Inflation has hit a 40-year high and shows no signs of slowing. This creates a climate of increased uncertainty for businesses and their Finance Directors. In this article, we provide three practical tips that every finance professional can take to help their company deal with inflation.

Overview

In the UK, reported inflation is 8%, the highest rate in 40 years. While both the Bank of England in the UK (and the Federal Reserve in the USA) have promised that inflation will fall in 2022, there are no signs of this, and the recent interest rate increases in both the UK and USA are an ominous sign.

My personal prediction is that we will see inflation exceed 12% in the UK this year, perhaps even reaching 14%. Practically speaking, this means that goods and services will cost at least 12% more in a year than they do today. So, what steps can a Finance Director take to ensure their company is prepared?

Tip 1: Collect money upfront.

Issue annual contracts where possible and collect money upfront. The value of cash to you today is worth 10% more than it will be in a year – assuming that my prediction is correct!

Historically, some Finance Directors have been reticent to accept upfront payments due to the accounting admin associated with deferred revenue.

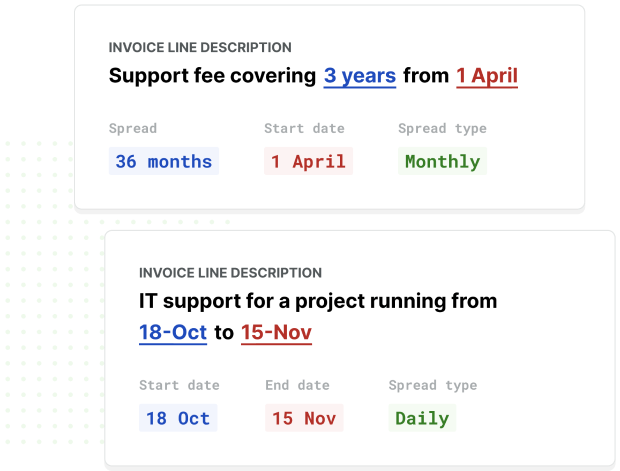

New technologies – including ScaleXP’s automated deferred revenue functionality – eliminates these headaches by fully automating the allocation of revenue per month, using nothing more than the data on the invoice. Our technology which is built using complex algorithms ensures that every company benefits from upfront payments with none of the downside. It works for invoice terms of any length, from 10 days to 10 years, across currencies and geographies.

As a pragmatic solution, we suggest setting a clear target with the sales team to move, say 20% of customers, to annual contracts. Even a modest amount can create a natural inflation hedge.

Collecting money upfront is our top inflation busting tip.

Tip 2: Ensure all contracts have a COL clause.

Review your customer contracts & ensure that you can pass on a cost of living increase each year. This is a standard clause in most contracts. It is best practice to tie the price increase to a well-publicised figure (say the Bank of England base rate).

Tip 3: Reconsider the cost of capital

Summary

These three simple tips will create a natural hedge against inflation, ensuring every business is better positioned to cope with higher inflation and increased economic uncertainty.

Next week, we will publish a second article with some practical pointers on costs.

You can read more about the importance of metrics in times of uncertainty here.

If you found this article useful, please share. If you’re interested in learning more about the other financial processes we automate and streamline, book your free demo.