informed decisions about how to price their products and services.

- Forecasting revenue: By understanding the CAC and the LTV of their customers, SaaS companies can make more accurate revenue projections and plan for the future growth of the business.

Understanding CAC is critical to allocating resources and driving long-term growth.

What are benchmarks for CAC?

For CAC benchmarks, it is most useful to look at CAC Payback periods, which relate CAC to customer value. See our article on this here CAC Paybacks page

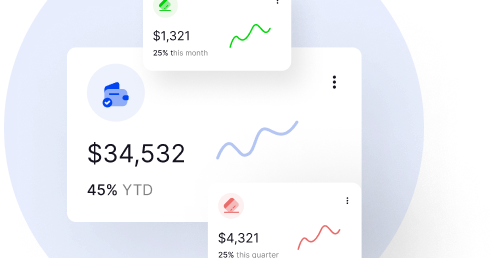

CAC Visualisation Example

ScaleXP fully automates the calculation of cost of customer acquisition. Through integrations with both your accounting and CRM systems, the system provides a full suite of SaaS metrics built using industry standard definitions, which can be easily customised to your requirements.

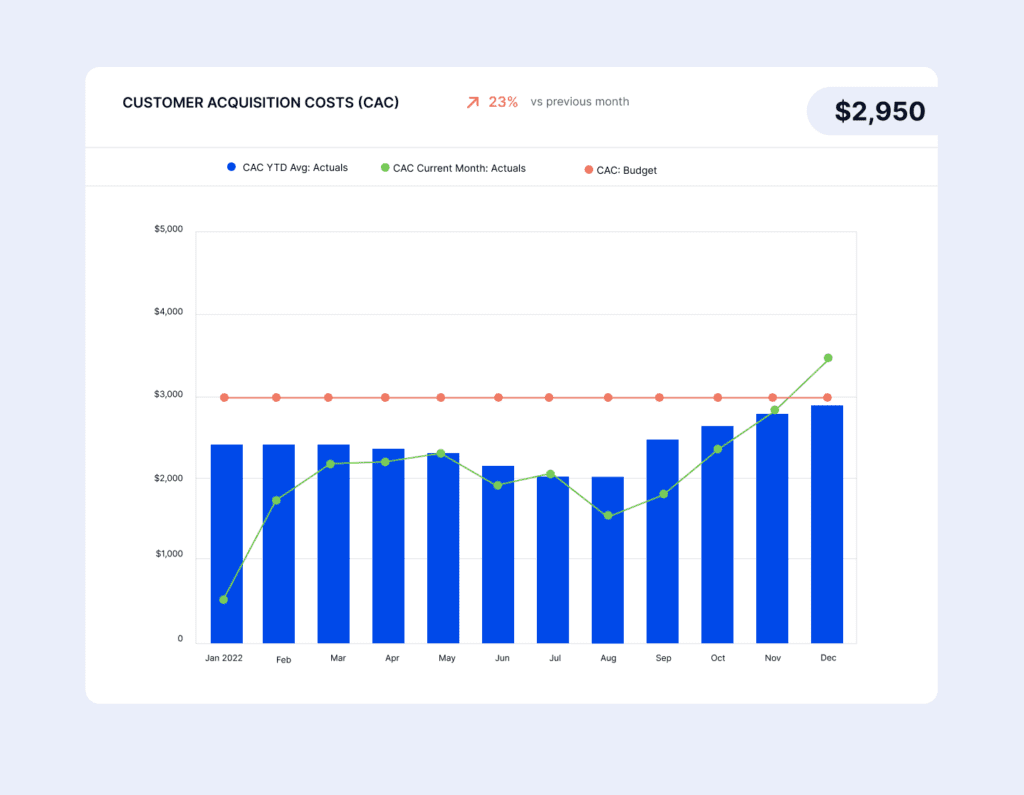

This chart is an example of customer acquisition costs. It shows CAC for the current month as well as a YTD average, making it much easier to understand trends, improvements, even seasonality. A comparison to budget is also included and can be fully automated from budgets or forecasts.

You may also be interested in

CAC Payback

Measures how long it takes for a company to recoup the costs of acquiring a new customer.

CAC / LTV ratio

Lifetime value divided by acquisition costs, indicating the margin delivered by each new customer.

SAAS Magic Number

A measure of growth or sales efficient. Calculated as Revenue Growth divided by Customer Acquisition Costs.

Automate all your SaaS KPIs through integrated data

Connect and combine data from a wide range of accounting & sales CRM systems. Use integrated data to create a comprehensive, fully automated suite of SaaS metrics.

Click below to understand if ScaleXP connects to your systems.