Accurate revenue recognition for accrued and deferred income is essential for performance analysis and forecasting via monthly management accounts, but many organisations still rely on spreadsheets and other inefficient manual processes for deferred and accrued revenue recognition.

Improve your revenue recognition

The simplest way to increase accuracy and to reduce manual errors is to automate revenue recognition. Spreadsheets are difficult to share across teams or departments, and errors are inevitable. Particularly as invoices are modified, it becomes increasingly challenging to ensure the entire organisation uses the most accurate and actionable information.

A joint study by IDC and Adobe found 76% of executives consider disconnected document processes to be the cause of many audit issues, adversely impacting revenue recognition. These issues are primarily due to incomplete, outdated, misfiled, or lost documents.

Streamline revenue recognition

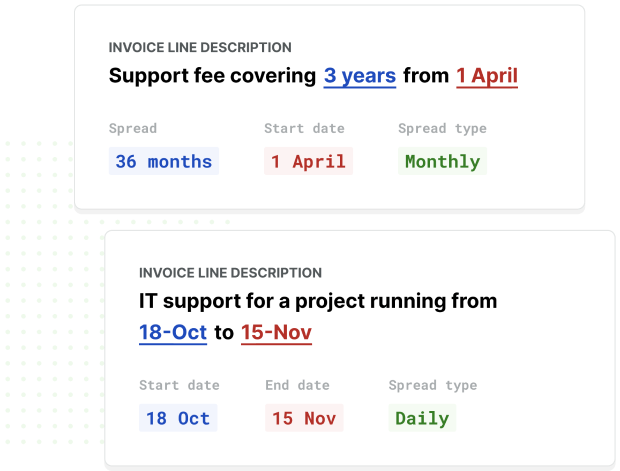

ScaleXP automates revenue recognition, using a series of sophisticated natural language processing algorithms, the system determines the relevant time period of an invoice. Revenue is then allocated to the correct time period, automatically.

Use your existing accounting system

Xero deferred & accrued income

ScaleXP integrates with Xero, importing all invoices, spreading deferred and accrued income by month.

Quickbooks deferred & accrued revenue

ScaleXP integrates with Quickbooks, importing all invoices, spreading deferred and accrued income by month.

Sage, NetSuite and so many other accounting systems

ScaleXP integrates with 10 different accounting systems, importing all invoices, spreading deferred and accrued income by month.

Comply with IFRS

Automate deferred revenue recognition and accrued revenue with ScaleXP, making it easy to audit and track revenue streams and overall financial performance.

Automate deferred revenue recognition and accrued revenue with ScaleXP, making it easy to audit and track revenue streams and overall financial performance.

The core principle of both IFRS 15 and ASC 606 requires revenue only to be recognised when the goods or services are supplied to the customer at the transaction price.

ScaleXP ensures compliance with revenue recognition under IFRS and GAAP accounting standards by automatically recognising revenue as it’s earned over the relevant period.

Provide critical business data

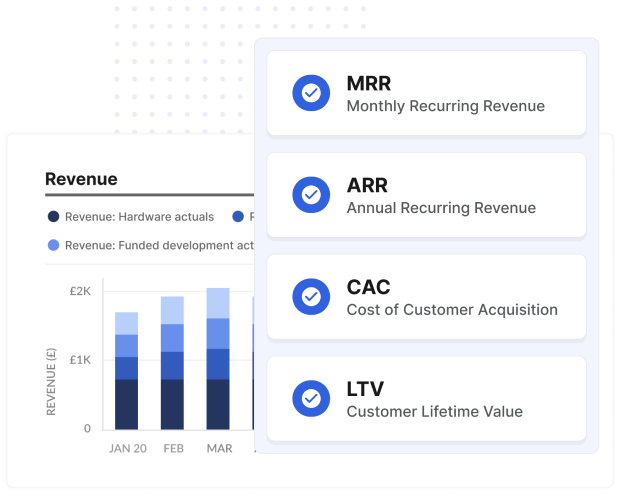

Once revenue has been allocated by month, ScaleXP provides business critical metrics such as MRR, ARR, and customer lifetime value, expense ratios, revenue per customer.

ScaleXP saves time and increases productivity by automating manual processes and providing interdepartmental access to crucial metrics and KPIs based on complete and current data.

Avoid errors and lost productivity with ScaleXP, where changes to an invoice or credit notes are automatically detected by the system.

ScaleXP saves time and increases productivity by automating manual processes and providing interdepartmental access to crucial metrics and KPIs based on complete and current data.

Find out how ScaleXP automated revenue reporting can improve your business. We connect to Xero, QuickBooks, Sage, NetSuite and many more to streamline revenue reporting.